- Glassnode announced that Bitcoin’s future contract short liquidations reached a 1-month high.

- The crypto market leader’s price is up more than 10% over the last week.

- Glassnodes made a few other announcements on Twitter about BTC.

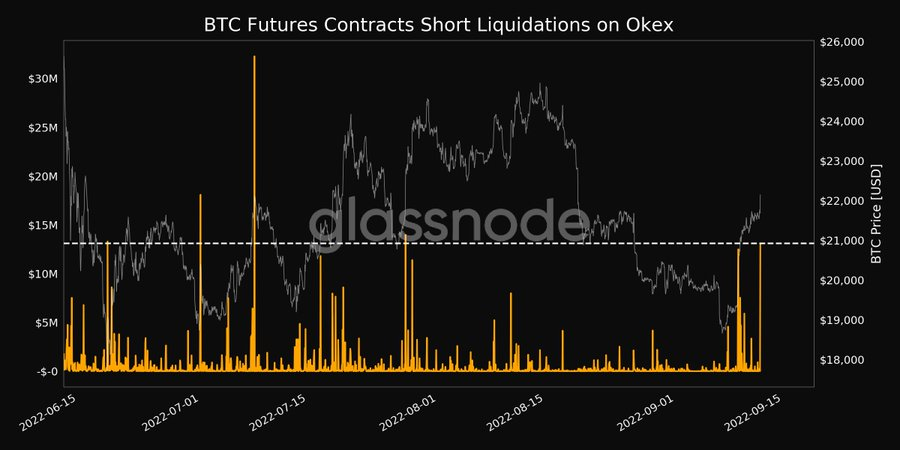

The on-chain market intelligence firm, Glassnode, took to Twitter on September 12 to announce that Bitcoin’s (BTC) Futures Contracts Short Liquidations had reached a 1-month high. According to the post, the number now stands at $13,094,043.09.

The previous high of BTC’s Futures Contracts Short Liquidations was recorded on September 9 of 2022 at $12,495,487.65.

According to the market tracking website, CoinMarketCap, BTC is currently trading at $21,763.07 after a 0.90% increase in price over the last day and after reaching a high of $22,206.37 and a low of $21,406.94 over the same time period.

The crypto market leader’s price is also still up more than 10% over the last week considering its stellar performance over the weekend when it crossed the psychological $20,000 level as well as the next key resistance level at $21,000.

At the time of writing, the king of crypto’s 24-hour trading volume was up more than 16% to stand at $40,267,705,855. In terms of market cap, BTC stands at $416,883,433,822.

In some related news, Glassnodes made a few other announcements on Twitter about BTC. According to the posts, BTC’s number of addresses holding ten or more coins reached a 19-month high on September 12. The number now stands at 150,734. The previous high was recorded on September 9, which stood at 150,724.

Additionally, Glassnode announced that the number of exchange withdrawals (7d MA) has reached a 1-month high and now stands at 2,139.137.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.