Introduction

With the surge in popularity of digital assets, platforms like BTSE have gained prominence among crypto enthusiasts and traders. In recent years, BTSE has distinguished itself in the cryptocurrency exchange industry due to its user-friendly interface, extensive range of supported cryptocurrencies and fiat on/off ramps, and innovative trading options. This BTSE Exchange Review 2023 will take an in-depth look at the platform, its key features, supported cryptocurrencies, trading options, fees, security, customer support, and more.

Table of contents

- Introduction

- BTSE Overview

- BTSE Crypto Exchange Details

- History Overview

- Platform Interface

- Key Features and Functions

- Supported Fiat Currencies, Cryptocurrencies, and Trading Pairs

- Services

- Fees and Limits

- Payment Methods

- Security

- KYC Process

- Mobile Application

- Customer Support

- Pros and Cons

- Final Score

- Summary

- FAQs

BTSE Overview

Founded in 2018, BTSE, short for “Buy, Trade, Sell, Earn,” is a global cryptocurrency exchange that offers a wide array of services, including spot and futures trading, investing, and straightforward crypto purchases. BTSE aims to bridge the gap between traditional fiat markets and the crypto world by providing a simple, secure, and efficient trading platform. Notably, BTSE supports more than 150 cryptocurrencies, over 10 fiat currencies, and 1,000+ different trading pairs.

The exchange facilitates crypto purchases through various fiat payment methods, including credit/debit cards and bank transfers. It also offers a trading experience with two distinct markets — spot and futures — where users can trade all the available pairs in a professional and advanced trading interface.

BTSE goes a step further by introducing investment opportunities, allowing users to earn returns on their cryptocurrency holdings. Options include staking, fixed and flexible savings, and lending, providing avenues for asset growth.

BTSE Crypto Exchange Details

| Website | https://www.btse.com/ |

| Native token | BTSE Token |

| Number of registered users | 1.4 million |

| Number of supported coins/tokens | 150+ |

| Number of supported trading pairs | 1,000+ |

| Number of supported fiat currencies | 10+ |

| Available on mobile | Yes |

| Headquarters | British Virgin Islands |

| Year founded | 2018 |

History Overview

BTSE, established in September 2018, is under the leadership of CEO Henry Liu. The exchange’s vision is to promote the widespread adoption of user-friendly and versatile crypto-based financial services that earn the trust of institutions.

The exchange touts several technical advantages, including minimal downtime, a high-performance trading engine capable of executing over one million order requests per second, a self-hosted infrastructure, horizontal scalability, and the secure storage of 99.9% of user funds in cold storage.

Platform Interface

BTSE’s homepage boasts a clean and beginner-friendly interface, with a focus on simplicity and ease of use, designed for traders of all experience levels. The intuitive layout ensures efficient navigation, allowing users to seamlessly engage in activities such as cryptocurrency purchases and trading while staying informed about market conditions.

Key Features and Functions

BTSE offers a range of features and functions, including:

- Instant buying and selling of crypto assets with fiat currencies

- Zero-fee crypto conversions

- A diverse selection of over 150 crypto assets and 1,000+ trading pairs

- Mobile applications for both iOS and Android

- Spot and futures markets

- Leverage of up to 100x

- Multiple earning and investment options

- Minimal downtime for a smooth trading experience

Supported Fiat Currencies, Cryptocurrencies, and Trading Pairs

BTSE currently supports over 150 cryptocurrencies, encompassing popular coins such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and Cardano (ADA), among others. Users can buy and trade these cryptocurrencies against various fiat currencies like the US Dollar (USD) and Euro (EU), as well as prominent stablecoins such as Tether (USDT) and USD Coin (USDC). BTSE actively adjusts its list of supported crypto assets in response to community demands.

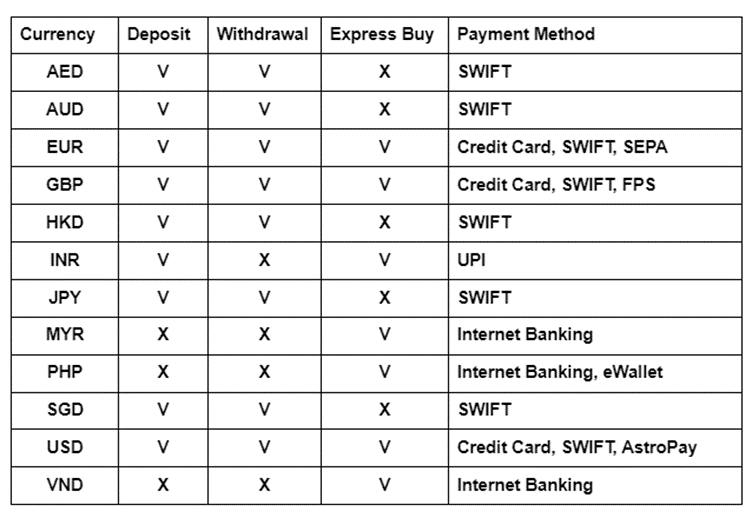

Furthermore, BTSE enables deposits, withdrawals, and instant crypto purchases in more than 10 fiat currencies, including USD, EUR, SGD, AUD, AED, and JPY, among others, providing flexibility to users worldwide.

Services

Express Buy and OTC Purchase

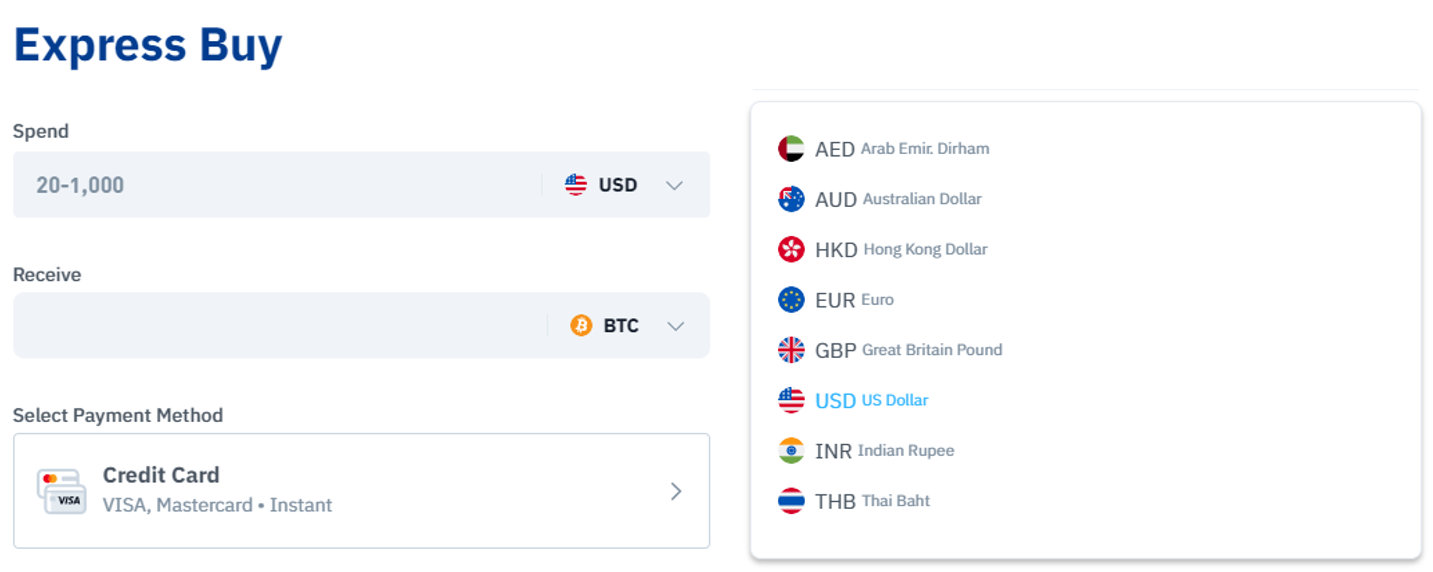

To begin with, BTSE provides a user-friendly way to purchase cryptocurrencies using traditional fiat currencies and cryptocurrencies.

The Express Buy feature allows for instant purchases of various cryptocurrencies, such as BTC, ETH, USDT, USDC, and FDUSD, with multiple payment options, including credit/debit cards and AstroPay.

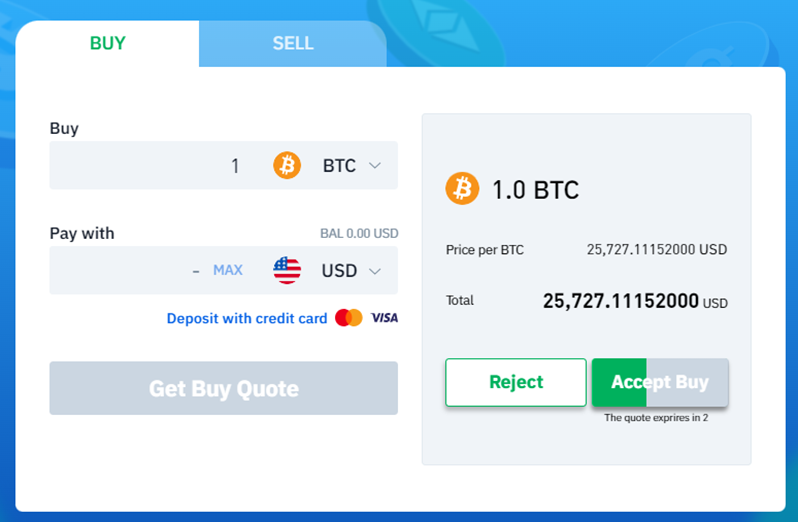

BTSE’s OTC section provides users with the freedom to buy and sell crypto assets, offering a wide choice of over 80 cryptocurrencies. Users enjoy the flexibility to make payments using either their fiat or crypto deposits without being restricted to conventional methods. Moreover, when selling crypto assets, users have the convenience of receiving fiat currency directly in their bank accounts.

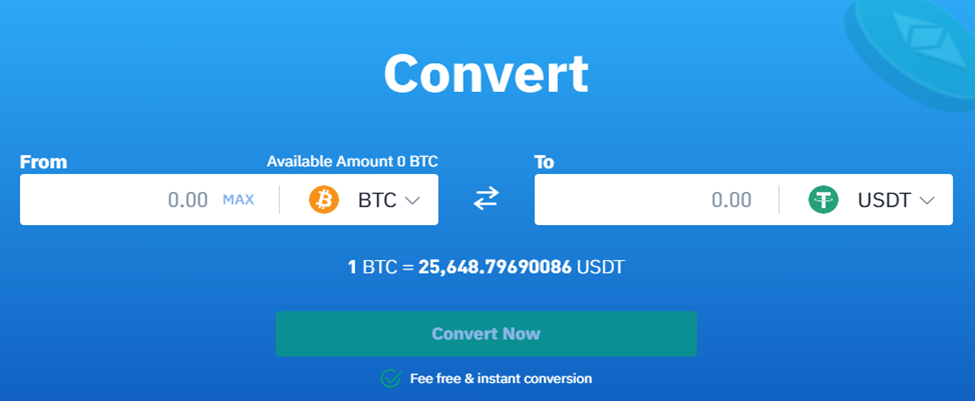

Convert Crypto

In addition to facilitating crypto-to-crypto exchanges, BTSE also offers users the convenience of converting supported cryptocurrency assets directly into fiat currency assets and vice versa. With BTSE’s Convert function, users can easily select the assets they wish to exchange and initiate the conversion process with a single click.

Spot Trading

BTSE provides a spot trading feature that allows users to buy and sell cryptocurrencies at real-time market prices.

Futures Trading

Traders can also engage in futures trading, enabling them to speculate on the future price movements of various cryptocurrencies. BTSE offers various futures contracts, including BTC, ETH, LTC, XRP, and others, with a maximum leverage of up to 100x. Most contracts are perpetual futures, though for large-cap cryptocurrencies such as Bitcoin and Ethereum, time-dated futures are available.

Bot Copy Trading

BTSE also offers a unique feature that enables users to copy the trading strategies of successful traders, gaining insights and potentially enhancing their chances of profitable futures trades. All users have to do is move funds into their futures wallet and select a trader’s strategy to copy.

BTSE Earn

BTSE Earn offers users various ways to grow their assets, including Staking, Fixed and Flexible Savings, and Lending options. Users can stake their assets to earn high returns, deposit funds into flexible or fixed savings accounts, and earn interest by lending their assets to BTSE’s capital pool.

Additionally, BTSE offers a testnet trading platform for novices to practice trading without using real funds. The exchange also provides incentives such as a referral program, affiliate program, VIP program, BTSE token staking program, and a rewards hub.

Fees and Limits

BTSE implements a transparent fee structure for its services, offering competitive fees for spot trading, futures trading, and other transactions. The fees and limits schedule is clearly outlined on the BTSE website, allowing users to have full visibility of the costs associated with their trades and other transactions.

Convert Crypto Fees

BTSE provides users with a conversion feature that facilitates cryptocurrency and fiat currency exchanges free of charge. The straightforward interface ensures the transactions on the platform are processed instantly, simplifying the trading process.

Spot Trading Fees

These spot trading fees are deducted from the currency that the user receives during a trade. Discounts on these fees are available based on the user’s VIP level, which is determined by their monthly trading volume and BTSE Token balance. The higher the user’s VIP level, the lower their fees will be.

Additionally, special discounts are provided for market makers based on their contribution to the exchange’s total volume. Market maker fees can be attractive, as high-volume market makers can benefit from rebates.

Futures Trading Fees

Future trading fees are charged when users open and close futures contract positions. The fees are calculated based on the Notional Value of a user’s positions and are subtracted from the user’s margin balance. Notional Value = Mark Price [USDT] * Position Size [Crypto Units].

Similar to spot trading fees, discounts are available for active traders based on their VIP level. Market makers also enjoy special rates, with lower fees for higher trading volumes.

Fiat Deposit and Withdrawal Fees

Note that non-USD SWIFT deposits totaling less than the equivalent of $100 USD at prevailing exchange rates incur a $3 USD deposit fee. It is important to be aware that non-USD fiat deposits and withdrawals may result in additional charges, such as bank fees, remittance fees, or transfer fees. These fees are determined and applied by the respective servicing banks, not by BTSE.

Crypto Deposit and Withdrawal Fees

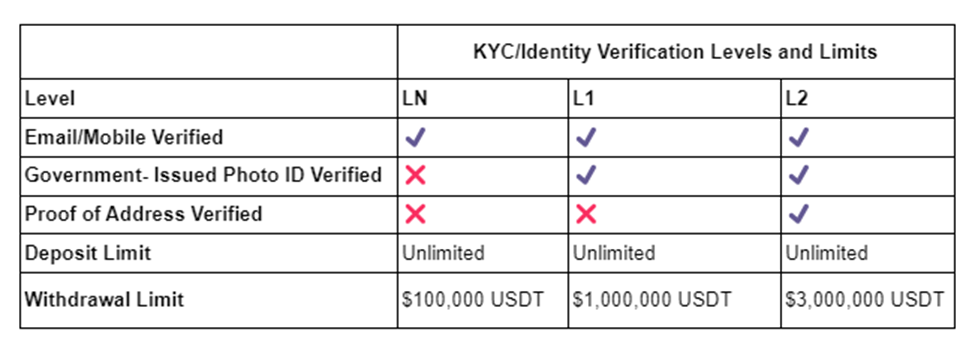

BTSE applies zero fees for crypto deposits and varying withdrawal fees depending on the cryptocurrency. The exchange also sets crypto withdrawal limits based on a user’s KYC Identity Verification level.

Payment Methods

BTSE supports various payment methods, including bank transfers, credit/debit cards, and cryptocurrencies. This provides flexibility for users to deposit and withdraw funds in a way that suits their preferences.

Security

BTSE places a strong emphasis on security, implementing robust measures to protect user funds and personal information. The platform utilizes advanced in-house technology and infrastructure, cold storage for most funds, and a user insurance fund to enhance security.

KYC Process

While users can commence trading on BTSE with a simple email address or mobile number, the exchange encourages users to complete the Know Your Customer (KYC) verification process. Completing KYC verification unlocks access to the platform’s fiat currency features, including higher withdrawal limits.

Mobile Application

BTSE offers a mobile application for both iOS and Android devices, allowing users to access their accounts and trade on the go. The mobile app offers a seamless and user-friendly experience, with all the key features and functionalities available on the desktop version.

Customer Support

Users can reach out to BTSE’s customer support team by sending an email or submitting a ticket for a report. Typically, the team responds within an hour, although some inquiries may require up to 24 hours for resolution, depending on their complexity. BTSE maintains an active presence on various social media platforms, including Twitter, Telegram, Discord, and LinkedIn. In addition, BTSE offers a support desk with a help chatbot designed to address general platform-related queries.

Pros and Cons

Here are some of the pros and cons of using BTSE:

| Pros | Cons |

| User-friendly interface | No NFT marketplace |

| Available crypto and fiat withdrawals | |

| Wide selection of cryptocurrencies and trading pairs | |

| Innovative trading features like bot copy trading | |

| Crypto Staking, Savings, and Lending services | |

| Mobile application available |

Final Score

| Services offered | 4 |

| Cryptocurrency support | 4 |

| Fees | 4 |

| Security | 4 |

| Review Score | 4 |

Summary

In conclusion, BTSE offers a comprehensive cryptocurrency exchange with a multitude of features and services catering to both beginners and experienced traders. Its commitment to security and transparent fee structure are notable strengths, making it a valuable option for those seeking to engage in cryptocurrency trading and investment. However, users should be mindful of fees associated with certain transactions and stay informed about the exchange’s policies regarding crypto assets.

FAQs

BTSE was founded in 2018.

BTSE supports over 150 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC), and Cardano (ADA), among others.

BTSE implements a transparent fee structure. Users can find detailed information about trading fees on the BTSE website.

BTSE provides two primary trading markets: spot and futures. Users can engage in real-time spot trading or participate in futures trading with leverage of up to 100x.

Yes, BTSE offers a mobile application for both iOS and Android devices, enabling users to trade on the go.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.