- BTC has been respecting the trendline since 2023; it may continue to abide by it.

- On the weekly chart, BTC has been moving sideways with negligible vertical movements.

- Crypto Investor states that it’s the beginning of a major bull run when the weekly RSI reaches above 70.

Crypto and stock investor who goes by the pseudonym Jelle tweeted that once the weekly Relative Strength Index (RSI) was above 70, it was the beginning of a major BTC bull run. In the analysis, Jelle clearly highlighted areas of the RSI, such as the Rally, RSI Reset, and Bull Markets which happened in the order mentioned.

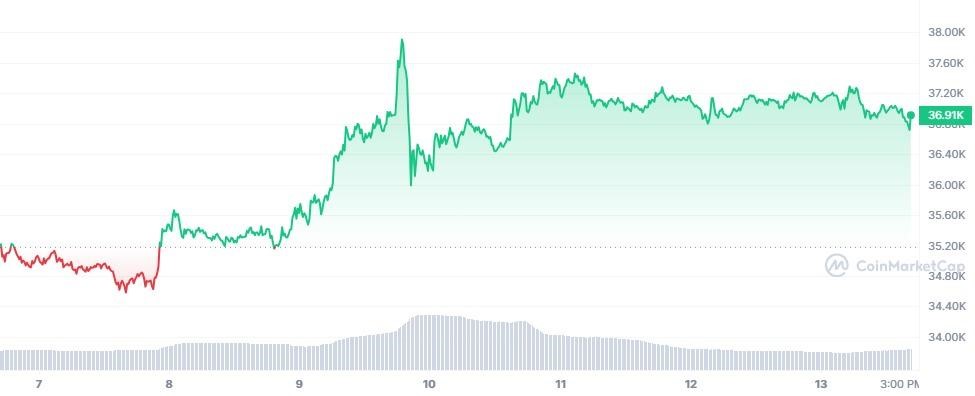

Since BTC was at the beginning of the Bull Market, Jelle was expecting the price to increase by quite a margin. However, when looking at the weekly chart below, it could be noted that BTC was consolidating throughout the last four days of the week. It was moving sideways while vertically fluctuating between $36.8K and $37.6K. BTC reached its highest price of $37,904 on the third day.

BTC/USD 1-Week Chart (Source: CoinMarketCap)

BTC/USDT 1-Day Chart (Source: TradingView)

When considering the movement of BTC since the beginning of 2023, it could be seen that it was on an upward trend. It was making higher lows, as shown by the trendline. If BTC keeps respecting the trendline, there is a possibility that it could rebound off of the trendline and keep moving upwards. The thesis of BTC testing the trendline is based on the fact that it has been overbought according to the Bollinger band.

However, when considering BTC behavior when it resided in this range in the past, we could see that it crashed to $29,000 before rising to $47,500. Hence, BTC could reciprocate this behavior too. On the flip side, if the support at $29,000 doesn’t hold BTC’s fall, then there is a high chance that BTC could fall below $19,000.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.