- Japan’s ¥17T fiscal shift may reshape global liquidity and influence Bitcoin moves.

- Bitcoin weakness grows as price breaks key on-chain metrics and loses momentum.

- Japan’s crypto tax cuts and reclassification may boost long-term digital-asset demand.

Japan’s new fiscal push is drawing global attention as policymakers prepare a ¥17 trillion package that marks a decisive shift away from decades of deflation. The plan arrives at a moment when global markets are highly sensitive to liquidity changes and currency swings.

Analysts say Japan’s attempt to stabilize household budgets while boosting competitiveness could influence risk assets, especially Bitcoin, which usually reacts early to liquidity shifts.

Japan’s Bullish Turn: ¥17T Package and 20% Crypto Tax

According to Reuters, Finance Minister Satsuki Katayama outlined the government’s intention to strengthen strategic industries, including semiconductors and AI. She also emphasized measures that help households manage rising prices. Japan aims to stabilize the domestic economy without forcing abrupt interest-rate decisions.

Consequently, investors see the package as part of a broader attempt to reduce long-term deflation risks. Additionally, the plan raises questions about global liquidity because changes in the yen often influence worldwide funding flows. A stronger or more volatile yen could disrupt the carry trade and tighten risk conditions across equities and credit.

Besides the spending plan, regulators are preparing major changes for digital assets. Japan’s Financial Services Agency intends to classify Bitcoin and similar assets as financial products.

The agency also plans to lower the tax rate on crypto gains from 55% to 20%. This move broadens market access and aligns the sector with traditional securities. Hence, Japan’s fiscal and regulatory direction may encourage new flows into digital assets once markets stabilize.

Related: Japan to Slash Crypto Tax From 55% to 20% by 2026: Here’s Why That’s Huge for Metaplanet

Bitcoin Faces Technical Pressure as Key Levels Erode

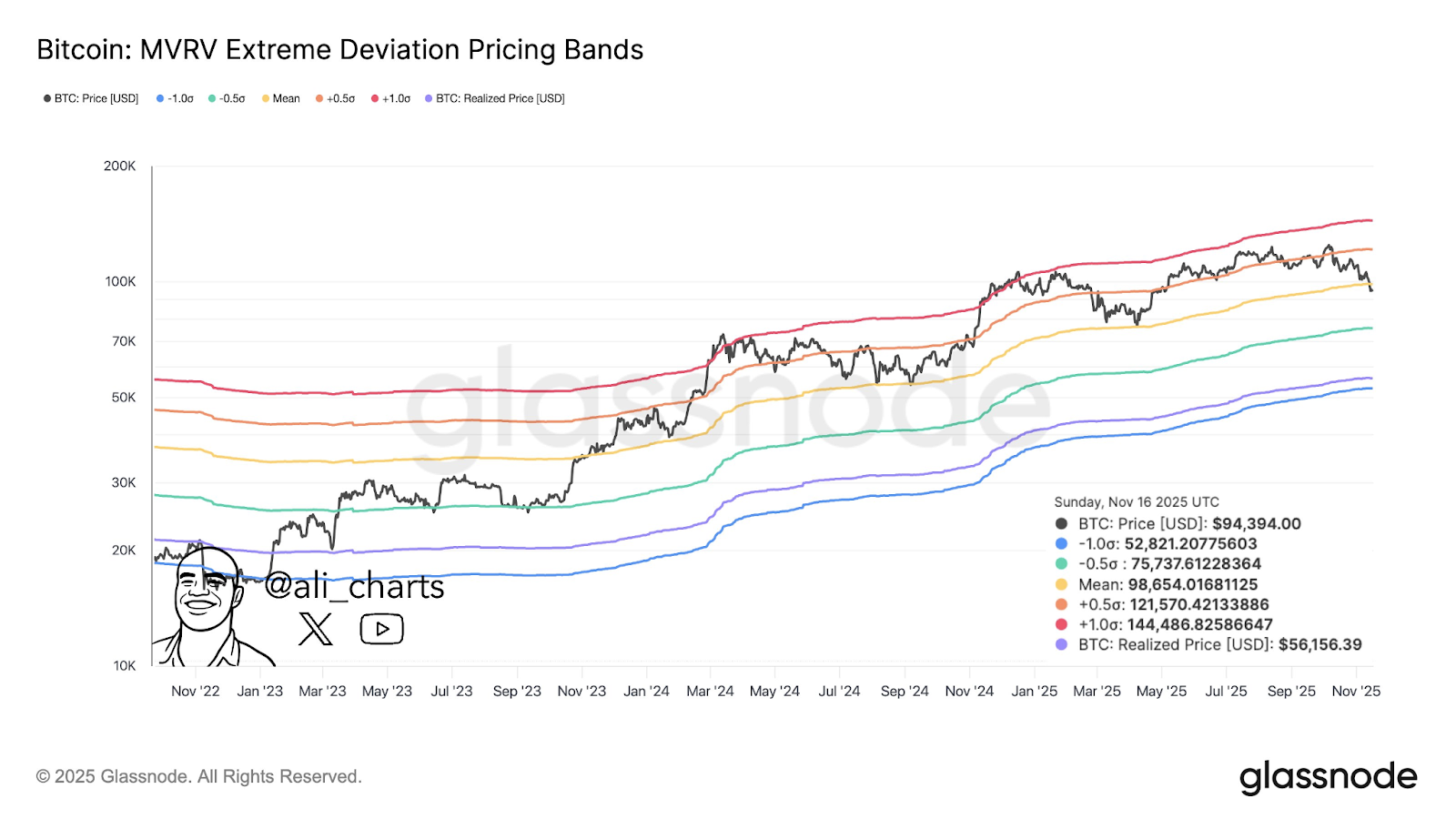

Bitcoin trades below $90,000 after a sharp weekly decline. Market data shows a seven-day drop of more than 13%. Analysts note that the price slipped below the MVRV mean band at $98,650. This break signals weakening momentum and increases the likelihood of deeper retracement.

Ali Martinez said the next major support sits at $75,740. That area aligns with a previous consolidation zone. Additionally, $56,160 represents the realized price and a major cyclical support level. A deeper reset near $52,820 would mirror prior capitulation zones.

Moreover, the chart indicates a trend toward lower volatility, which often precedes larger moves. Bitcoin must reclaim $98,650 to reduce the risk of revisiting deeper supports. Until then, analysts consider the trend fragile.

Significantly, Bitcoin often reacts first to liquidity shifts linked to Japanese policy cycles. However, current technical signals show that the market is not ready for a strong recovery.

Related: Why Sanae Takaichi’s Historic Win Today Could Reset Japan’s Crypto Policy Path

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.