- Bitcoin (BTC) holds above $114,000, showing low volatility “quiet strength” according to Lark Davis

- Easing inflation and expected 2026 Fed rate cuts create a stable macro backdrop

- Altcoin/BTC chart flashes rare bullish MACD cross, historically preceding major altcoin rallies

Bitcoin (BTC) is exhibiting a phase of “quiet strength,” consolidating calmly above the $114,000 level after months of heightened volatility. According to Lark Davis, this steady recovery shows that investors are adapting, not retreating. The wild swings of early 2025 have given way to slow, consistent growth. He describes this moment as “the silence before expansion,” a period where conviction outweighs excitement.

At the time of writing, Bitcoin is trading at $114,300, gaining more than 5% in the last week.

Related: Bitwise CEO Teases ‘Big Week,’ Hinting at Major Progress in SOL ETF Application Process

Macro Shift: Easing Inflation, 2026 Fed Rate Cuts Support Stability

Global markets are also showing signs of adjustment. Inflation across major economies has eased, and central banks are preparing to cut interest rates in early 2026. That combination, Davis explains, is allowing investors to remain exposed to risk without the same fear of sudden volatility.

This cycle, he says, may unfold differently from previous ones. Instead of explosive rallies followed by deep crashes, the current phase could see gradual, sustained growth as institutional investors move in under clearer regulatory conditions.

Altcoin Bottom Signal? Rare MACD Cross vs. BTC Hints at Turning Point

Some altcoins have recently collapsed to zero within minutes, shaking confidence across the retail market.

Throughout this cycle, altcoins have underperformed. Only brief bursts of gains have appeared, such as XRP’s sevenfold rise or short-lived momentum among AI-related tokens. For most of 2024 and 2025, the broader altcoin market, especially beyond the top ten—has remained in a bear phase.

Source: TradingView

Still, a possible shift could be forming. The chart comparing altcoins to Bitcoin now shows a major bottom with a bullish MACD crossover. This pattern has appeared only twice before, in 2017 and 2021, both times leading to massive altcoin rallies.

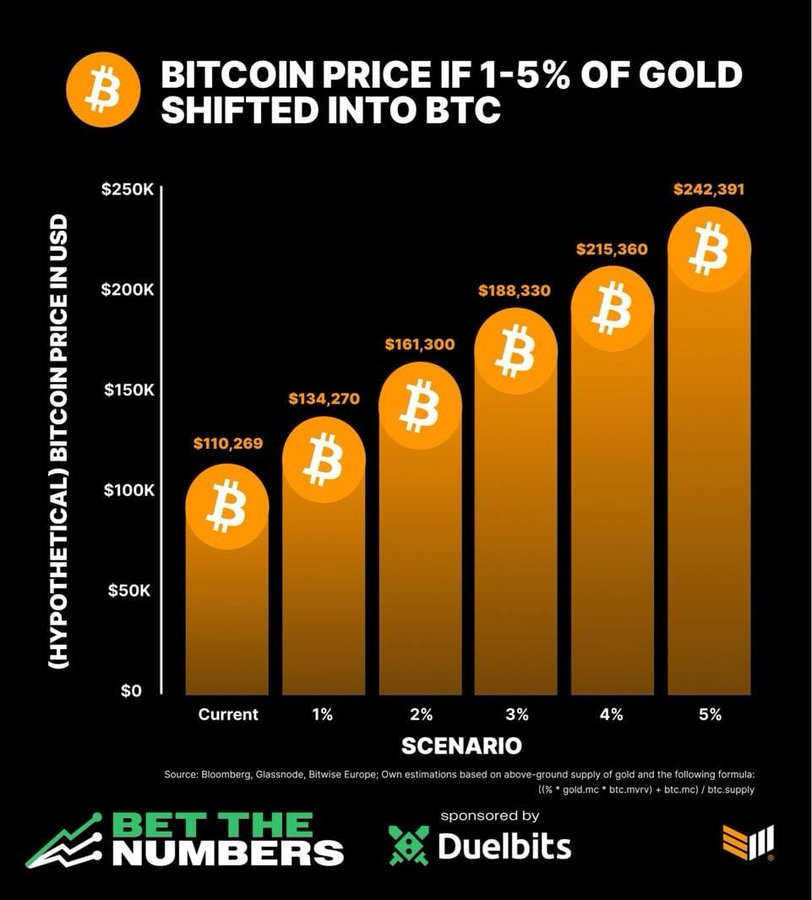

Gold Fades, Bitcoin Gains: Is the Rotation Underway?

Last week’s rush to buy gold may have marked a local top. Gold has dropped around 5% this week, while Bitcoin has gained roughly 3%. Davis says this could mark the start of a rotation from traditional safe-haven assets into digital ones.

Source: X

If Bitcoin captures even a small share of gold’s market value, the price could rise sharply. A 1% rotation would value Bitcoin near $134,000, a 3% shift near $188,000, and a 5% shift around $242,000.

Related: Bitcoin Price Prediction: BTC Bulls Regain Control Despite Mt. Gox Repayment Delay

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.