- Binance to buy rival cryptocurrency exchange FTX.

- Bitcoin fell below $19,000 at a 10% loss after the announcement.

- Major cryptos dropped in value including ETH losing 15% and SOL falling by 20%.

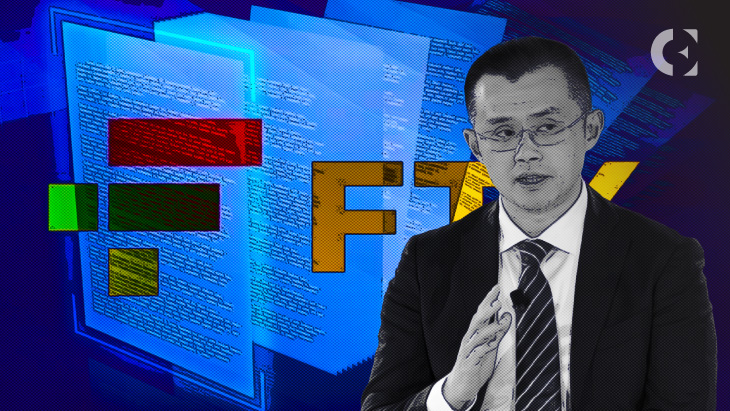

The world’s leading cryptocurrency exchange Binance announced it would purchase its biggest rival, Bahama-based FTX, on November 8. The news sent the crypto market into a frenzy as the crypto Twitter community expressed that they didn’t anticipate this deal anytime soon.

The reaction of the market was directly reflected in the trading prices of the major cryptocurrencies. After maintaining a stable $20,000 for the last two weeks, Bitcoin fell once again. A few hours later, the leading cryptocurrency in the market, tanked below $19,000, falling below its mid-September mark.

In the last 24 hours, Bitcoin has dropped 10% in value, trading at $18,500.

On the other hand, ETH fell to its lowest in over two weeks, trading at a 15% drop at a little over $1300. Meanwhile, Solana was down by 20% following speculations that Alameda Research, Bankman-Fried’s trading company, may have potentially dumped SOL holdings in order to raise liquidity.

FTX’s FTT also faced repercussions, including a 75% drop in its value while the token traded at $5. However, Binance’s BNB outdid the market, while still at a 4% decline.

Crypto fund manager BitBull Capital’s CEO, Joe DiPasquale stated,

The FTT token will find it very hard if not impossible to recover while SOL and ecosystem tokens are likely to suffer losses too as trust appears to be eroded entirely…We don’t expect Bitcoin to face an extreme scenario. In fact, it could see increased inflows as market participants withdraw from riskier assets

He further added that the sooner the prices recover, the better it proves for the market, as this will certainly attract attention from cryptocurrency regulators.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.