- ADA’s ranking drops to 10th by market cap amid a significant price decrease.

- Only 35% of ADA holders are currently in profit, contrasting with BTC and ETH.

- ADA’s on-chain activity declines, reflecting reduced engagement amidst the price drop.

Cardano (ADA), a layer-1 blockchain network, is facing a challenging period as its price continues to drop and its market ranking declines. Notably, ADA is now ranked as the tenth largest cryptocurrency by market cap, following a huge decrease in value. In the last month alone, ADA’s price has fallen by 28%, and it has seen a nearly 22% drop year-to-date, according to CoinMarketCap.

Moreover, recent data from IntoTheBlock shared on X reveals that only about 35% of ADA holders are currently in profit. This contrasts starkly with other major cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH), where 86% and 81% of holders, respectively, are seeing profits. The situation has led to increased scrutiny of Cardano’s near-term demand potential as more investors are facing losses.

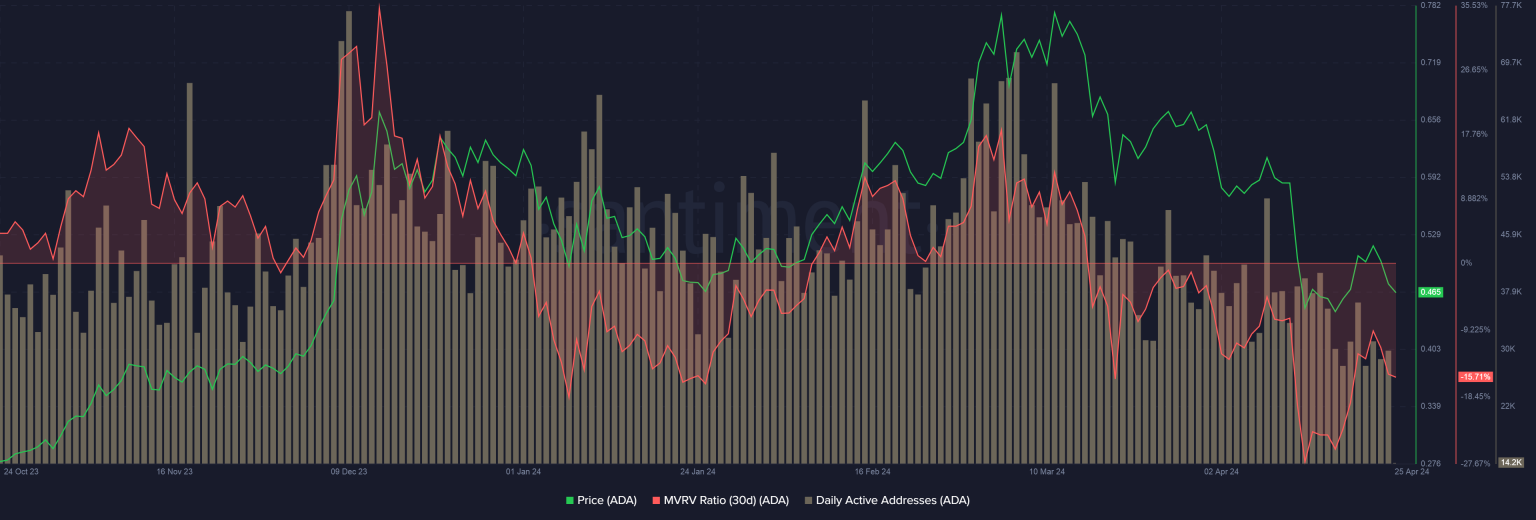

ADA’s market performance has also influenced its position relative to other cryptocurrencies. Over the past month, it has been surpassed in market valuation by Dogecoin (DOGE) and Toncoin (TON). Furthermore, the network has seen its average unrealized loss widen to 15.71%, indicating that if holders were to sell their ADA at current prices, they would incur an average loss of 15.71%.

A significant drop in on-chain activity accompanies the downturn in ADA’s market value. According to Santiment data, daily active addresses on the Cardano network have decreased from over 70,000 during its price peak to about 30,000 currently. This decline in activity reflects the reduced engagement and transaction volumes on the network.

Despite the current market conditions, ADA’s recovery remains possible. Historical data suggests that ADA could enter a super cycle in 2025, potentially reaching new all-time high levels, following a pattern observed a year after the 2020 Bitcoin halving.

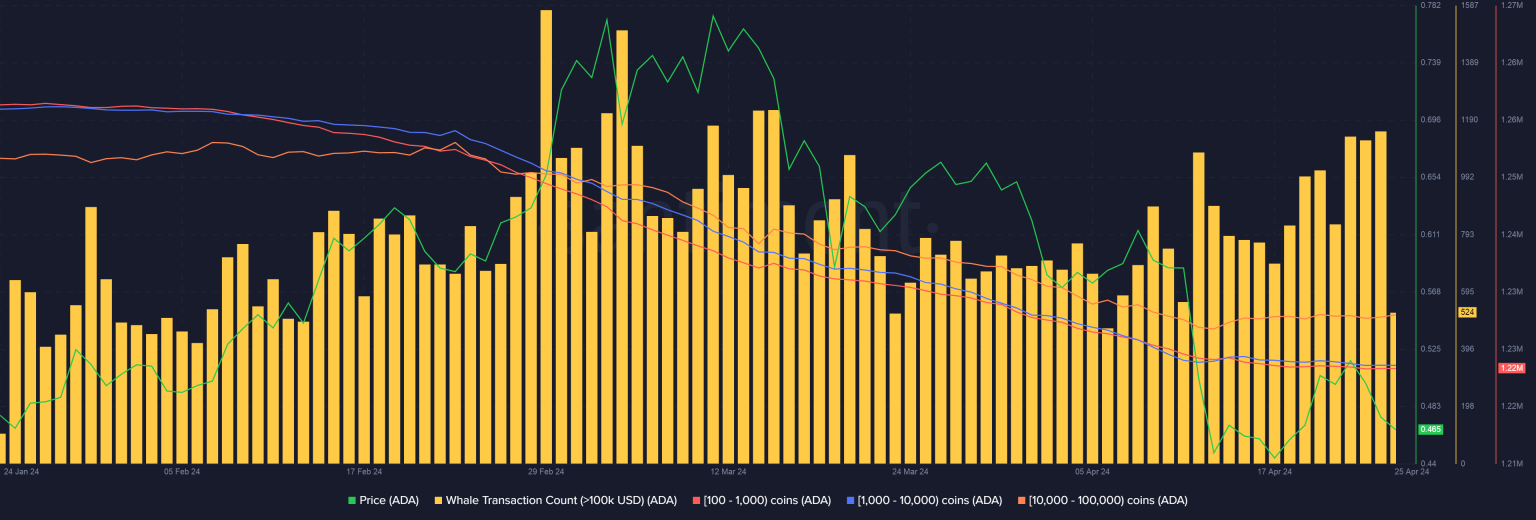

However, investor sentiment remains tepid as data from Santiment shows that whale cohorts have been net sellers, reducing their holdings consistently over the last 2-3 months. This lack of significant buying activity during the price dip raises questions about the depth of investor interest in ADA at lower prices.

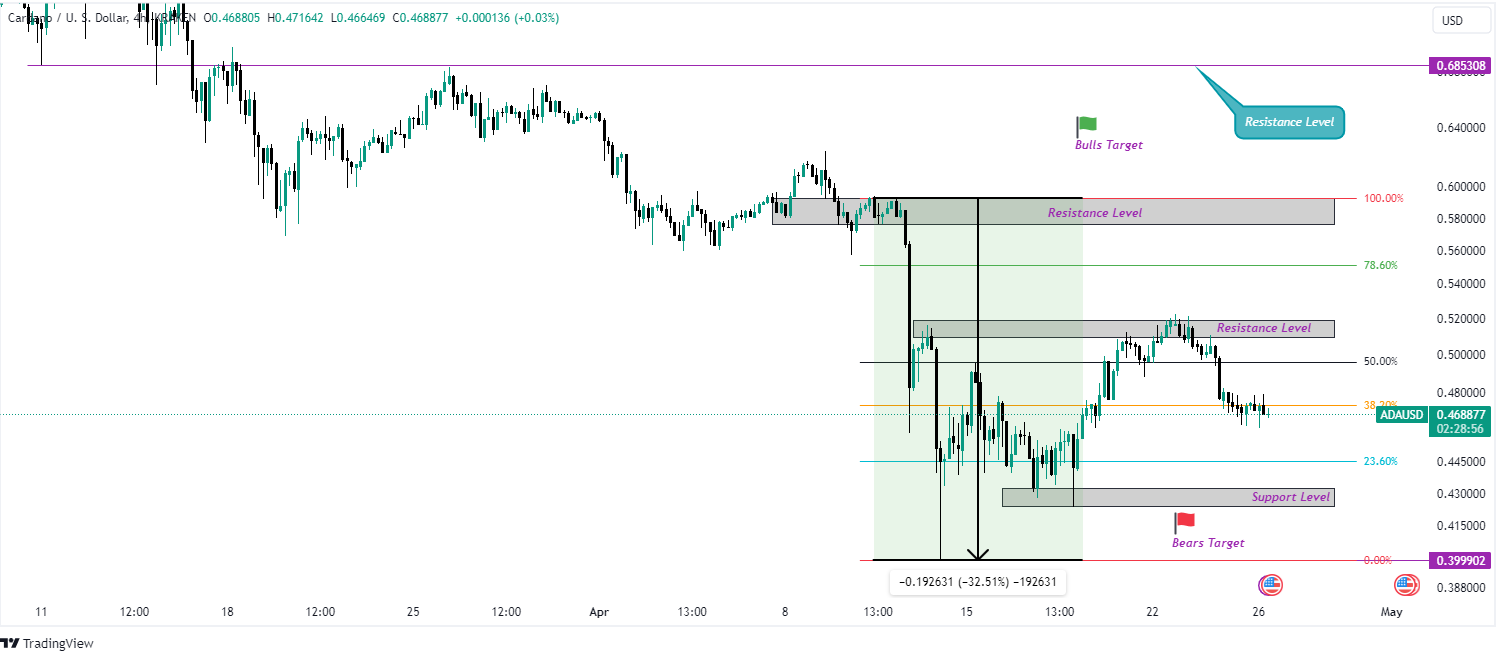

ADA/USD Price Action

On the 4-hour chart, the ADA token is under the influence of a bearish sentiment, indicating potential further price declines. Since reaching a crucial level on April 12, ADA has seen a significant drop of 32.15%, as depicted by the price range tool. Presently, ADA’s price hovers around the 38.20% Fibonacci retracement level.

Should ADA manage to close above this point, it may signal an upward trajectory, potentially challenging the 50% Fibonacci level and even surpassing resistance levels favored by bulls. Conversely, should ADA continue its bearish momentum and close below the 38.20% Fibonacci level, it could signal a continuation of downward movement, possibly retesting the support level below it. A successful breach of this support level could lead ADA prices further downwards, aligning with bearish targets.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.