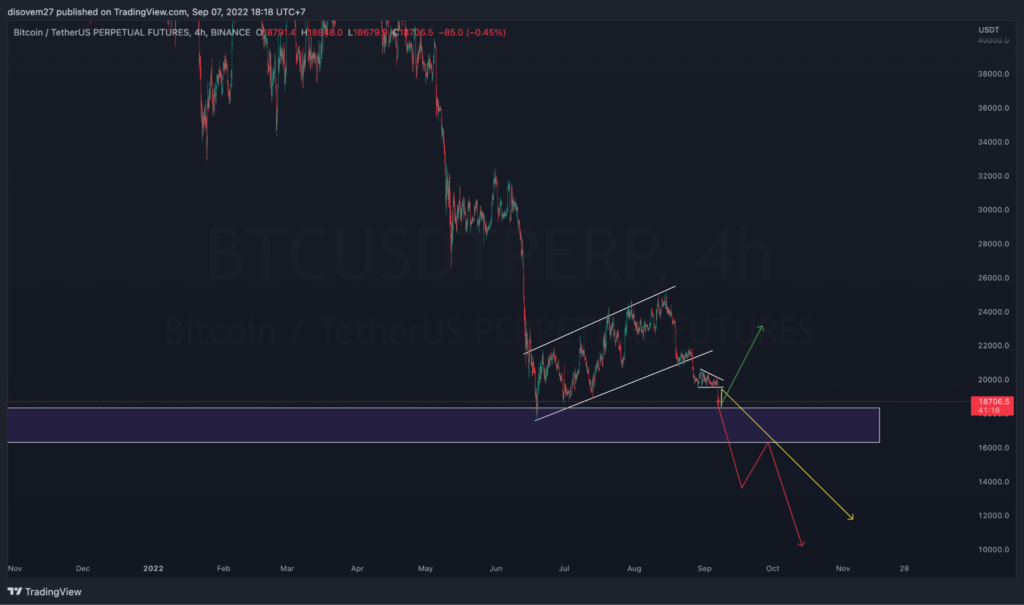

- Bitcoin (BTC) is at critical support, sitting between $17,925.91 and $18,672.46.

- The price of the coin dropped by 5.8% within the past 24 hours.

- BTC’s bearish market price prediction is $12,000.

Having the largest market capitalization in the crypto industry, according to CoinMarketCap, the price of Bitcoin is hovering at $18,758. Bitcoin and other coins faced a massive decrease within the past 24 hours. After that, Bitcoin is now forming a few retrace patterns. Leverage traders are searching for the opportunity to enter sell positions, while spot investors are looking for the chance to buy.

Bitcoin is hovering at its critical support at the 4-hour chart. If the price can break the support zone of $17925.91 and 18672.46, there is a possibility that the price will eventually drop to $14,000 and even as low as $12,000. But if it cannot break this critical support level, we can expect the price to form a reversal during the bearish pressure and reach as high as $23,000.

On the 4-hour chart of BTC/USDT, Bitcoin remains below the 200 MA, and the bears are currently sitting on the throne. The RSI value currently sits at 27.45, meaning that the coin has been oversold. Nevertheless, readings of 30 or fewer indicate oversold market conditions and a more significant possibility of a reversal.

BTC has been consolidating sideways within $19,500 and $20,500 for eight days straight. There is a bearish order block positioned at $19,985 on September 2, 2022, with investors and traders hoping the price will dip from that area. Bitcoin finally broke out from the sideways and dropped 6.05% within 24 hours with a price decrease of $1,204.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.