- Bitcoin falls 1.84% to $68,811 after rebounding from session lows near $68,000 as Bernstein reiterates $150,000 year-end price target.

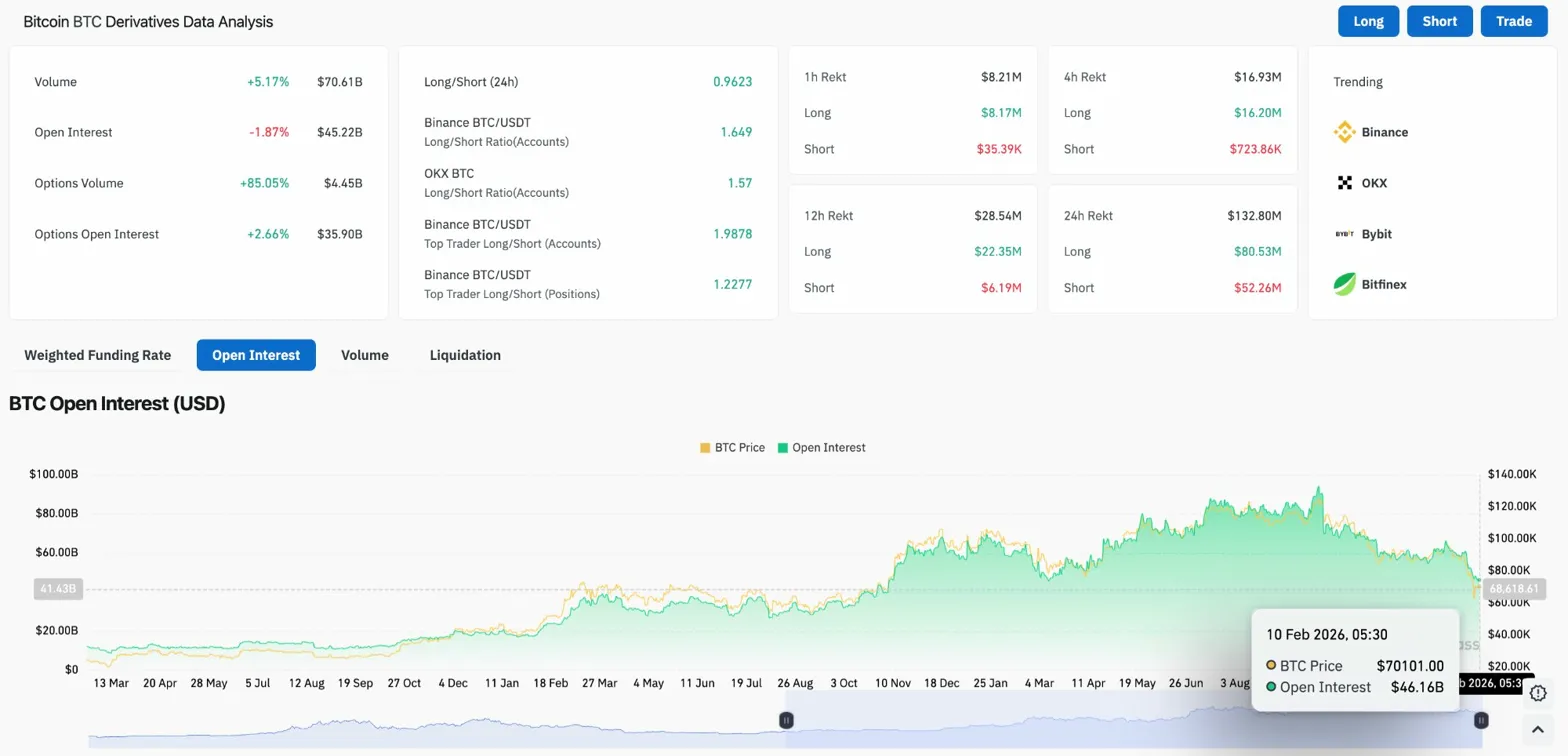

- Open interest drops 1.87% to $45.22 billion while options volume surges 85.05% as traders position for volatility.

- Recovery requires reclaiming $77,227, while a close below $68,000 opens downside toward the $60,000 crash low.

Bitcoin price today trades near $68,811 after recovering from early session weakness that saw the token briefly dip toward $68,000. The bounce comes as Wall Street firm Bernstein reiterates its bullish $150,000 year-end target, arguing that what the market is experiencing represents the weakest Bitcoin bear case in its history.

Bernstein Calls This The Weakest Bear Case Ever

Bernstein analyst Gautam Chhugani delivered a forceful rebuttal to bearish sentiment, maintaining the firm’s $150,000 year-end price target despite the 45% drawdown from October highs.

Chhugani argued that nothing has fundamentally broken during this correction. The analyst noted that when all stars are aligned, the Bitcoin community manufactures a self-imposed crisis of confidence. He stated that no skeletons will unravel and the media is once again writing an obituary for Bitcoin.

The analyst concluded that time remains a flat circle on Bitcoin, referencing the cyclical nature of sentiment swings that have historically preceded major recoveries.

The bullish case rests on structural factors that remain intact including institutional adoption, regulatory progress, and the maturing market infrastructure. From this perspective, the current drawdown represents a buying opportunity rather than a fundamental shift in the thesis.

Mining Difficulty Posts Largest Drop Since 2021

Schwab’s Jim Ferraioli provided technical context for identifying market bottoms, pointing to Bitcoin mining dynamics as a key indicator.

Previous selloffs have usually bottomed near Bitcoin’s cost of production. Miners with less efficient equipment typically shut down operations temporarily during deep drawdowns. This capitulation becomes visible through the mining difficulty adjustment, which falls as miners leave the network.

CoinDesk reported that Bitcoin mining difficulty just dropped by its largest amount since 2021 as at least some miners capitulated to plunging prices. Once difficulty starts to rise again, that represents confirmation the bottom may be in.

The mining capitulation signal aligns with the deleveraging seen in derivatives markets, suggesting the market may be approaching the exhaustion phase that precedes recoveries.

Daily Chart Tests $73,375 Support Zone

On the daily chart, Bitcoin trades below all four major EMAs within a descending structure. The 20 day EMA sits at $77,227, the 50 day at $83,994, the 100 day at $89,879, and the 200 day at $95,439.

The Supertrend indicator remains bearish at $81,644. The $73,375 horizontal support zone marked on the chart represents immediate support, while the $75,000 level has acted as a pivot through the consolidation.

The current price represents a decline of roughly 45% from the October all-time high near $126,000. Despite the severity of the drawdown, Bernstein’s thesis suggests this represents a buying opportunity with substantial upside to their $150,000 target.

Hourly Chart Shows Ascending Trendline Support

On the hourly chart, Bitcoin has formed an ascending trendline from the February 6 crash low at $60,000. This trendline currently provides support near $68,000, which held during today’s early session weakness.

RSI sits at 39.49, recovering from oversold conditions but still below neutral. MACD remains negative but has stabilized, suggesting downside momentum is fading without yet signaling a reversal.

The $72,000 level represents immediate resistance where price has struggled to break through since the February 7 bounce. A sustained move above this level would signal potential continuation toward the $75,000 zone.

Derivatives Show Mixed Signals As Volatility Positioning Increases

Open interest dropped 1.87% to $45.22 billion while volume rose 5.17% to $70.61 billion. Options volume surged 85.05% to $4.45 billion, indicating traders are positioning for significant price movement.

The long/short ratio sits at 0.96, showing a slight short bias across the market. On Binance, top traders maintain a 1.98 ratio by accounts, indicating some bullish positioning remains among larger players.

Over the past 24 hours, $132.80 million in positions were liquidated, with $80.53 million from longs and $52.26 million from shorts. The more balanced liquidation profile compared to the heavily long-biased flush during the crash suggests the market is normalizing.

Options open interest rose 2.66% to $35.90 billion, reflecting increased hedging activity and directional bets on both sides of the market.

Outlook: Will Bitcoin Go Up?

The trend remains bearish while price trades below all EMAs, but mining capitulation and Wall Street conviction suggest conditions for a bottom are forming.

- Bullish case: A daily close above $77,227 would reclaim the 20 day EMA and signal that the crash low marked the bottom. Bernstein’s $150,000 target implies 118% upside from current levels, with the firm arguing all structural catalysts remain intact.

- Bearish case: A close below $68,000 would break the ascending trendline support and target the $60,000 crash low. Despite bullish institutional calls, the technical structure remains bearish until reclaiming the EMA cluster.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.