- Bitcoin (BTC) holds firmly above $115K, showing stability before a critical macro week

- Key events: Fed decision (Wednesday), Big Tech earnings, Trump-Xi summit (Thursday) to bring on crypto volatility this week

- CryptoQuant: Large whale inflows to Binance look like repositioning, not pre-sell panic

Bitcoin (BTC) maintained its ground above the $115,000 level early Monday, demonstrating notable stability as traders brace for a potentially turbulent week packed with high-stakes macroeconomic and geopolitical events. Currently trading above $115,300 the market seems paused, digesting recent gains while anticipating catalysts that could violently break the current calm.

Related: Fed Balance Sheet Pivot Raises Altseason Odds if BTC.D Softens

Bitcoin Holds $115K+ in Calm Before Macro Storm This Week

This week sees a rare convergence of market-moving events:

- Wednesday: The US Federal Reserve concludes its FOMC meeting, announcing its latest decisions on interest rates and, crucially, the future of its Quantitative Tightening (QT) program. Fed Chair Jerome Powell’s subsequent press conference will be scrutinized for signals on future policy direction. Simultaneously, tech behemoths Microsoft, Alphabet (Google), and Meta (Facebook) release quarterly earnings, setting the tone for risk assets.

- Thursday: The earnings wave continues with Apple and Amazon. More significantly, President Donald Trump is scheduled to meet with China’s President Xi Jinping in South Korea, where hopes are high for finalizing a framework to de-escalate the long-running trade dispute.

Asian markets already surged Monday on optimism surrounding the Trump-Xi talks, with Japan’s Nikkei 225 and South Korea’s KOSPI hitting records. This backdrop highlights the market’s sensitivity to these upcoming events.

Bitcoin’s Moment: CryptoQuant Sees Whale Inflows as Repositioning, Not Panic

For Bitcoin, this mix of monetary policy, earnings data, and geopolitics could go either way. A dovish Fed or a strong trade deal could boost risk assets, pushing BTC higher.

On the other hand, signs of renewed trade friction or hawkish Fed language could cause a pullback. Traders are also watching the US–China dynamic closely, given how directly Trump’s tariff comments have affected Bitcoin prices throughout October.

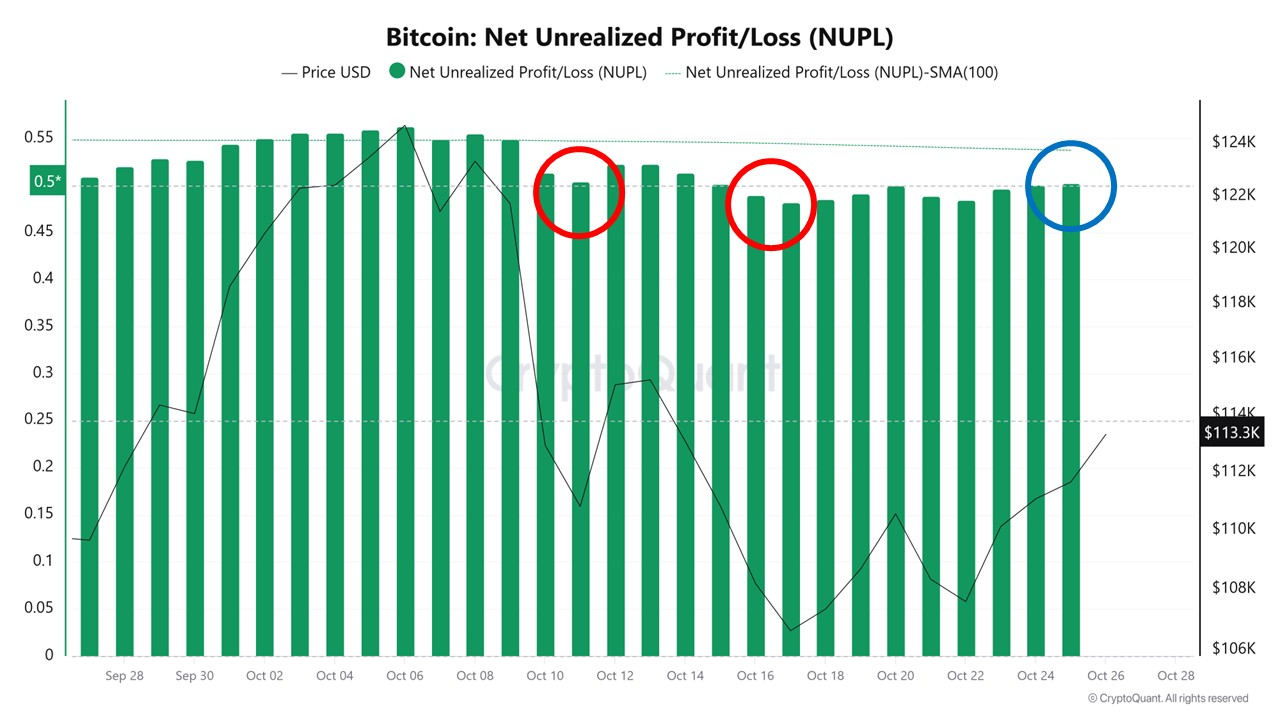

CryptoQuant data shows that each shift in Trump’s tone on China has mirrored Bitcoin’s price movements and the Net Unrealized Profit/Loss (NUPL) indicator.

When Trump threatened 100% tariffs, Bitcoin fell nearly 8%. When talks resumed, it bounced back. The upcoming Trump–Xi meeting could therefore become a pivotal moment for BTC price.

Whales Move, But No Panic Yet

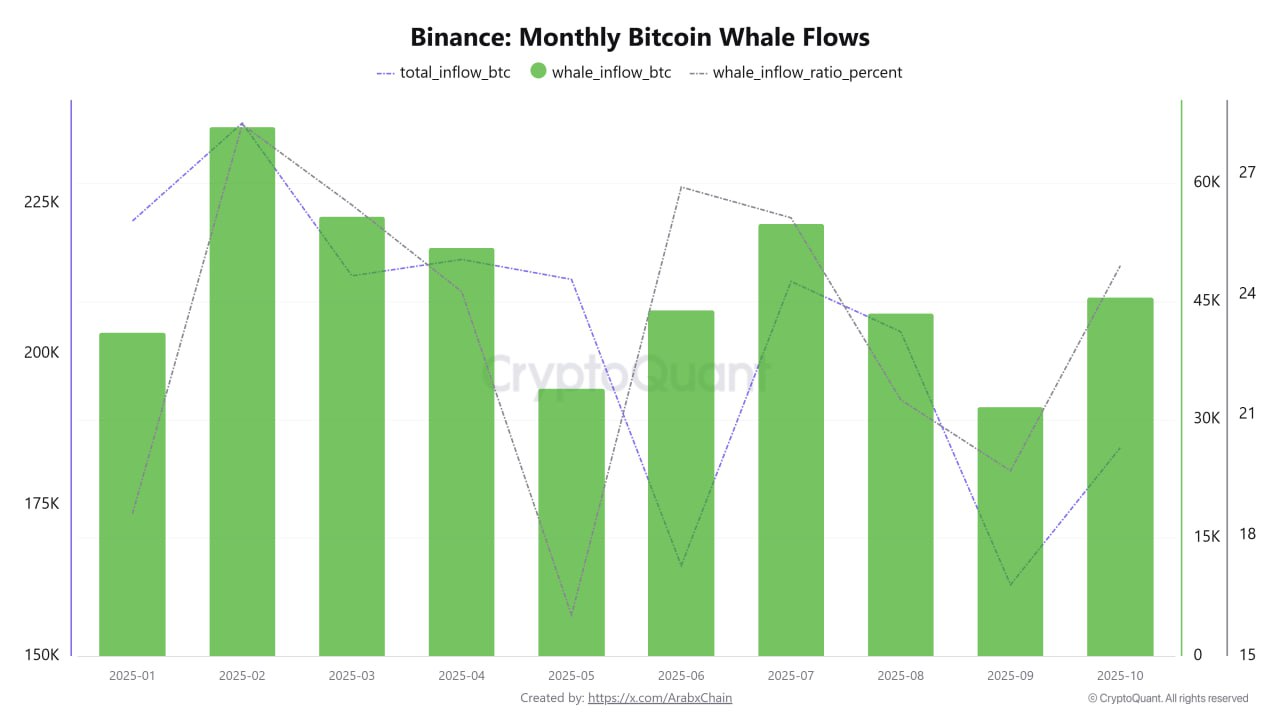

Meanwhile, Bitcoin inflows to Binance surpassed 185,000 BTC in October, the highest in months. About a quarter of those transfers came from whales.

While big inflows sometimes suggest selling pressure, analysts at CryptoQuant believe this wave looks more like repositioning than panic, preparing for volatility rather than exiting the market.

Interestingly, Bitcoin hasn’t fallen below $100,000 since early October. It’s holding steady, even as traders anticipate major macro events.

Related: Here’s How CZ Responded after Trump’s Pardon Triggered a Washington Backlash

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.