- The Bitcoin Fear & Greed Index is at “Fear,” a classic contrarian signal that often marks market bottoms

- Key on-chain data, like the STH Realized Price, is confirming a potential reversal at current levels

- The main risk is a drop below $108k, which would confirm a bearish “double-top” pattern instead

The Bitcoin Fear & Greed Index has just flashed “Fear,” a classic contrarian buy signal, as the price bounces hard off the $107,500 support level to reclaim $110k. For traders, the question is whether this is the real bottom and a prime “buy the dip” opportunity, or is it a bull trap before another leg down.

Why “Fear” Can Be a Buy Signal

The core of the bull case is that the market is showing signs of peak fear, which is often when the smart money starts to buy.

What is the Fear & Greed Index telling us?

The index has dropped to a reading of 46 (“Fear”). While not “Extreme Fear,” this level of pessimism has historically appeared near market bottoms, especially when combined with other key on-chain metrics.

So what are these other key on-chain metrics?

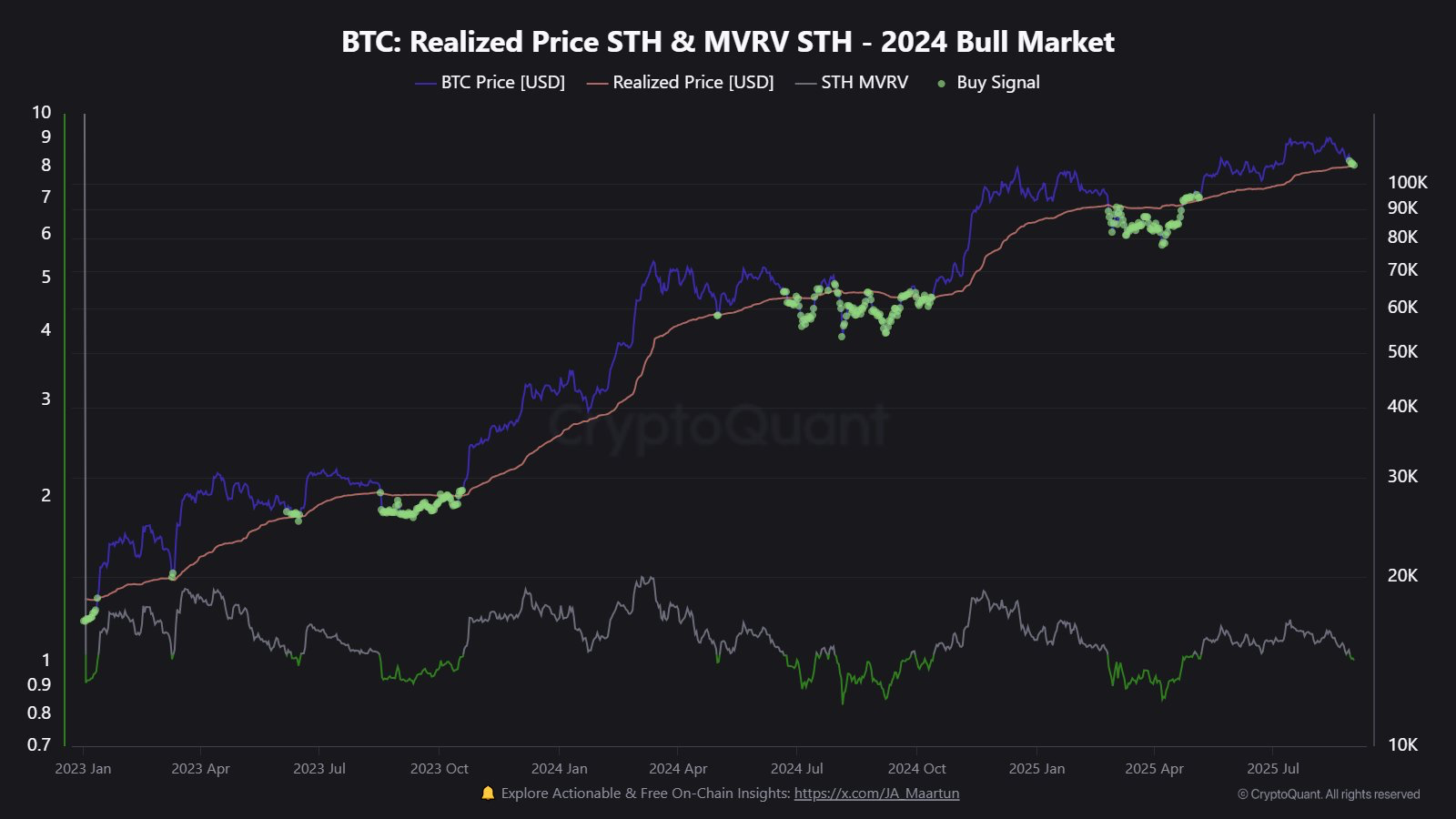

The Bitcoin price is currently testing the Short-Term Holder’s (STH) Realized Price. This is the average price that recent buyers paid for their coins.

How should traders use this “Fear” signal?

The best way to trade the Fear & Greed Index is by combining it with other on-chain signals. According to CryptoQuant, when Bitcoin’s price drops to retest the STH Realized Price, and is confirmed by the MVRV for STH, it has historically signaled a reversal pattern. However, a true capitulation bottom often forms only when the crowd completely loses hope and becomes afraid to buy the dip.

The contrarian view: Don’t Just Buy the Dip, Buy the Strength. Five Altcoins to Watch Now

How Are Macro Tailwinds Supporting the Bullish Case?

Supporting the bullish on-chain setup are two powerful macro factors: an expected Fed pivot and a breakout in Gold.

How likely is a September rate cut?

The market is now pricing in an 80% chance that the Fed will cut interest rates by 25 bps on September 17, according to prediction market Kalshi. Furthermore, Fed Chair Jerome Powell signaled a change in monetary policy amid heightened pressure from the executive branch led by President Donald Trump.

Related: For Crypto, a 25 Bps Rate Cut is Now the Baseline Expectation for September

Is Gold’s new all-time high a leading indicator for Bitcoin?

Gold just surged to a new all-time high above $3,500 per ounce. Bitcoin has been closely following Gold’s bullish price action over the past 24 hours, suggesting that macro investors are treating both as key assets amid broader economic uncertainty.

At the time of this writing, BTC price traded slightly above $110k, signaling potential full-blown recovery ahead.

What Are the Key Risks That Could Invalidate BTC Buy Signal?

Bitcoin price is likely to rebound in the near future fueled by the high demand from institutional investors.

Last week, JPMorgan analysts said that the BTC price is undervalued relative to the Gold price, and the former could rally to $126k before the end of this year.

What is the must-hold support level for Bitcoin?

From a technical analysis standpoint, the $108,000 level is the must-hold support level BTC must hold to maintain its bullish structure.

What then is the bearish chart pattern to watch?

But if Bitcoin’s price drops below the $108k support level, it would confirm the bearish “double-top” reversal pattern that has formed with resistance near $120k. This breakdown, if confirmed by a bearish divergence on the weekly RSI, would signal that a much deeper correction is likely.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.