- Cardano price holds $0.85 support while resistance at $0.87–$0.88 keeps bulls waiting for a decisive breakout.

- Derivatives data shows trimmed open interest but strong long bias among whales, signaling cautious confidence.

- Analysts compare ADA’s structure to early 2021, projecting a potential cycle breakout toward $1.00.

Cardano price today is trading near $0.86, stabilizing after a sharp pullback from last week’s $0.94 peak. Buyers are defending the $0.85 support zone, but the short-term outlook hinges on whether ADA can reclaim the $0.87–$0.88 resistance cluster marked by key moving averages.

Cardano Price Holds Key Support

The 4-hour chart shows ADA consolidating just above the 200-EMA at $0.85, a level that coincides with the 0.382 Fibonacci retracement of the recent rally. The 20- and 50-EMAs are aligned near $0.88, creating immediate overhead pressure.

Related: XRP (XRP) Price Prediction For September 17

Momentum indicators highlight the standoff. The Parabolic SAR remains above price, signaling a bearish bias, while the RSI has cooled into neutral territory. A break above $0.88 could invite momentum buyers, while losing $0.85 would expose ADA to $0.83 and $0.82.

Derivatives Data Suggests Fragile Sentiment

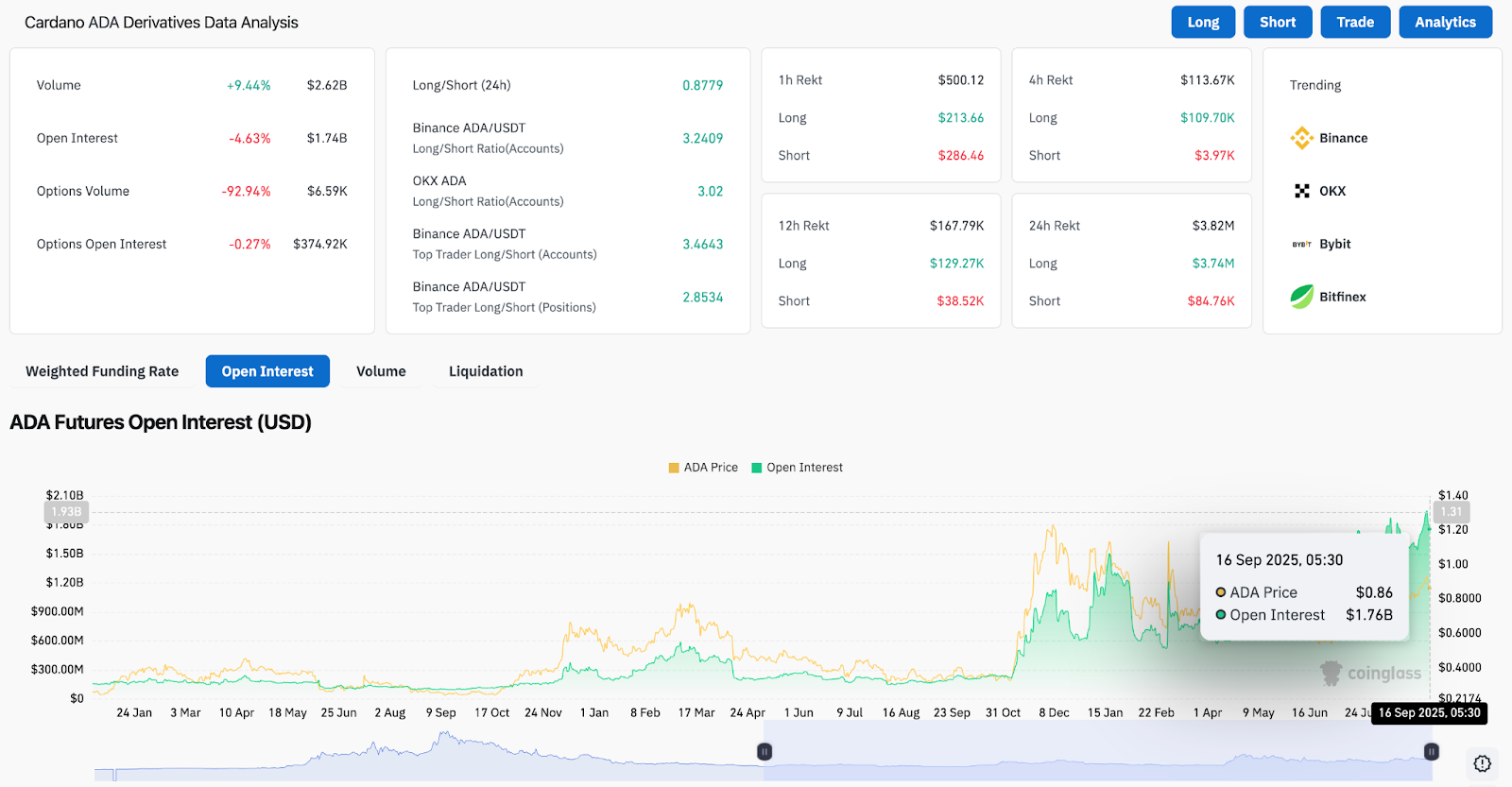

On-chain and futures data reveal cautious positioning. Open interest slipped 4.6% over the last 24 hours to $1.74 billion, reflecting trimmed exposure as price pulled back. At the same time, futures volume rose by nearly 9.5% to $2.62 billion, suggesting that traders are rotating positions rather than exiting completely.

Related: Bitcoin (BTC) Price Prediction For September 17

Notably, Binance and OKX long/short ratios show strong long bias, with top traders holding ratios above 3.0. This implies confidence among whales, even as broader open interest trends downward. If open interest stabilizes above $1.7 billion, it could provide a base for renewed upside momentum.

Analysts Highlight Early Bull Cycle

Market commentators argue that Cardano’s latest structure mirrors its early 2021 breakout. Analyst Ali Charts posted that “the bullrun for Cardano is in its early stages,” pointing to a Fibonacci roadmap that projects long-term upside beyond $3.00 if the cycle repeats.

This narrative aligns with historical accumulation phases, where ADA consolidates before extended rallies. With Bitcoin stabilizing near $108,000 and Ethereum holding above $4,500, the broader market backdrop supports the argument for ADA to sustain its bullish trajectory.

Technical Outlook For Cardano Price

Key levels are now well defined. On the upside, a clean break above $0.88 would target $0.90 and $0.93, with a further extension toward $0.96 if bullish flows return. A decisive move through $0.93 would validate the cycle breakout thesis, opening the path to $1.00.

Related: Linea (LINEA) Price Prediction 2025, 2026, 2027, 2028–2030

On the downside, losing $0.85 risks deeper retracements toward $0.83 and $0.82. A breakdown below $0.82 would unwind the recent rally, exposing ADA to the $0.78–$0.80 support zone.

Outlook: Will Cardano Go Up?

Cardano price action is at a pivotal juncture. Short-term technicals suggest pressure at the $0.87–$0.88 resistance, but on-chain flows and cycle comparisons keep the bullish narrative alive.

Analysts remain cautiously optimistic. As long as ADA holds above $0.85, the bias leans toward another retest of $0.90–$0.93 in the near term. A breakout beyond $0.93 would confirm the early-stage bull cycle view, while losing $0.82 could delay the rally and force a return to consolidation.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.