- Solidity’s TVL has dropped from $179.49 billion to $50.4 billion.

- Cairo has overtaken Rust in terms of market cap.

- ETH is now trading at $1,194.46 following a 2.39% drop over the last 24 hours.

The total crypto market cap has dropped by 1.85% over the last 24 hours according to CoinMarketCap. This has brought the global crypto market cap down to $797.69 billion at press time.

The global crypto market cap has plummeted below $800 billion in what will go down in crypto history as the worst bear cycle yet. This bear cycle has also seen the Total Value Locked (TVL) nosedive for several smart contract based projects.

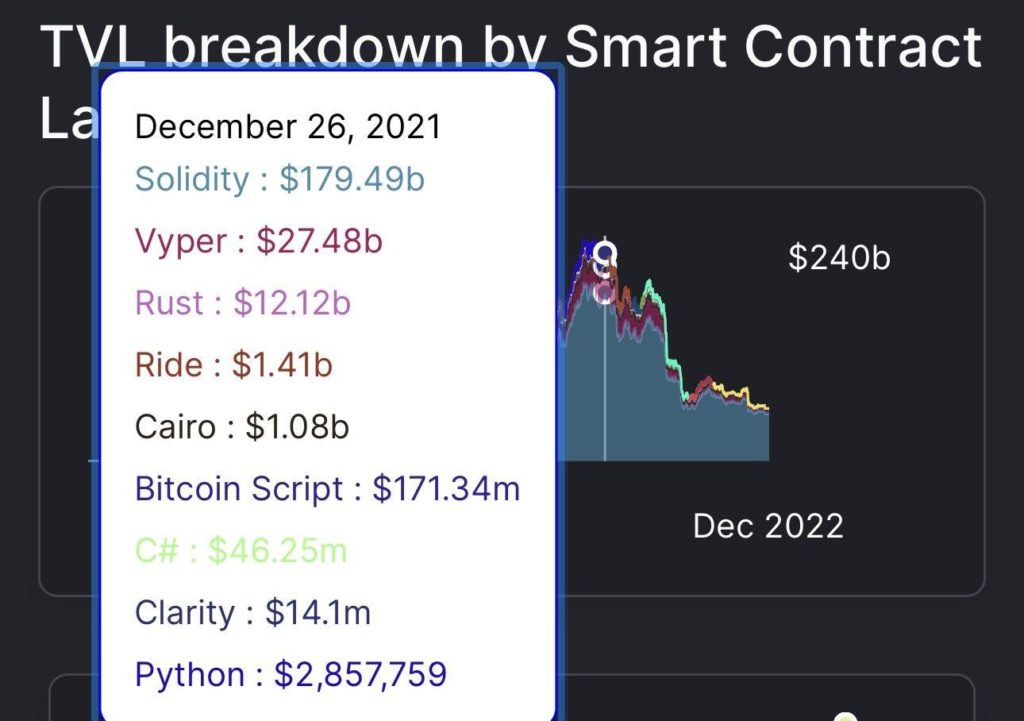

Two snapshots shared by the TVL aggregator for DeFi, Defi Llama, shows the magnitude of the effect that this bear market has had on the crypto market. According to the first snapshot shared by Defi Llama, Solidity led the charge with a TVL of $179.49 billion. Meanwhile Vyper and Rust were second and third with respective TVLs of $27.48 billion and $12.12 billion.

The second snapshot shared by Defi Llama was taken on December 26 of this year. According to the snapshot, the TVL for Solidity has dropped to $50.4 billion. Meanwhile, Vyper’s TVL dropped to $3.98 billion.

Rust was overtaken by Cairo after its TVL dropped down to sub $400 million. Cairo’s TVL now stands at $418.23 million after dropping from $1.08 billion.

In related news, the price of Ethereum (ETH) has dropped by 2.39% over the last 24 hours. This has flipped its weekly price performance into the red. Currently, ETH’s price is down 1.36% over the last 7 days. As a result, the price of the leading altcoin trades at $1,194.46 at press time.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.