- Whales have been dumping their BTC over the last 13 months.

- The last 5 days have seen BTC whales accumulate 47,888 BTC.

- BTC’s price has risen over the last 24 hours as well as the last 7 days.

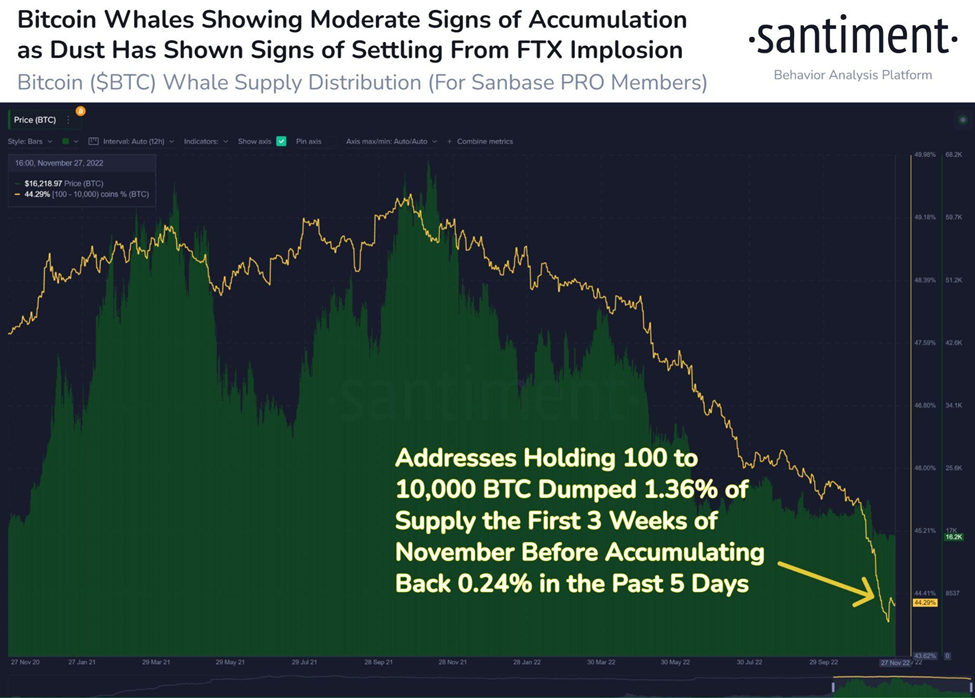

Once the news regarding FTX broke, the first three weeks in November this year saw investors dump their Bitcoin (BTC) holdings. There may be a trend reversal, however, as 47,888 BTC has been accumulated back in the past 5 days. This is according to a tweet made by the blockchain analysis firm, Santiment.

The chart shared by Santiment in the tweet this morning shows that BTC addresses holding between 100 to 10,000 BTC dumped approximately 1.36% of the supply in the first three weeks of November this year. This has added to the trend witnessed over the last 13 months as whales have spent this period dumping their cumulative holdings.

This trend has not yet reversed, however, it has been put on hold as the past 5 days have seen 0.24% of the supply accumulated back by these addresses.

The crypto market tracking website, CoinMarketCap, shows that the price of BTC is trading at $16,470.67 following a 1.89% gain over the last 24 hours. The accumulation by BTC whales has evidently had a positive impact as the crypto market leader’s price has also risen 4.42% over the last 7 days.

BTC is also currently trading closer to its 24-hour high of $16,504.25 than its daily low of $16,054.53. The daily trading volume for the coin has risen 1.18% over the last 24 hours to take the total to around $25,297,571,245. As a result of the recent price movements, BTC’s market cap now stands at $345,922,157,011.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.