- Analyst Mags forecasted that Bitcoin could reach $155,600, based on Fibonacci extensions.

- FOMC decision expected is to bring volatility, with base case a 25bps rate cut.

- $116,000 resistance is the key level Bitcoin must reclaim for fresh upside.

Crypto analyst Mags (@thescalpingpro) has projected Bitcoin could climb to $155,600 using Fibonacci extension levels.

According to Mags, Bitcoin has flipped the 1.618 extension into support and is now aiming for the 2.618 level, which aligns with the $155,600 zone.

Related: Tom Lee Says Bitcoin and Ethereum Could See ‘Monster Move’ After Fed Rate Cuts

BTC is consolidating above $116,000 after touching $124,100 in mid-August. With the extension target now firmly in play, Bitcoin trades at $116,843.03, up more than 4% in the past week, as per CoinMarketCap data.

FOMC Looms: Neutral Guidance vs Bullish Bias

According to Swissblock, the upcoming FOMC meeting is one of the most anticipated macro events of the year. While the S&P 500 is pushing to all-time highs, Bitcoin is showing signs of decorrelation from equities.

Swissblock warned that a “sell the news” reaction is possible, but added that BTC is unlikely to turn bearish.

Instead, the most probable outcome is continued upward movement with more volatility, as markets adjust to a 25bps rate cut with neutral guidance, versus the more dovish expectations currently priced in.

Resistance at $116,000: Key Breakout Level

Bitfinex analysts said in a report that $116,000 is a critical resistance that Bitcoin must decisively reclaim before resuming its uptrend.

After peaking at $124,100 in August, momentum slowed, with many recent buyers now underwater in the $108,000–$116,000 range.

A breakout above $116,000 could re-energize bullish sentiment, validating Mags’ Fibonacci-based target of $155,600. Until then, the level remains a ceiling capping upside momentum.

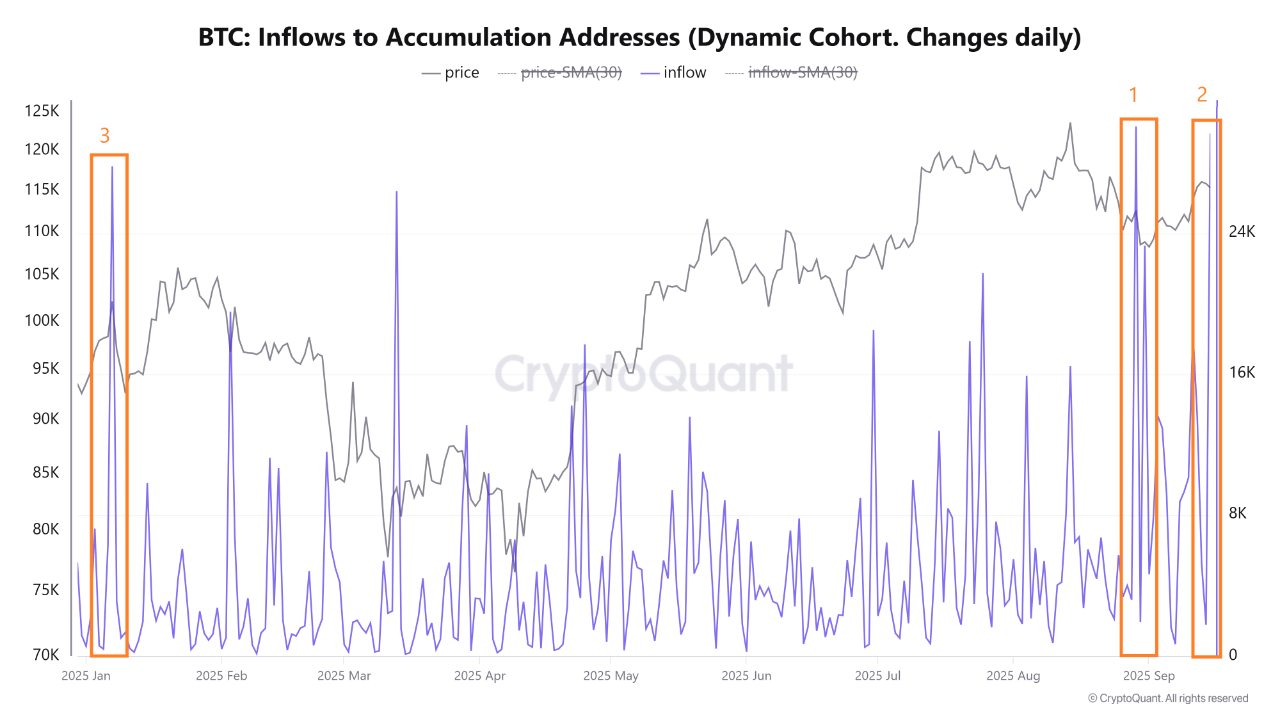

Accumulation Surge: $3.4B in BTC Added

On-chain data from CryptoQuant paints a bullish picture. Just hours before the Fed’s rate decision, 29,685 BTC ($3.4 billion) flowed into accumulation addresses, the second-largest single-day inflow of 2025.

This brings the total BTC held in accumulation addresses to 2.84 million, with an average cost basis of $72,437. The move signals strong confidence among long-term holders, even in the face of macro uncertainty.

Related: Bitcoin (BTC) Price Prediction For September 17

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.