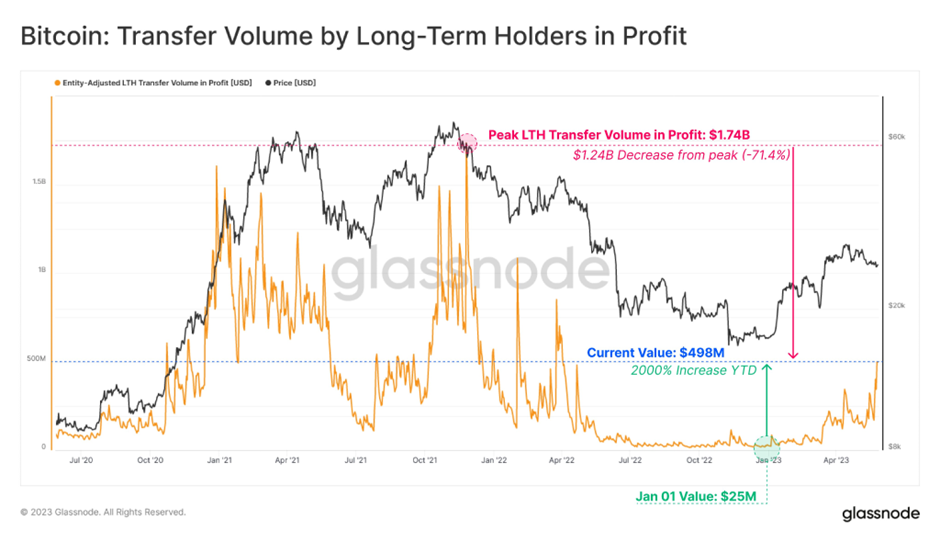

- Glassnode tweeted Bitcoin transfer volume sent by long-term holders in profit has surged by almost 2000% YTD.

- Current profitable transfer volume for BTC is $1.24B, 71.4% lower than the peak during the 2021 Bull Market.

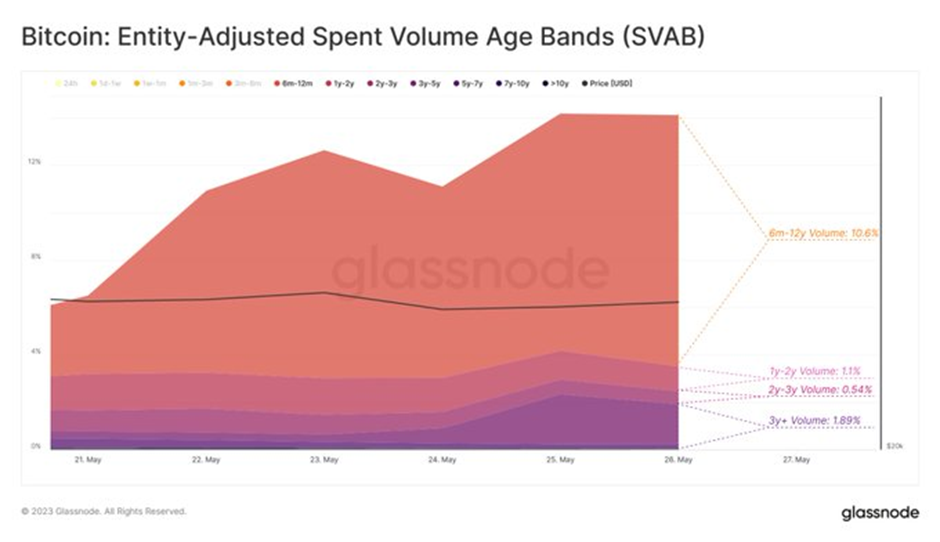

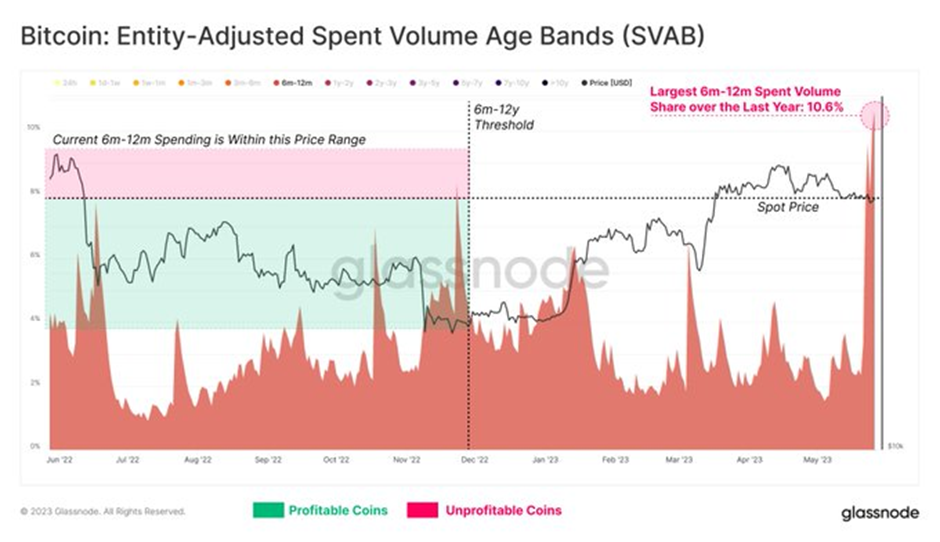

- The 6-month to 12-month cohort of long-term holders are the largest spenders.

Data analytics platform Glassnode reported that the Bitcoin transfer volume sent by long-term holders in profit has experienced a noteworthy rise year-to-date (YTD), surging from $25 million to $489 million, marking an almost 2000% increase.

Nevertheless, the current profitable transfer volume for BTC stands at $1.24 billion, which is 71.4% lower than the peak of $1.74 billion witnessed during the 2021 Bull Market.

Meanwhile, upon examining the breakdown of the Bitcoin long-term holder (LTH) spending by age cohort, Glassnode expressed that it becomes apparent that the 6-month to 12-month cohort stands out as the largest spenders. They have recorded a transfer volume three times greater than all other LTH cohorts – 1 year or more.

Moreover, when analyzing the spending range for coins aged 6 months to 12 months, Glassnode says it is important to note that out of a total of 183 potential acquisition days, 167 of them (92%) are currently in a profitable position relative to the current spot price. This information helps to contextualize both the high volume of spending within the 6-month to 12-month age cohort and the recent surge in profitable transfer volume.

Additionally, in a previous tweet, Glassnode noted that The Bitcoin market continues to operate in a state of unrealized profit, with the supply currently in profit being almost twice as large as the supply in loss, at a ratio of 1.9 to 1.

However, the platform emphasizes that it is important to note that this ratio is still considerably lower than the peak reached during the exuberance of the 2021 Bull Market. At that time, the Supply in Profit and Loss Ratio soared to a staggering value of 554.5, indicating a much higher degree of profitability in the market.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.