- ADA faces $25M in outflows over 3 weeks, signaling reduced accumulation.

- Price holds $0.63 support inside triangle, with risk of breakdown below $0.62.

- Leios upgrade milestone reinforces long-term fundamentals despite weak liquidity.

Cardano price today trades near $0.63, holding slightly above support as weakness spreads through the altcoin market. The token’s consolidation inside a tightening triangle signals growing pressure, with sentiment shifting toward caution while institutional flows retreat from risk assets.

CoinShares reported $300,000 in ADA outflows this week, reversing the prior week’s inflows. The rotation follows delays in crypto ETF approvals and a broader pullback in speculative exposure. Traders have shifted focus to Bitcoin and cash-based holdings, leaving ADA exposed to volatility if support fails.

Buyers Defend Support As ADA Trades Within Tightening Triangle

The 4-hour chart shows ADA confined between $0.62 and $0.68 within a symmetrical triangle. The 20-EMA sits near $0.65, the 50-EMA at $0.67, and the 100-EMA near $0.71, all stacked above price and confirming short-term pressure.

A break below $0.62 would complete a bearish continuation setup, targeting $0.59 and $0.56. A move above $0.67 could restore short-term momentum toward $0.71, where the 200-EMA caps upside.

The RSI near 36 shows muted demand and limited buying strength. Repeated rejections near the mid-range underline the absence of conviction. Until ADA reclaims its 50-EMA with stronger volume, sellers maintain control.

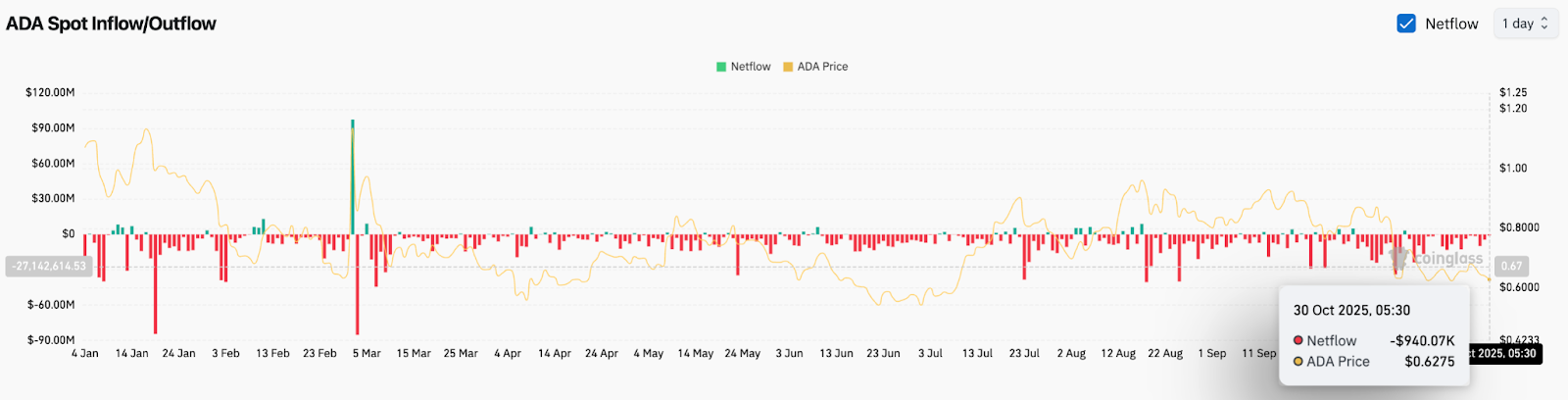

Net Outflows Deepen As Traders Reduce Exposure

Coinglass data confirms continued capital flight. As of October 30, ADA registered $940,000 in net outflows, extending a three-week decline exceeding $25 million. Persistent red readings across spot exchanges point to reduced accumulation and lighter liquidity on rallies.

Analysts link the withdrawals to pre-FOMC caution and reduced risk appetite across altcoins. With U.S. monetary policy under review, traders have trimmed exposure, preferring assets with deeper liquidity and clearer catalysts. The lack of inflow support leaves ADA vulnerable if broader market sentiment weakens further.

Leios Upgrade Adds Long-Term Strength

Cardano’s technical outlook may look heavy, but development momentum continues. Input Output Global confirmed that Ouroboros Leios, Cardano’s largest consensus upgrade, has entered active engineering.

Leios introduces a split-layer design separating input and endorser blocks, a change expected to lift throughput toward 10,000 transactions per second. The engineering shift marks completion of the design phase and begins benchmarking across live prototypes.\

The milestone reinforces long-term fundamentals, though it has yet to attract near-term capital. Market participants acknowledge the progress but remain focused on liquidity and ETF timelines rather than distant network upgrades.

Outlook: Will Cardano Go Up?

For now, the ADA price outlook remains balanced between cautious optimism and technical fragility. Long-term investors are encouraged by the Leios milestone, which strengthens Cardano’s infrastructure narrative. Yet, in the short term, persistent outflows and RSI weakness suggest the path of least resistance may still lean lower.

If ADA holds above $0.62 and reclaims the 100-EMA near $0.71, sentiment could turn constructive again, paving the way for a measured recovery. Until then, analysts expect the token to remain range-bound with potential for a breakdown if broader market conditions fail to stabilize.

Breadcrumb: Cardano price consolidates near $0.63.

Image caption: ADA compresses inside a tightening triangle as traders weigh ETF delays and Leios upgrade optimism.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.