- LFG denied withdrawing $67M after Terra’s founder became wanted.

- Blockchain data shows the foundation carried out the transactions by proxy.

- The wallets that transferred the 3,133 BTC were active during UST de-pegging.

Contrary evidence has surfaced, confirming that Luna Foundation Guard (LFG) attempted to withdraw $67 million worth of Bitcoin (BTC) a day after its founder was declared wanted.

Last month, a report said South Korean authorities ordered the KuCoin and OkEx exchanges to freeze 3,133 BTC tied to the controversial Terra LUNA founder, Do Kwon. However, LFG called the information false, adding that it had never created a new wallet nor moved Bitcoin (BTC) since May 2022.

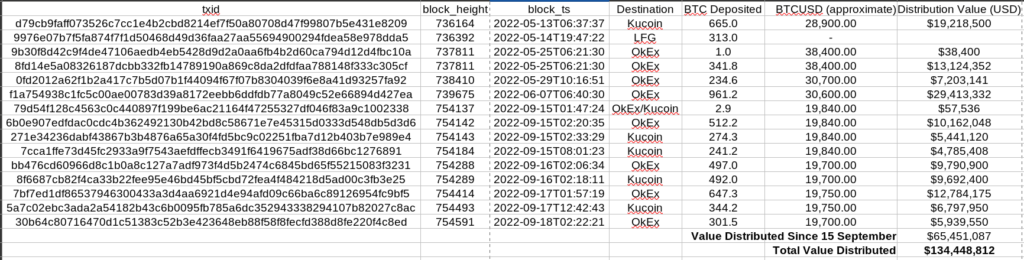

Interestingly, blockchain transaction histories published by OXT Research on Twitter told a different story. The tweet noted that while it may be true that the LFG’s official wallet has made no transactions recently, the foundation carried out the disputed transfers by proxy.

To boost the reserves for its stablecoin UST in the months leading up to Terra’s collapse, the LFG spent almost $1.5 billion on bitcoin purchases. OXT Research asserted the addresses that made the significant deposit of 3,133 BTC to KuCoin, which the Korean authorities requested its confinement, were the same wallets LFG used prior to the UST de-pegging events.

Additionally, @ErgoBTC claimed that the transaction sequence from the LUNA proxy wallets distributed about $65 million worth of BTC as of the date, a figure closely related to the disputed $67 million deposits to Kucoin and OKEx.

Furthermore, the analytics believed that the fact that there was no massive outcry of “unjustly seized funds” from giant whale/OTC traders also proves that the monies were related to the funding of the LFG treasury.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.