- Analyst Moustache tweeted that BTC was retracing in preparation for a spike.

- BTC reached the maximum price of $28,227 on the third day of the week.

- Bitcoin’s new uptrend gradient is higher than its previous one. BTC could reach $31.5 shortly.

Trader and analyst Moustache tweeted that BTC has been retracing in a Wyckoff pattern and was gearing for a spike since it bottomed in 2022. Moustache stated that it will be a “choppy Price Analysis” until it shoots towards $40,000 and leaves the masses in disbelief. To further supplement his prediction, he attached his previous forecast and showed how BTC fell in line with his prediction.

By applying the principles of the Wyckoff pattern, the analyst stated that the stock market was at the stage of Mark-up/Profit Release. As such, it was due for a spike that could make BTC reach $40,000.

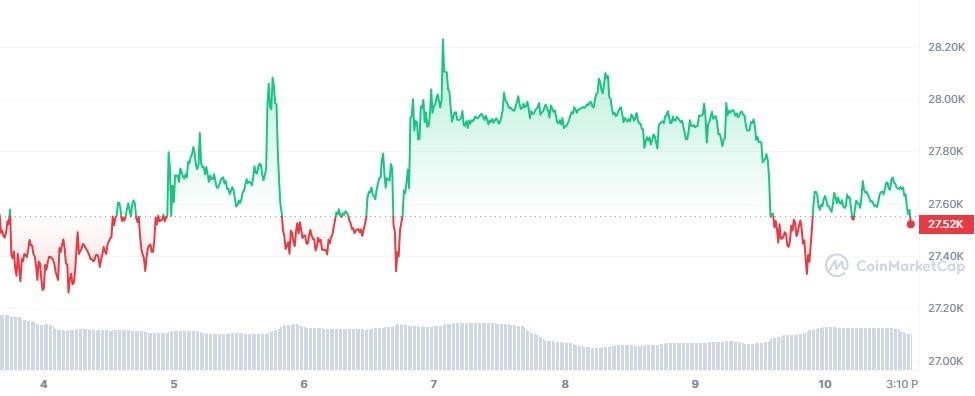

Considering the weekly price action for BTC, it could be said that BTC has been on a roller coaster ride. It was exchanging hands at $27.55K when the markets opened for trading for this week. For the first three days, BTC price action was all over the place. At times it gained value and rose above the opening market price and, at other times, it lost value and sank below the opening market price.

However, on the third day of the past week, BTC reached its maximum value of $28,227. Its lowest price of $27,260 was reached on the first day itself. At press time, BTC is trading at $27,533.86 after a decrease of 0.07% during the last week.

From the above chart, it can be seen that BTC is on an uptrend. The gradient of the current uptrend is higher than the previous uptrend marked in white dotted lines. BTC may travel along the dotted white lines and at times may be supported by the 2:1 Gann fan line as it heads toward $31.5K.

However, the Accumulation/Distribution Line (ADL) reads a value of 10.7M, and then the line seems to be heading downward. This shows that BTC’s uptrend has no volume to support. Hence BTC may fall and test the $25.3K support level.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.