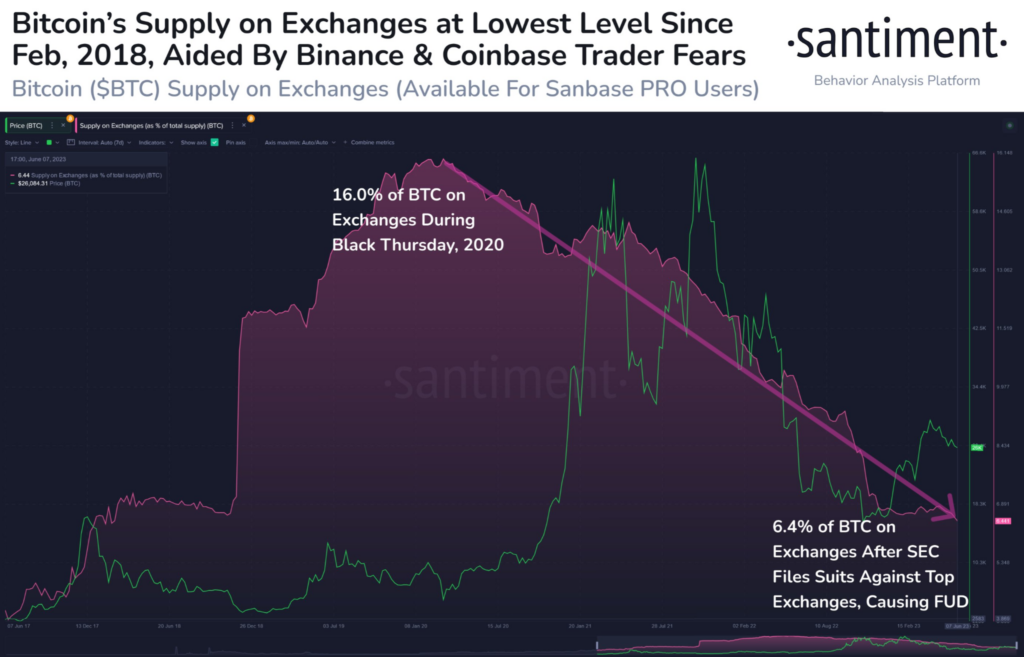

- Santiment recently tweeted that BTC’s supply on exchanges has dropped to 2018 lows.

- The firm attributed this decline in exchange supply to the latest SEC lawsuits.

- At press time, BTC was trading at $25,965.49 following a 0.33% drop.

Recent data from the blockchain intelligence firm Santiment shows that traders and investors prefer to keep their Bitcoin (BTC) off of exchange platforms. According to a tweet published this morning, the supply of BTC on exchanges has fallen to its lowest level since February 2018.

Santiment attributed the drop in BTC’s supply on exchange platforms to the uncertainty surrounding Binance and Coinbase due to the recent SEC lawsuits against the crypto giants. In its tweet, the firm predicted that this trend will continue for as long as the SEC lawsuits loom.

At press time, CoinMarketCap indicated that the market leader was trading below $26K at $25,965.49. This is after the crypto’s price dropped 0.33% over the past 24 hours. BTC’s daily price performance had pushed its weekly performance further into the red to -3.65% as well.

BTC’s dominance in the market also dropped over the past 24 hours. As a result, its market dominance stood at around 47.59%, which was a 0.15% decrease compared to what it was yesterday.

From a technical perspective, BTC’s price dropped below the 9-day and 20-day EMA lines on 7 June 2023, where it continued to trade at press time. Furthermore, the 9-day EMA was positioned below the longer 20-day EMA line, which indicated that BTC was in a short-term bearish cycle and its price would continue to drop in the next few days.

Should the leading crypto’s price continue to decline, it may break below the key support level at $24,992 in the coming week. If bulls don’t buy into BTC once it breaks below this key price point, then it may continue to move toward the next major support at $21,410.

On the other hand, if BTC is able to remain above the aforementioned $24,992 support for the next 3 days, then the bearish thesis will be invalidated. Should this happen, the leading crypto’s price may look to reclaim a position back above the 9-day and 20-day EMA lines at around $26,990 in the following 48 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.