- EGRAG CRYPTO posted two tweets regarding BTC this morning.

- The trader’s first tweet highlighted that a bullish trend reversal pattern has formed on BTC’s chart.

- In his second tweet, the trader stated that BTC’s price will remain on a battlefield until around August and September.

The crypto trader EGRAG CRYPTO shared his latest analysis for Bitcoin (BTC) via two tweets this morning. In his first tweet, the trader stated that a 5-day Hammer chart pattern – a bullish reversal pattern – has formed on BTC’s chart.

5 D Hammer on BTC’s chart (Source: Twitter)

According to the trader, this chart pattern suggests that a local bottom has formed on BTC’s chart. In addition, this chart pattern shows that bears had attempted to push BTC’s price down but were “outnumbered by bulls who pushed the price up.” The tweet concluded by stating that the next daily candle open and close will assist in identifying the trend direction.

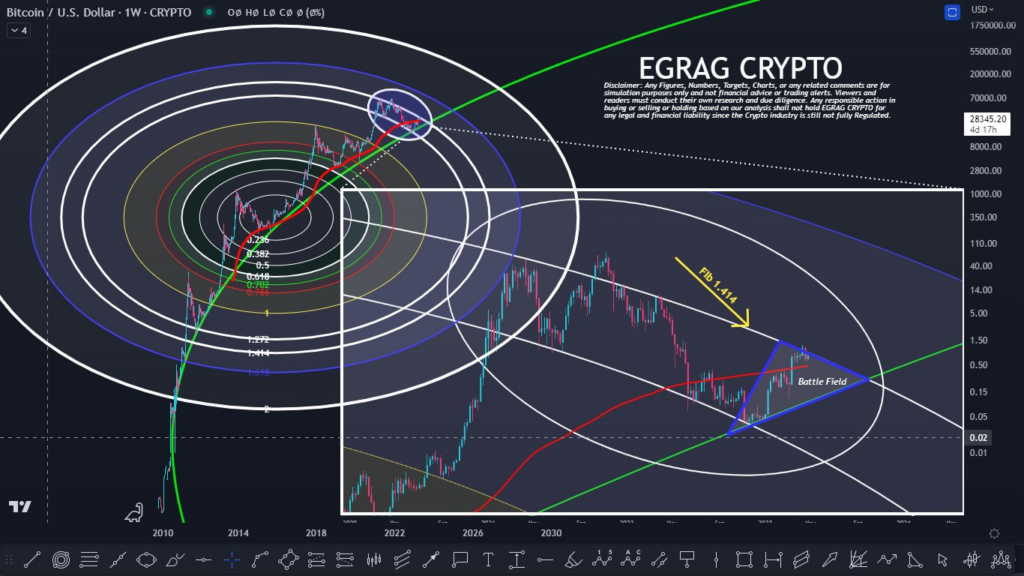

In his next tweet, the trader posted an update to a tweet he made on 13 January this year wherein he predicted a target price for BTC based on a method called “Fib Circle.” According to the tweet, BTC’s price needed to conquer the Fib Circle 1.414 level in order to signal for the next bull run.

In his follow-up tweet, EGRAG CRYPTO shared that BTC’s price is currently trading above the 200 weekly moving average and that it can retest $25.9k for a rigid foundation. He added that as long as BTC does not close above Fib Circle 1.414 that it will continue to face resistance and remain in a “battlefield”.

Fib Circle on BTC’s weekly chart (Source: Twitter)

The timeframe for this battle is expected to end between August and September of this year. Should this happen, the trader believes that BTC’s price will either break above the Fib Circle 1.414 resistance level or break below the green arc he had drawn on BTC’s weekly chart.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.