Cardano (ADA) price today is trading near $0.91 after a brief pullback from the $0.95 high. The token continues to defend the $0.90 zone as support, with buyers eyeing the $0.96–$1.00 range as the next breakout target. The move comes as ADA reclaims its position as the ninth-largest cryptocurrency by market capitalization, overtaking TRON.

Cardano Price Holds Rising Channel Support

The daily chart shows ADA trading inside a rising channel since July, with price bouncing from mid-channel support near $0.88 to retest the upper band. The 20- and 50-day EMAs at $0.86 and $0.83 are trending higher, providing dynamic support to the structure.

Related: Dogecoin (DOGE) Price Prediction For September 16

Momentum remains constructive. A series of higher lows and break-of-structure signals highlight renewed accumulation. The 200-day EMA at $0.75 sits as a longer-term safety net, while the channel ceiling near $1.05 is emerging as a key resistance zone.

ADA Flips TRON In Market Rankings

On September 13, Cardano officially surpassed TRON to become the ninth-largest cryptocurrency by market capitalization. The development underscores ADA’s return to the top tier of digital assets, reinforcing investor confidence at a time when traders are searching for relative strength in altcoins.

The milestone has also sparked renewed social momentum, as community-driven support often translates into stronger market participation. Analysts suggest that sustaining this rank could provide a psychological boost for ADA holders and attract fresh inflows.

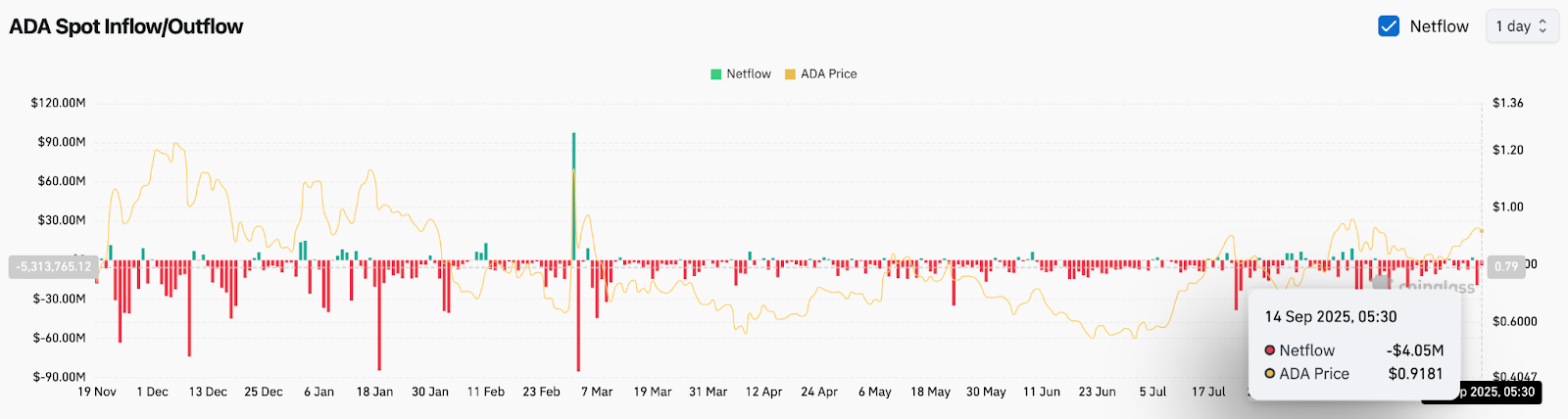

On-Chain Data Shows Mixed Flows

Exchange flow data highlights cautious positioning. On September 14, ADA recorded a net outflow of $4.05 million, extending a series of mixed flows observed throughout September. While net outflows typically suggest accumulation, the scale of these moves has remained modest compared to earlier cycles.

Related: Solana (SOL) Price Prediction For September 16

The pattern reflects a market still testing conviction. Active addresses and spot demand remain below peak levels, yet consistent net outflows indicate that long-term holders continue to withdraw supply from exchanges. Sustained accumulation could strengthen ADA’s base above $0.90.

Fibonacci Levels And Parabolic SAR Define Resistance

The 4-hour chart shows ADA respecting Fibonacci retracement zones. Price pulled back after briefly tapping the 0.618 retracement at $0.928, but the Parabolic SAR remains beneath spot levels, supporting bullish momentum.

Immediate resistance is visible at $0.95–$0.96, which aligns with the 0.786 retracement zone. A successful breakout above this cluster would open the path to $1.00–$1.02. On the downside, $0.90 remains the key short-term floor, with deeper risk toward $0.87 if sellers regain momentum.

Technical Outlook For ADA Price

Key levels are well-defined. On the upside, ADA must clear $0.95 to confirm a breakout toward $1.00 and $1.05. A move beyond this zone would align with the broader channel trajectory and could extend toward $1.10.

Related: Ethereum (ETH) Price Prediction For September 16

On the downside, losing $0.90 would shift near-term sentiment, exposing $0.87 and potentially $0.83. Failure to hold those levels could push price back toward $0.75, the longer-term EMA cluster.

Outlook: Will Cardano Go Up?

Cardano price action suggests a bullish bias as long as $0.90 holds firm. The combination of a rising channel, improving EMA structure, and psychological momentum from flipping TRON supports the bullish case.

However, on-chain flows remain moderate, signaling that traders are not yet fully committed. For ADA to extend gains decisively, inflows must strengthen alongside a breakout above $0.95.

Analysts remain cautiously optimistic. If ADA holds its channel and breaks above $0.96, the path toward $1.00 and beyond looks increasingly viable.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.