- Bitcoin’s price has fallen another 1.58% over the last 24 hours.

- Santiment shared that BTC’s price fall is correlated with diminishing whale interest.

- Daily technical indicators are still bearish for the market leader.

The crypto market leader, Bitcoin (BTC), has seen its price drop 1.58% over the last 24 hours according to the crypto market tracking website, CoinMarketCap. At press time, BTC is changing hands at $16,618.67.

After establishing a daily high at $16,895.28, BTC’s price has since declined to its current level. BTC’s 24-hour low sits at $16,608.18. Meanwhile, the daily trading volume for BTC has risen 34.41% – taking the total volume for the day to $16,752,177,832.

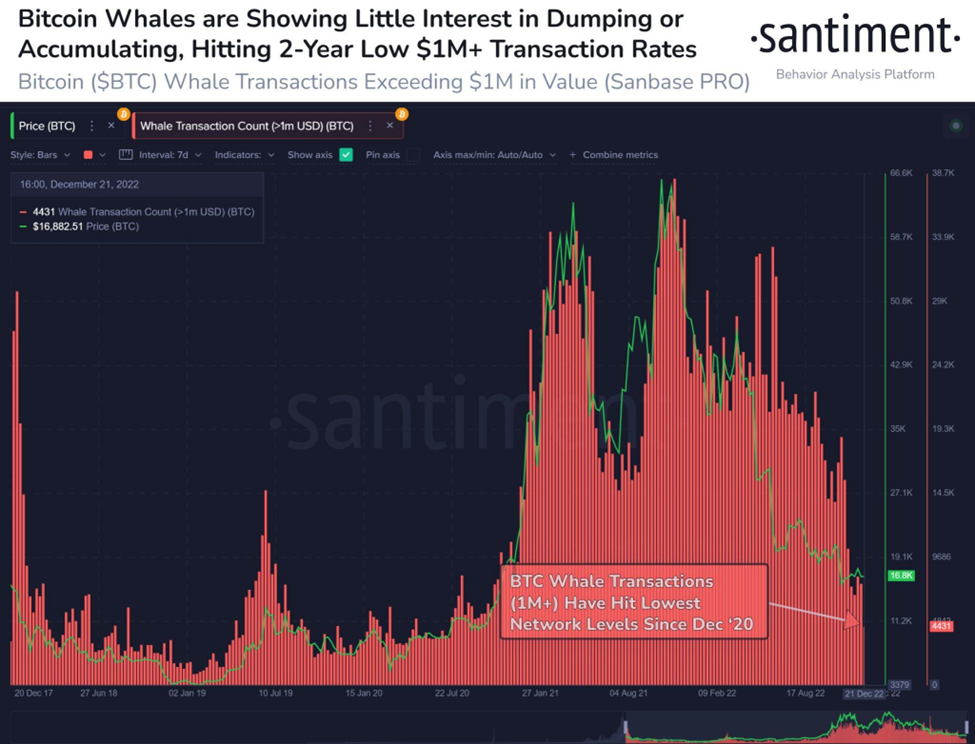

Santiment, the blockchain analysis firm, tweeted this morning that BTC’s ranging prices have a lot to do with declining whale interest.

According to the chart shared by Santiment, the price of BTC and $1M+ valued whale transactions are closely correlated. The tweet concluded that a continued slide in BTC’s price and a spike in whale interest will be a historic bullish signal that investors and traders need to keep note of.

The price of BTC has dropped below the 9-day and 20-day EMA lines after a failed attempt at breaking above the two lines in the last 48 hours. BTC’s price has been in a narrow consolidation channel between $16,564.94 and $16,952.00.

Technical indicators on BTC’s daily chart suggest that bears still have a slight upper hand. The first bearish technical indicator is the relative positions of the 9 and 20-day EMA lines. Currently, the 9-day EMA line is positioned below the 20-day EMA line. In addition to this, the 9-day EMA line is breaking away below the 20-day EMA line.

The daily RSI line is also positioned below the daily RSI SMA line and is sloped negatively toward oversold territory.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.