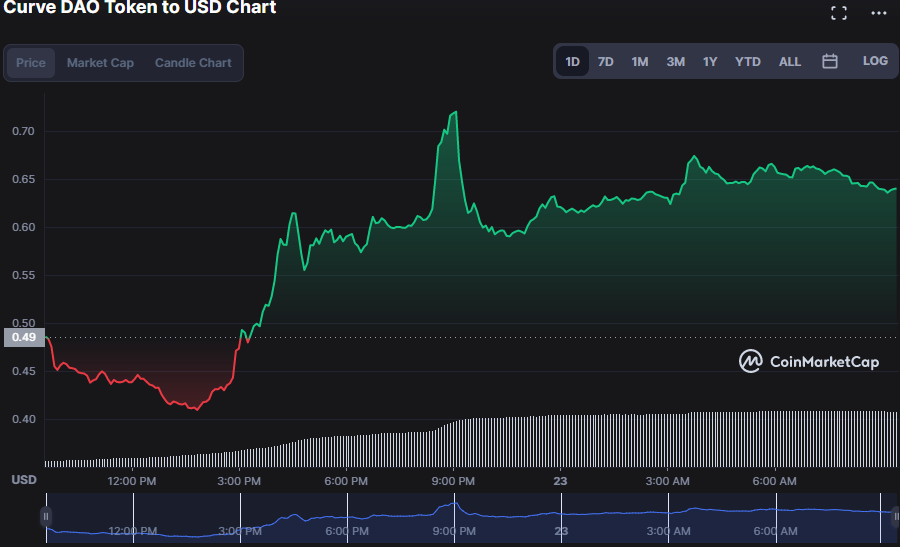

- In the last 24 hours, bullish dominance has extended in the Curve DAO Token (CRV).

- This bull run is being supported by an increase in market capitalization and trading volume.

- Technical indicators indicate that the bulls will continue to dominate the CRV market.

Curve DAO Token (CRV) bulls managed to outmaneuver the bears after finding support at $0.4096, pulling prices up consistently over the past few hours. At the time of writing, CRV prices had risen by 44.17% to $0.645.

At present, the market capitalization and 24-hour trading volume have elevated by 32.45% to $341,808,876 and 1112.71% to $1,022,268.853, respectively.

According to the Williams alligator, the three lines are moving upriver with an open mouth, pointing to a positive trend. Unless bears nullify the recent trend in the CRV market, the green line will remain above the red line, and the red line will remain above the blue line. The green (lips) line connects at 0.5888, the red (teeth) line intersects at 0.567, and the blue (jaw) line intersects at 0.557. Supporting this bull’s pattern is the price movement above the alligator’s mouth, which indicates that bullish superiority will persist.

Investors ought to proceed with caution as the Stoch RSI recently crossed into the overbought zone with a reading of 97.73. The Stoch RSI’s action serves as a warning to investors rather than a guarantee that prices will reverse lower; it suggests that a turnaround is possible.

CRV’s 4-hour price chart’s MACD, which has a reading of 0.019 and is soaring above the signal line in the positive area, adds support to the current bullish framework. This trend is aided by a positive histogram trend with a reading of 0.021.

The market price is currently trading above both moving averages, with the 5-day MA touching 0.629 and the 20-day MA touching 0.538. As seen on the CRV price chart, the shorter MA is perceived to cross above the longer MA, signaling the continuation of the extended bullish trend.

To maintain this steady growth, bulls must maintain the resistance level and push prices higher.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.