- Analyst states that Bitcoin traverses the green line in his trend pattern price model.

- Peak-to-peak angle reduces by half while peak-to-2 peaks later too reduces by half

- Bitcoin’s period of consolidation could end anytime soon before it spikes to $31,500.

Technical Analyst CryptoCon tweeted that Bitcoin (BTC) was traversing the trend pattern price model’s green line in his analysis of BTC’s halving cycle. As per the analyst’s prediction, the trend line is drawn from a cycle bottom to a predicted top of $130K by November 2025. Moreover, CryptoCon believes that by December 2025, BTC has the potential to reach $145K.

CryptoCon found some useful correlations and commonalities by comparing the peaks with the peaks, and peaks with the bottoms. The first commonality he spotted was that when comparing the peak to peak the angle reduced from 39,21, to 10. This common factor here was that the angle was reduced by half (divided by approx. 2). As such, the analyst predicted the next angle to be 5.

Moreover, when comparing a peak to 2 peaks later, CryptCon found out that these angles-29,16 were also reduced by almost half. Therefore, as per the pattern, the analyst predicted the next angle to be 7.

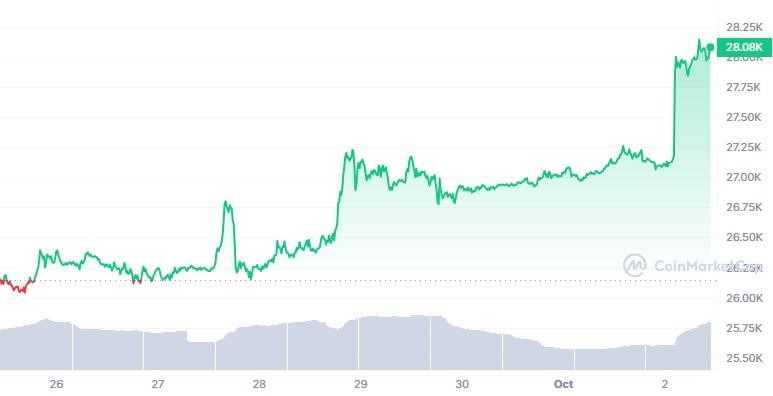

The chart above shows that BTC has been performing well during the past seven days. During the first five days, BTC consolidated. However, there was a small spike that saw BTC rise from $26,240 to $26,800, but this was short-lived. Thereafter on the fifth day, BTC spiked to $27,228 from $26,500 and consolidated between $26,500 and $27,250. After spiking once more, BTC is trading at $28,085 at press time.

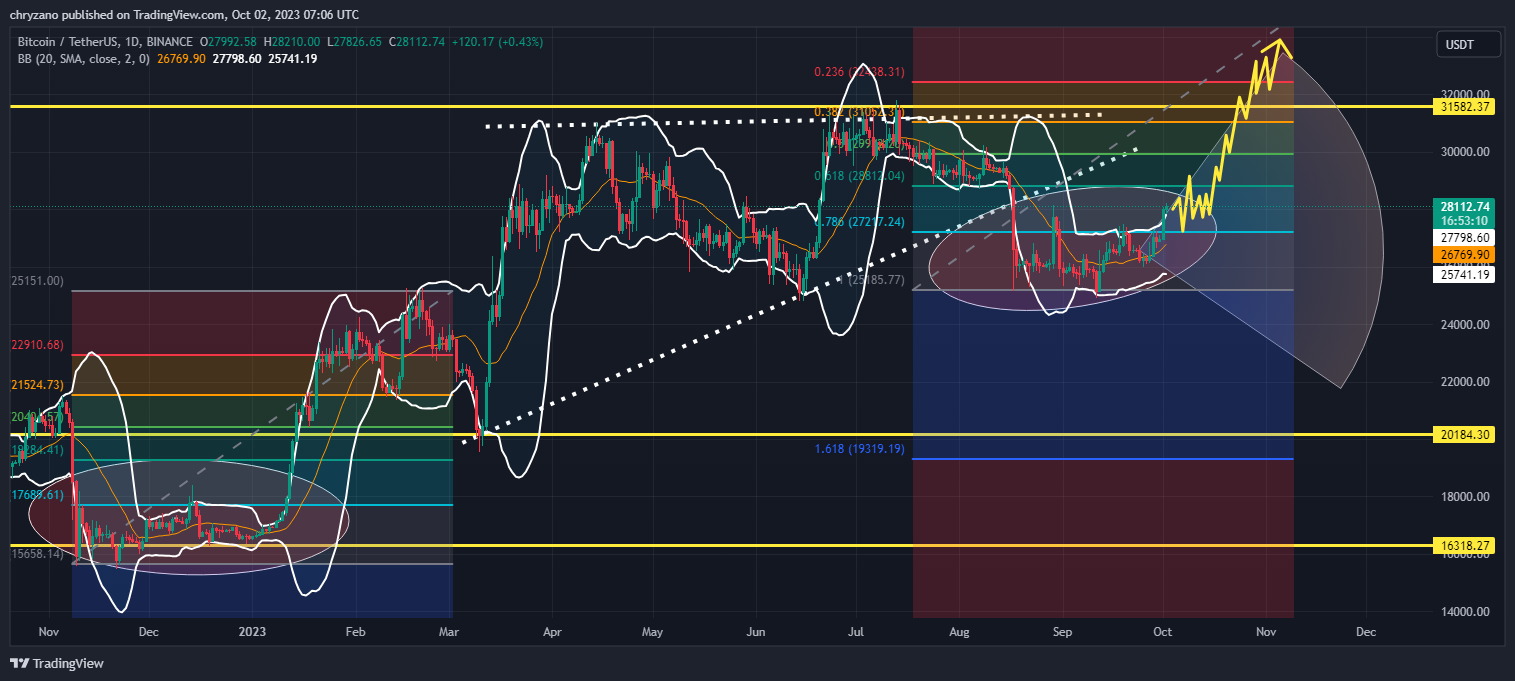

When looking at the chart above, it can be seen that BTC seems to be reciprocating its behavior back in early 2023. Hence, if the reciprocation of the BTC pattern in early 2023 is validated, then, it can reach above $31,500. However, BTC has touched the upper Bollinger, hence, there might be a slight retracement before Bitcoin starts to climb up. If the bears take hold of BTC when it retraces then it may fall to support near $25,750. So to make sure that the bears have no control, it might be useful to check the accumulation and distribution line (ADL) for BTC.

The ADL is moving upwards indicating a value of 10.748M which denotes that more and more people are accumulating. This also means that the rise in BTC price has volume to back it up. Hence, BTC may be in for a roll.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.