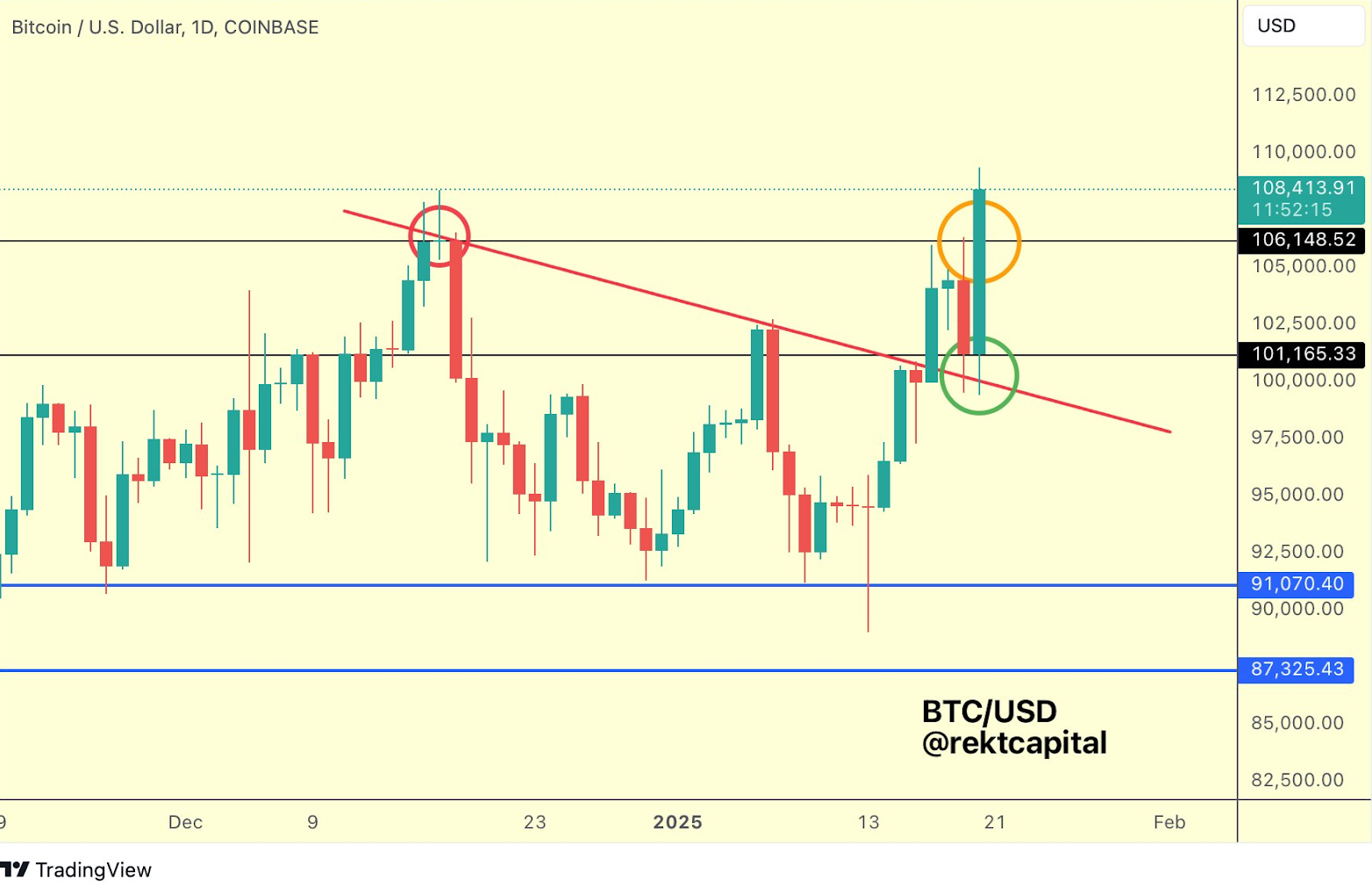

- Bitcoin price is currently testing support levels below the $101,000 level.

- Bitcoin’s shallow correction suggests less volatility than previous pullbacks in 2021, 2017

- A breakout above $107,000 may trigger a short squeeze, pushing Bitcoin to new highs.

Bitcoin’s price has once again dropped below $101,000, sparking concern across the market. While the market is currently in a state of flux, this doesn’t mean the bull run is over.

According to analyst Rekt Capital, Bitcoin is in a parabolic upside phase, which means we’ll see a series of price gains followed by corrections.

These ups and downs were seen in past Bitcoin markets, such as during the 2021 bull run. Back then, Bitcoin experienced multiple price run-ups before a correction and then a bear market.

What Happened in 2021 and 2017?

In 2021 Bitcoin didn’t undergo the typical post-breakout retest, which means it moved higher without revisiting key resistance levels. On the other hand, the 2017 cycle saw Bitcoin successfully retest and confirm old resistance as new support before the price continued to rise.

Related: Bitcoin Dominance Mirrors 2020/2021 Pattern: What Could This Mean?

Right now, Bitcoin seems to be in the midst of its own price discovery phase. The latest correction is pretty mild, dropping only 17% over five weeks, which is a lot less dramatic than the 31% and 34% dips seen in 2021 and 2017. This might signal that the market is getting less volatile in its corrections.

Bitcoin’s Next Move: New ATHs Soon?

For Bitcoin to keep the rally going, it needs to break through key resistance levels and establish a solid weekly close above them. Bitcoin is now facing resistance strong between $106,000 to $107,000.

Meanwhile, support is forming around the $100,000 to $103,000 range, which is helping to steady the price. For a breakout towards new highs, Bitcoin needs to close above $107,000, potentially sparking a short squeeze and driving prices higher.

Related: Bitcoin in 2025: Can Optimism Match Reality? True Price Predictions

In the coming weeks, Bitcoin’s price will likely be determined by whether it follows the 2021 pattern—where a breakout occurred without a retest—or if it leans more toward the 2017 approach, where the retest of resistance was crucial.

Either way, the main point is that a firm weekly close above the current resistance could mean Bitcoin is prepping for new all-time highs.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.