- Santiment data shows that the BTC supply off of exchanges is at an ATH.

- The price of BTC has dropped slightly over the last 24 hours.

- Daily technical indicators are bearish for the market leader.

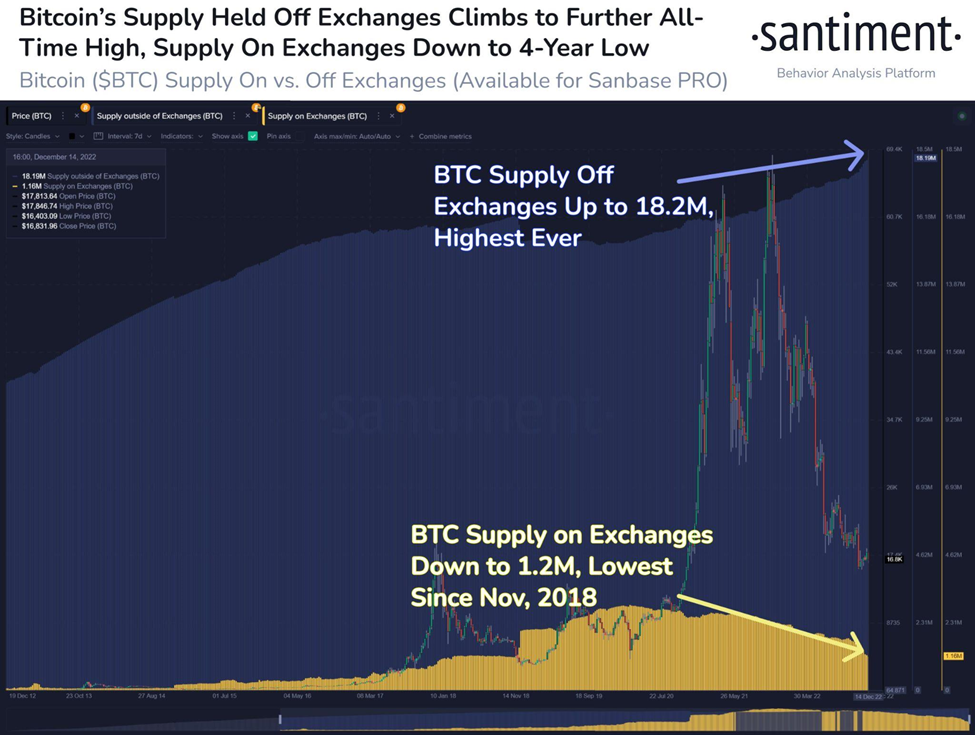

The blockchain analysis firm, Santiment, posted a tweet today relating to the amount of crypto that has moved off of exchanges and into self-custody. In the post, Santiment shared a 10-year snapshot that shows how investors have shifted their funds into self-custody over time.

The tweet added that the “amount of coins in self custody continues to create a new all-time high.” Currently, there are 18.2 million Bitcoin (BTC) stored in self-custody solutions. Meanwhile, it is estimated that the number of coins on exchanges totals 1.2 million BTC, which is a 4-year low.

At press time, the price of the crypto market leader stands at $16,816.49. This is a 0.19% drop in price over the last 24 hours, according to the crypto market tracking website, CoinMarketCap. BTC’s price is still down by 5.18% over the last 7 days as the crypto market cap falls by 0.10% in the past day. This leaves the total crypto market cap at approximately $809.39 billion.

The price of BTC is challenging the 9-day EMA line, which has been a key resistance level in this bear market. The daily technical indicators are, however, bearish, as the 9-day EMA is positioned below the 20-day EMA and the daily RSI line is positioned below the daily RSI SMA line.

In addition to the 9-day EMA being positioned below the 20-day EMA and the daily RSI being positioned below the daily RSI SMA line, the 9-day EMA is breaking away below the 20-day EMA line and the daily RSI line is sloped negatively towards the oversold territory. Both of these technical situations are bearish and suggest a continuation of the bearish trend.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.