- Binance CEO Changpeng Zhao in a tweet on X denied any ties between Binance.US and crypto custodian Ceffu.

- The SEC accused the company of being inconsistent in characterizing the nature of its relationship with Ceffu.

- The SEC suggests that Binance holding company BAM “doesn’t understand what Ceffu is”

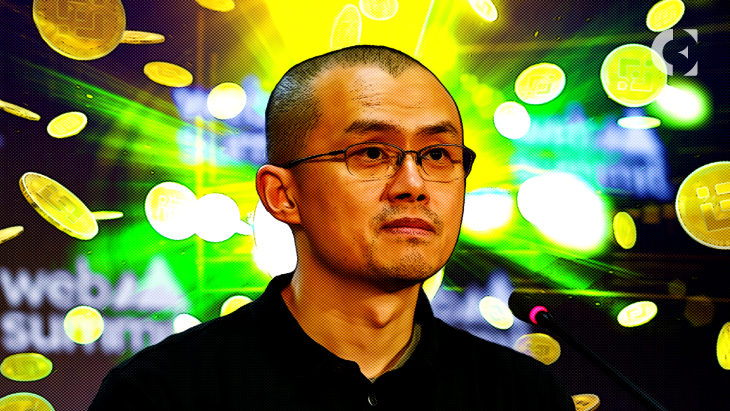

Binance CEO and co-founder Changpeng Zhao took to X (Twitter) to deny alleged connections between Binance.US and crypto custodian Ceffu. His post came on the heels of a U.S. court refusal to grant an inspection order to the United States Securities and Exchange Commission (SEC) in its lawsuit against Binance.

According to the tweet, Zhao said Binance.US has never used the services of Ceffu, formerly known as Binance Custody. Ties between Binance.US and Ceffu adds to the list of things being investigated by the SEC. The regulator claims the global crypto exchange enterprise has been misusing customer funds, alongside other securities violations.

In its September 18 filing, the SEC noted that Binance.US had been inconsistent in characterizing its relationship with Ceffu. Furthermore, the regulator stated that it is likely the company “does not understand what Ceffu is.”

Barely a week ago, Ceffu posted a statement disputing SEC filing claims that it had ties to Binance.US. Per the statement, Ceffu said it provides custodian services in select jurisdictions, excluding the United States.

Meanwhile, Binance.US’s legal team confirmed that Changpeng Zhao received a $250 million loan from BAM Management U.S. Holdings — another one of his affiliates.

Recent filings by the SEC claim that upon receipt of the funds, Zhao transferred them to BAM Trading. The allegations by the SEC aligned with previous allegations by a popular crypto account that Zhao loaned himself money using customer’s funds.

Since making these claims, the SEC has accused Binance.US of being uncooperative in the investigation. On the other hand, Binance.US said the regulator’s document requests are a “fishing expedition” and “overboard.”

Some in crypto circles say the company’s actions are similar to those of FTX and Alameda, inducing fears of a possible collapse.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.