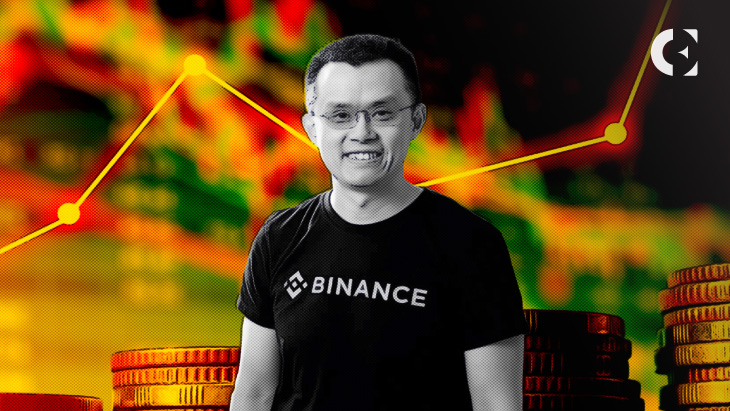

- Binance Changpeng Zhao announced the departure of key executives in its Russian branch.

- The two top executives, Gleb Kostarev and Vladimir Smerkis, made the announcements today.

- The departures have raised fears and speculations that Binance might exit Russia.

Founder and CEO of Binance Changpeng Zhao took to X – formerly Twitter – to announce the departures of key executives of the company in Russia. “Some of our team members are growing into bigger roles, some outside of Binance,” he said in the post.

Notably, Gleb Kostarev, head of Eastern Europe and Russia at Binance, announced his exit today in a post on Facebook. While thanking CEO Zhao and Binance co-founder He Yi for his time with them, he mentioned that he would pursue other endeavors in the meantime.

Vladimir Smerkis, general manager for Russia and CIS at Binance, also made a similar exit announcement after two years with the company.

However, the two top executives failed to give reasons for their sudden exits. On his own part, Smerkis promised to shed more light on the reasons behind his departure in the next few weeks.

The departures come amid increased speculations about the company’s possible departure from Russia following multiple sanctions against the country. Since the announcement, members of the cryptocurrency community in Russia have posed questions to the two exiting executives. Majorly, the users want to know if Binance will be leaving Russia any time soon.

The two departures add to a growing list of top executives that have departed the company lately. On September 4, Mayur Kamat, the company’s head of product, confirmed his departure from the exchange. Way back in July, Patric Hillman, the company’s chief strategy officer, also exited the company.

Meanwhile, Binance has been the subject of increased scrutiny and widespread FUD. Regulatory concerns in multiple countries have users on the edge and unsettled.

Surprisingly, the company continues to record moderate positive performances. As earlier reported by Coin Edition, the exchange last month posted a future’s trading volume of $21.06, 219% more than the crypto-derivate volume of its closest competitor OKX.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.