- Ethereum has been trading in the red zone throughout the last seven days.

- ETH has been crashing on every occasion. The 200-day MA line formed a hump.

- The bulls give enough momentum to ETH to register higher lows but not higher highs.

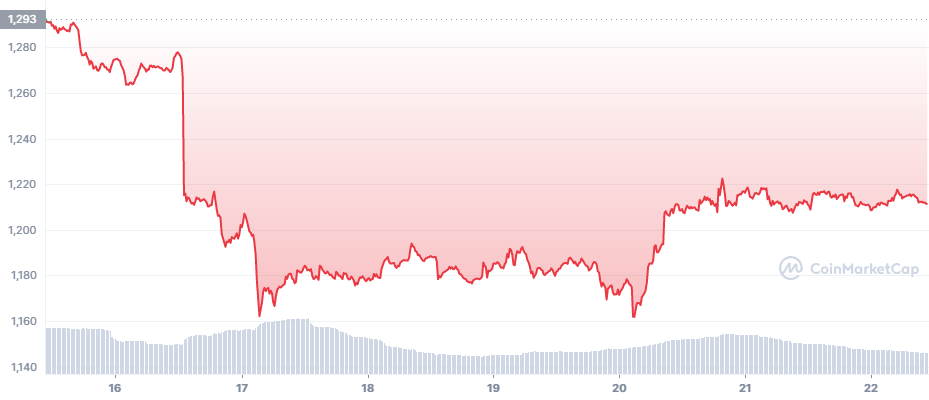

Ethereum has been trading in the “red zone” throughout the previous week. Its opening market price was $1,293, as shown below in the Chart.

On December 16, ETH fluctuated between $1,260 and $1,290, but it took a deep dive during the second half of the day. ETH fell from $1,277 to $1,215 within a few hours. However, this wasn’t the bottom of the fall, as ETH tanked even further the next day.

ETH tanked to $1,162 on December 17. Following this descent, ETH consolidated its position by fluctuating between $1,160 and $1,200 until December 20. However, ETH gained some momentum, rose to $1,207, and is currently fluctuating very close to $1,220.

As of press time, ETH is down 0.05% in the last 24 hours and is trading at $1,211.56.

When the below chart is considered, ETH came crashing down every time the 200-day MA line (yellow line) formed a crest. ETH’s crash divided the 200-day MA hump almost equally, as denoted in the chart (The Crash).

Just after the first crash at the hump, ETH tested the 200-day MA on multiple occasions but was unable to retain its position despite breaking through. Contrastingly, ETH tested the 200-day MA after the second breakout but couldn’t break through.

Nonetheless, ETH gained enough momentum from the bulls to set high lows, but this momentum wasn’t enough for ETH to set higher-highs.

Towards the mid of December, ETH gained momentum to hit Resistance 1 ($1320-$1350). Shortly after ETH reached Resistance 1, it plunged to Support 1 ($1,150). Currently, ETH is consolidating its position near $1200, with the 200-day MA above it acting as the immediate resistance. If the bulls push ETH hard, then it could be aiming at reaching Resistance 1.

Contrastingly, if the bears take over, ETH could tank to Support 1. However, the contracting Bollinger Bands predict there will be less volatility and more sideways movement.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.