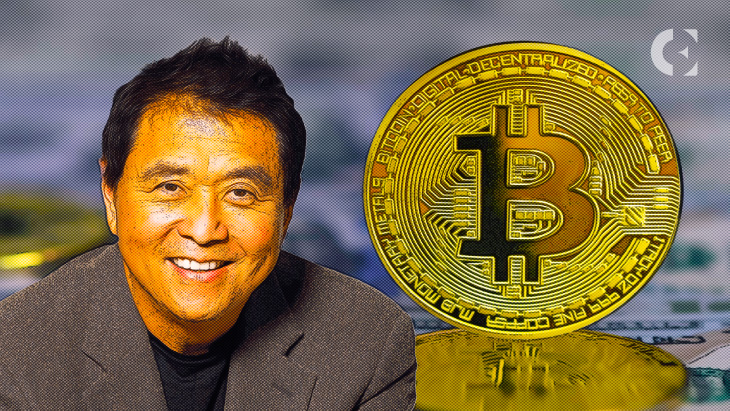

- Robert Kiyosaki says BTC investors will get wealthier than “fake money savers.”

- Author contends the “biggest losers” will be those saving “fake money.”

- With the prior halving in 2020, miners are now producing half the amount of BTC.

Renowned author of “Rich Dad, Poor Dad,” Robert Kiyosaki, contends Bitcoin investors will gain more wealth than “fake money savers.” He actively encourages his followers on social media to buy the apex crypto.

In a tweet, Kiyosaki said the holders of silver, gold, and Bitcoin will become considerably wealthier after the Treasury, Wall Street, and the U.S. Federal Reserve commences printing “fake dollars.”

The author believes the value of assets like precious metals and Bitcoin will greatly increase in the wake of the Federal Reserve reversing its hawkish policy and placing unbacked dollars into the economy.

Kiyosaki reasons that when the Fed adjusts its monetary policy and puts more dollars into circulation, Bitcoin investors will likely reap hefty financial benefits.According to him, the “biggest losers” will be those saving “fake money.”

During the pandemic, the BTC fell below $4,000, and oil plummeted below zero. In total, over $6 trillion dollars were printed in 2020 alone.

In a recent tweet, Mike McGlone, senior commodity strategist of Bloomberg Intelligence, said that he anticipates the BTC price to rise in the near future.

With the world rapidly shifting towards digitalization, McGlone stated this might drive the BTC price up substantially. In his recent tweets, he says it’s just a “matter of time” before BTC touches $100,000.

At the time of writing, over 18 million Bitcoins have already been mined. With the prior halving in 2020, miners are now producing half the amount of Bitcoin.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.