- Global market cap touched $918 billion , up less than 1% from the previous day.

- Bitcoin is in the consolidation phase and trading at near $19,222.

- Klaytn (KLAY), Chiliz (CHZ), and Casper (CSPR) have been performing well too.

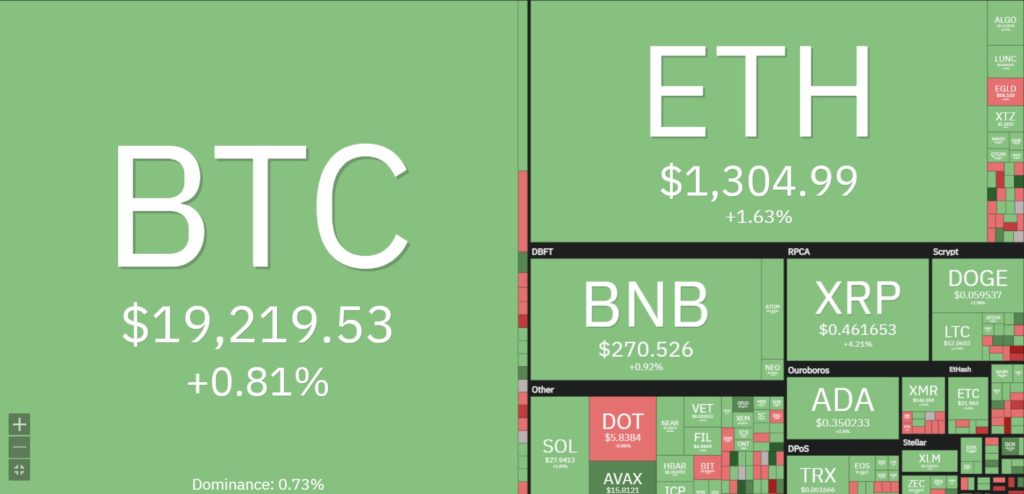

Earlier today, many cryptocurrencies showed slightly positive price movements while Bitcoin(BTC) and Ethereum(ETH) saw sideways trading. Infact, the global market capital touched $918 billion which was somewhat up less than 1% from the previous day as per data.

Also note that, the entire cryptocurrency market volume in the last 24 hours was $53 billion, a 21% increase. Strikingly, Casper (CSPR) has grown by more than 27% in the last seven days to trade at $0.046.

The most popular cryptocurrency Bitcoin is in the consolidation phase and trading at near $19,222.

A tweezers’ top pattern was formed by BTC, and an uptrend followed up. This further hints at the likelihood of a bearish trend.

In a similar instance, Ethereum looked stable at a price of $1,306, moving up by less than 1%. On the other hand, the market reflects risk-off with the anticipation of a Fed rate hike.

Taking a look at the Asian session, Klaytn (KLAY), Chiliz (CHZ), and Casper (CSPR) have been performing well. The Klaytn has indeed risen 8% to $0.14, and the market price of CHZ has risen by over 6% to $0.18. Furthermore, the CSPR gained over 5% to $0.045.

The Chain (XCN) price has gone down by over 7% in the past 24 hours to $0.06. The price of Elrond has dropped more than 5% to around $54.

However, the market reflects hesitant to take risk, with investors preferring assets like gold and the US dollar.

The fear and greed index in the market indicates “Extreme Fear,” as being one of the reasons for the general cryptocurrency market decline.

The current market cap of BTC $367 billion and ETH $159 billion respectively.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.