- Bitcoin (BTC) experts anticipate a bullish June amid historical data.

- According to Willy Woo, June has historically shown a tendency for bullish behavior.

- The real opportunity lies when the market returns to the mean, not during extreme movements, according to experts.

Bitcoin enthusiasts are eagerly eyeing June for a potential bullish rally, according to analysts engaged in a dialogue on Twitter. A Bitcoin fundamental data analyst Willy Woo suggested that despite the usually flat or bearish summer market trend, historical data indicated that June, within the re-accumulation phase, has consistently exhibited a bullish inclination. Meanwhile, analyst “Colin Talks Crypto” added a twist by questioning the accuracy of a specific indicator.

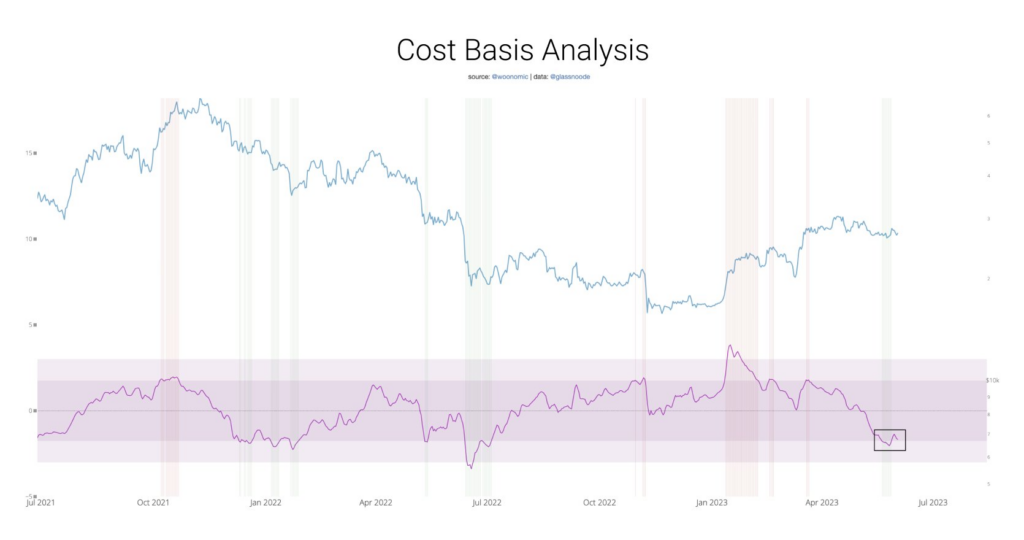

In a series of tweets, Willy Woo underscored the importance of analyzing Bitcoin’s cost basis to gauge potential market movements accurately. He pointed out that the indicator in question, depicted in purple on the chart, represents the pricing relative to the cost basis. Woo advised against oversimplifying market dynamics, cautioning against blindly following a single signal for investment decisions.

Expanding on Woo’s explanation, the lighter pink regions on the chart represent extreme zones where Bitcoin’s pricing has deviated significantly from its cost basis. However, these extreme deviations tend to initiate a mean reversion path back to the center, indicating a potential opportunity for market participants.

While the CBBI and similar indicators offer valuable insights, the analyst believes that it is crucial to exercise caution when interpreting their signals. Woo clarified that these oscillators signal an opportunity when the market begins its mean reversion toward the center rather than during the movement toward extremes. This clarification highlights the importance of comprehending the broader context and employing a comprehensive approach to analyzing Bitcoin’s market dynamics.

As the conversation on Twitter between these analysts continues, market participants eagerly await the predicted “window for BTC to rip” in June. With historical data and cost basis analysis supporting the potential for a bullish rally, Bitcoin enthusiasts and investors are closely monitoring the market.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.