- BNB’s price tanked due to the lawsuit the SEC served its parent exchange.

- The coin’s value could fall further since the 12-day EMA diverged below the 26-day EMA.

- Binance responded to the allegations, noting that the SEC was dishonest in carrying out its duties.

The value of Binance Coin (BNB), the native exchange of the world’s largest exchange fell by 7.93% in the last 24 hours. This could be the result of the lawsuit the U.S. Securities and Exchange Commission (SEC) served Binance during the trading hours of June 5.

According to the regulatory agency led by Gary Gensler, Binance, including its U.S. entity was involved in several irregularities.

The charges also affected CEO Changpeng Zhao (CZ) whom the SEC accused of illegally diverting customers’ funds for personal use.

Furthermore, BNB, Solana (SOL), and Cardano (ADA) among other cryptocurrencies were labeled “unregistered securities” in the lawsuit.

Coping with the wave of withdrawals

Defending the position of the SEC, Chairman Gensler said, “Through thirteen charges, we allege that Zhao and Binance entities engaged in an extensive web of deception, conflicts of interest, lack of disclosure, and calculated evasion of the law.”

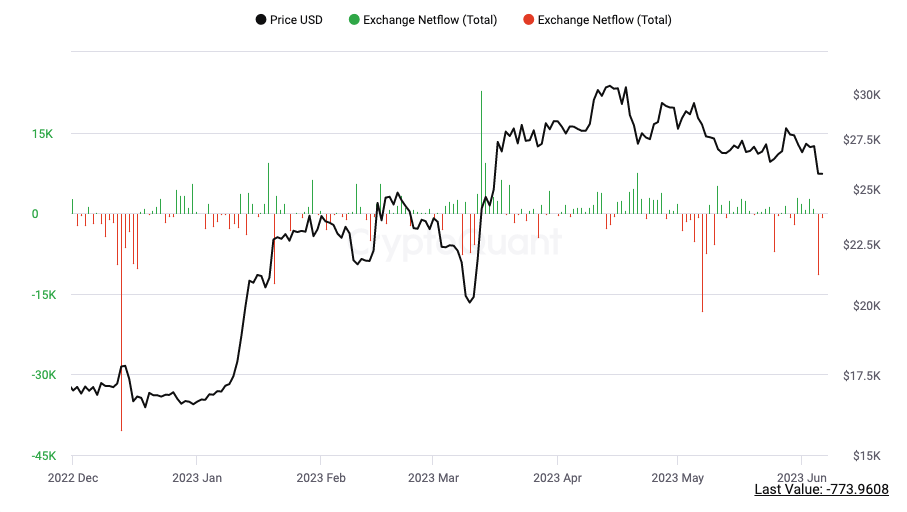

Additionally, the exchange has begun to feel the consequences of the regulatory action. According to CryptoQuant, the request to withdraw funds on the exchange skyrocketed in the wake of the news.

Apart from BNB, stablecoins, Bitcoin (BTC) and Ethereum (ETH) were other cryptocurrencies that had a lot of withdrawals. This, then led the Binance exchange netflow into the negative region.

Although negative exchange netflow sometimes precedes an increase in price, it might not be the case this time. This was because the rate of users withdrawing massively superseded deposits.

However, Binance officially responded to the SEC lawsuit. In its reply, the exchange counter-accused the agency of failing to define a clear regulatory structure.

While expressing disappointment in the allegations, Binance said the SEC had failed to do its job of protecting users. Binance mentioned, “Rather, the SEC’s actions here appear to be in service of an effort to rush to claim jurisdictional ground from other regulators – and investors do not appear to be the SEC’s priority.”

BNB: A bearish outlook continues to loom

Based on the daily chart, the Moving Average Convergence Divergence (MACD) fell into the negative region. Negative MACD values indicate that the 12-day EMA had diverged further below the 26-day EMA.

And since the orange dynamic line was above the blue, it means that sellers were in control of the market. Thus, this infers that downward momentum was increasing and BNB’s trading price at $276.6 could fall further.

In conclusion, the crypto community seemed divided by the recent tussle. For some, Binance operations were shady and deserved to be looked into.

But another section believes allegations to be a case of a witchhunt. Whichever way the matter tilts, BNB might still have to cope with a bearish state for the time being.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.