- According to recent research, ICP bulls have had the upper hand.

- Technical indicators alert investors to be cautious.

- Bulls must hold the $4.01 resistance level to extend this trend.

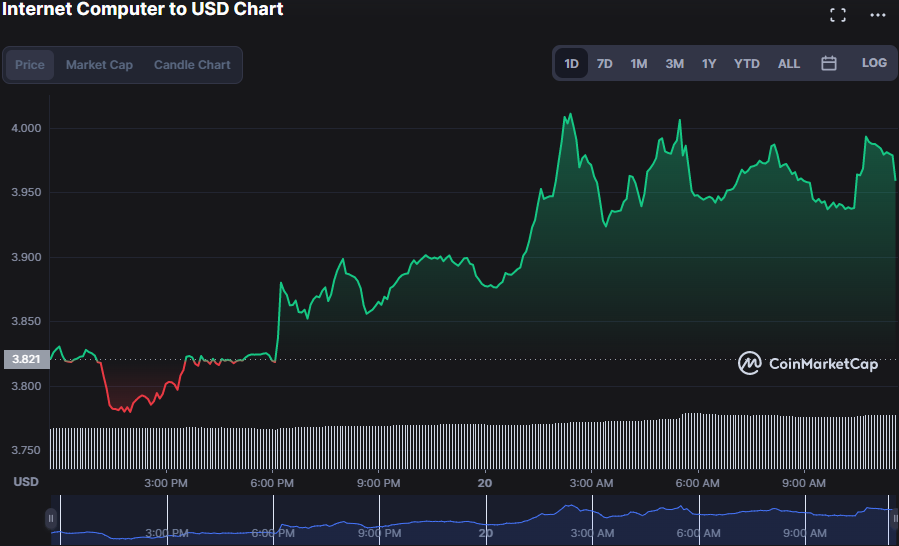

Bullish prominence has been noticeable in the Internet Computer (ICP) over the last 24 hours, with bulls able to sustain the bullish trend to a value of $3.98, a 4.31% increment as of press time.

This uptick has been attributed to a 4.49% rise in the market capitalization and a 34.76% upsurge in 1-day trading volume, respectively, to $1,073,419,490 and $29,835,657.

The three lines are moving upstream, suggesting a positive fad, according to the Williams Alligator. The recent trend in the ICP market will exist as long as the green line is above the red line and the red line is above the blue line unless bears nullify it. The green line (lips) connects at 3.909, the red line (teeth) intersects at 3.891, and the blue line (jaw) intersects at 3.891. Price action above the alligator’s mouth tends to suggest that bullish superiority will proceed.

The Stoch RSI reading of 87.33 concerns investors as it is in the overbought region, insinuating that the latest trend is nearing its end and prices may revert lower; however, this serves as a warning to traders rather than a guarantee of price reversal.

Values above 50 on the Relative Volatility Index reflect that volatility is on the rise, but as seen on the ICP 4-hour chart, where the RVI is at 48.79 and pointing south, the bullish momentum is fading as the RVI approaches the oversold region.

When the MACD blue line traverses above the signal line, a bullish trend is perceived, as seen on the ICP market, where the signal line is -0.018 and the MACD is 0.005. This optimistic train is bolstered by progression in the positive region of the MACD and histogram.

The upward motion of the Elder Force Index (EFI) and Chaikin Money Flow (CMF) above the “0” level, with readings of 2.563k and 0.71, respectively, reinforces the rising trend in ICP prices. The CMF’s upward trend strengthens this bullish outlook.

Technical indicators caution traders, however, if bulls continue to influence the ICP market, a prolonged bullish trend is inclined.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.