- CEXs experienced a surge in spot and futures trading volume in October.

- Leading the pack in spot volume growth were Crypto.com (201%), Upbit (75%), and Bybit (73%).

- This increased activity came following the Bitcoin-led bull rally that commenced in October.

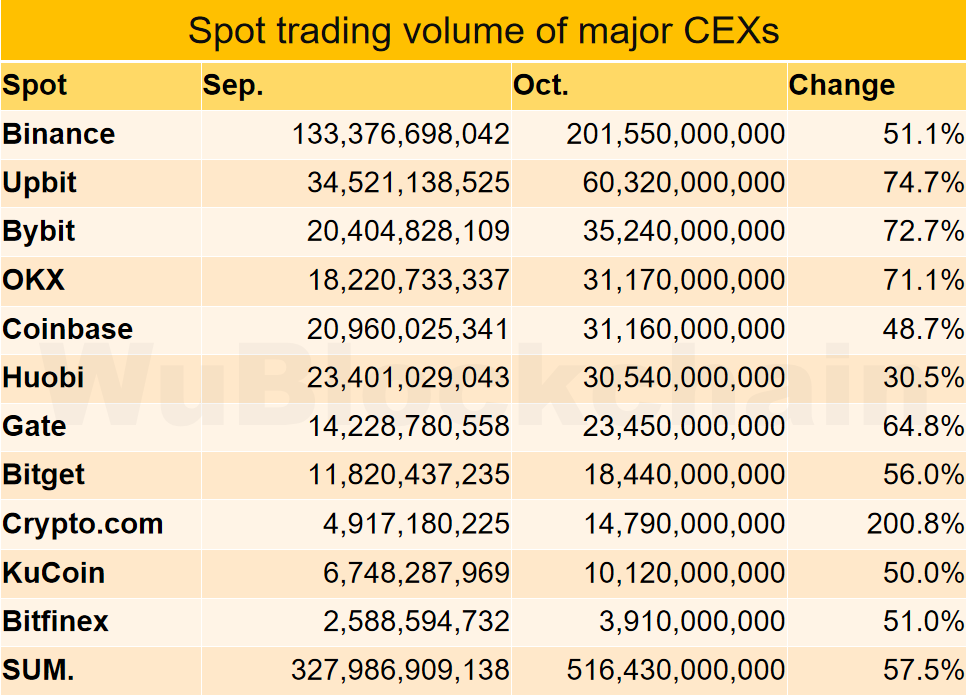

In October, the spot trading landscape witnessed a substantial interest surge, with leading centralized exchanges (CEXs) collectively experiencing a remarkable 57.5% month-on-month increase in volume. According to the well-known crypto-focused Chinese reporter Colin Wu, these figures recorded for October were last seen six months ago.

Furthermore, Wu noted that the frontrunner exchanges in spot trading volume growth were Crypto.com, Upbit, and Bybit. Specifically, he disclosed that Crypto.com recorded approximately $5 billion spot volume in September, only to surge 201% to nearly $15 billion in October.

Upbit followed with a 75% uptick from $34.52 billion to $60.32 billion. Likewise, Bybit improved 73%. On the other hand, the exchanges with the lowest growth change were Huobi, registering a more modest 31%, Coinbase at 49%, and Kucoin at 50%.

Notably, the largest trading platform, Binance, commanded about 40% of the cumulative spot trading volume of the ranked 11 exchanges. In perspective, Binance controlled nearly four times the spot volume of its closest rival, Upbit.

Delving into the crypto derivative market, the Chinese reporter revealed that the ranked exchanges exhibited a 44.5% month-on-month growth, scaling heights unseen since June. Deribit spearheaded the pack with an extraordinary 260% surge, trailed by Crypto.com at 199% and Bitmex at 171%.

Meanwhile, Huobi trailed behind again with a mere 14% growth change. Binance followed, recording a 62% increase, and OKX at 65%. While Binance’s percentage growth change was only 61% compared to others, the exchange’s derivative volume grew from $663 billion in September to over $1.07 trillion by October. Interestingly, other exchanges, despite registering a more significant growth in terms of percentage change, failed to attain the figure Binance recorded in September.

Cumulatively, the crypto derivative market saw over $2.31 trillion in trading volume. It is worth mentioning that the increased activity in the crypto spot and futures market may be attributed to the Bitcoin-led bull market rally that commenced in October.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.