- BTC has been steadily trading above $21K over the last few days.

- ETH is only up by 18% over the last week, while BTC is up 21+%.

- The overall supply of BTC on exchanges has dropped from 11.85% to 6.65%.

The crypto market leader, Bitcoin (BTC) has been steadily trading above $21K over the last few days, which is well above its November 2022 price of $20,283. BTC now trades hands at $21,294.32 This means that BTC has now recovered its losses since the dramatic collapse of FTX near the end of 2022.

Although the price BTC saw a drop of more than 22% after the FTX meltdown, data from the crypto market tracking website CoinMarketCap indicates that BTC saw a price increase of more than 21% over the last seven days.

These numbers indicate that not only did BTC recover from its losses after a grueling 2022, but the crypto king is outperforming most of the other top 10 biggest cryptos in the market at the moment.

While BTC is up by almost 22% over the last week, its biggest competitor, Ethereum (ETH) is only up by 18% over the same time period. Binance Coin (BNB) and Ripple (XRP) are only up about 8% and 7% respectively.

The Ethereum-killer Solana (SOL) is one of the only big cryptos outperforming BTC at the moment as the altcoin is up by more than 40% over the last seven days.

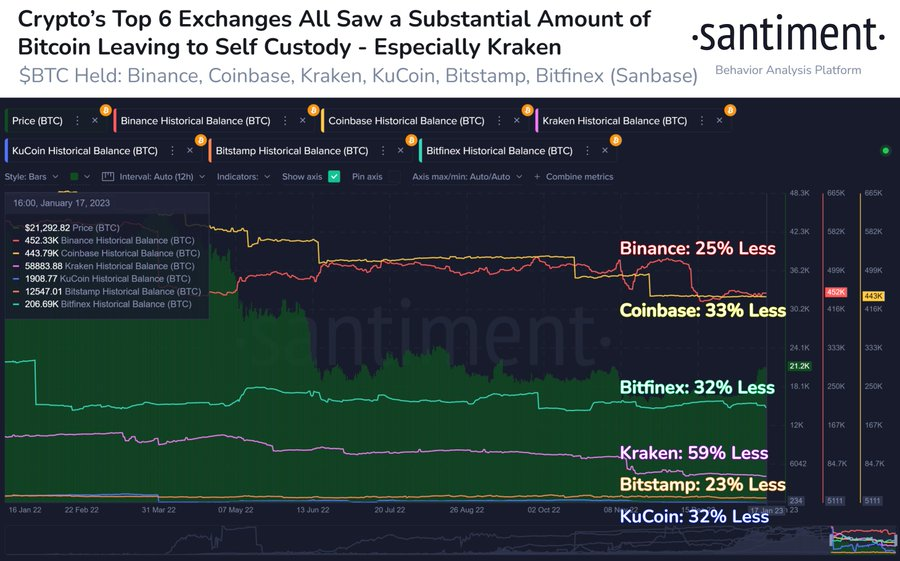

In related news, Santiment revealed in a recent Tweet that the overall supply of BTC on exchanges has dropped from 11.85% to 6.65% over the past year. This historic drop just highlights the fact that there is a rising interest in self-custody when it comes to BTC.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.