- Bullish Casper (CSPR) price prediction ranges from $0.02435 to $0.14296

- Analysis suggests that the CSPR price might reach above $0.10985 soon.

- The CSPR bearish market price prediction for 2023 is $0.02312.

If you want to diversify your holdings and get experience with different cryptocurrencies, there are several alternative digital currencies to explore besides Bitcoin (BTC) and Ethereum (ETH). Casper (CSPR) is one of them.

The native currency of the Casper proof-of-stake (PoS) blockchain is CSPR. This is how validators are paid for staking their tokens to participate in the consensus mechanism. CSPR is also used to pay network transaction fees. Vlad Zamfir, who also helped build the Ethereum network, came up with the Casper Correct by Construction (CBC) consensus method used by the Casper network. Proof-of-work (PoW) is being replaced by proof-of-stake (PoS) in Ethereum 2.0. A hybrid protocol called Casper Friendly Finality Gadget (CFFG) will be used.

If you are interested in the future of Casper and want to know its predicted value for 2023, 2024, 2025, and 2030 – keep reading!

Table of contents

- Casper (CSPR) Market Overview

- What is Casper (CSPR)?

- Casper (CSPR) Current Market Status

- Casper (CSPR) Price Analysis 2023

- Casper (CSPR) Price Prediction 2023 – 20230 Overview

- Casper (CSPR) Price Prediction 2023

- Casper (CSPR) Price Prediction 2024

- Casper (CSPR) Price Prediction 2025

- Casper (CSPR) Price Prediction 2026

- Casper (CSPR) Price Prediction 2027

- Casper (CSPR) Price Prediction 2028

- Casper (CSPR) Price Prediction 2029

- Casper (CSPR) Price Prediction 2030

- Casper (CSPR) Price Prediction 2040

- Casper (CSPR) Price Prediction 2050

- Conclusion

- FAQ

- More Crypto Price Predictions:

Casper (CSPR) Market Overview

HTTP Request Failed... Error: file_get_contents(https://api.tokenncoin.com/coins/info?name=casper-network): Failed to open stream: HTTP request failed! HTTP/1.1 404 Not FoundWhat is Casper (CSPR)?

Casper is the first live proof-of-stake (PoS) blockchain, launched on mainnet on 30 March 2021 and based on the Casper CBC protocol. The Casper platform is intended to accelerate the worldwide adoption of blockchain technology, smart contracts, and decentralized applications (DApps).

The future-proof architecture of Casper is meant to ensure the platform is constantly changing to meet the needs of its users. According to the official whitepaper, Casper is geared for corporate and developer requirements. Casper’s goal is to start a new era for Web3 as the demand for simple, integrated services grows. Casper solves the adoption trilemma by putting enterprise-grade security, scalability, and decentralization into a single blockchain protocol.

Casper uses blockchain technology and the proof-stake (PoS) consensus process uniquely. The network is incredibly adaptable in terms of use cases, and Casper has a future-proof design with upgradeable smart contracts and predictable transaction costs. Casper is also setting a new bar for blockchain energy usage, at 136,000% more efficient than Bitcoin.

Casper is a standout feature. This standard enables the quick implementation of blockchain services across the company, and Casper enables scalability and database management solutions. Casper and CSPR coin are the culmination of CasperLabs’ years of study.

Furthermore, CasperLabs exists to provide enterprise-level services and support for firms built on the Casper Network, similar to how Red Hat supports organizations built inside the Linux ecosystem. CasperLabs is perfectly positioned to elevate Casper as the de facto blockchain for the rising number of corporate enterprises who want to work in Web3 settings but demand more devoted levels of support than open-source, decentralized initiatives can provide.

To ensure the safety of its network, Casper uses a PoS consensus process. Token staking is used to choose which nodes will be validators in a Proof of Stake network, which makes the consensus very flexible and scalable. In contrast to the proof-of-work (PoW) consensus utilized by the Bitcoin blockchain, proof-of-stake (PoS) does not necessitate a significant amount of resources (electricity, processing power) to carry out validations and add new blocks to the chain.

Additionally, Casper makes use of the Correct-by-Construction (CBC) Casper standard, an improved method of implementing Byzantine Fault Tolerance (BFT). Multiple security audits have been performed on Casper’s enterprise-grade architecture, the most recent being with Trail of Bits in January 2021, which identified zero high-severity outcomes and concluded that Casper “showed good usage of security hygiene.”

Casper (CSPR) Current Market Status

Casper (CSPR) has a market cap of $595,556,383, putting it in the 83rd position among all cryptocurrencies on CoinMarketCap. The current circulating supply of CSPR is 10,924,003,627 CSPR coins. CSPR’s 24-hour trading volume is $18,320,167 down 40.93% from the previous day. Over the last 24 hours, the value of the token (CSPR) has increased by 0.59%.

At the moment, the best places to buy and sell CSPR are Bithumb, XT.COM, OKX, Gate.io, and KuCoin.

Casper (CSPR) Price Analysis 2023

Will CSPR’s most recent improvements, additions, and modifications help the CSPR price rise? First, let’s focus on the charts in this article’s CSPR price forecast.

Casper (CSPR) Price Analysis – Keltner Channel

The Keltner channel is a technical indicator introduced by American grain trader, Chester W. Keltner to gauge the volatility of the market. For this purpose, it has three bands; the Upper band, Middle band (EMA), and lower band.

The upper band is calculated by adding twice the Average True Range (ATR) to the EMA (middle band), while the lower band is calculated by subtracting twice the ATR from the EMA. Moreover, the Keltner bands could also be used to determine the direction of the price movement.

The chart above shows two red rectangles that denote the expansion and contraction of the Keltner channels. When the bands widen it means that there is going to be more volatility. Or in other words, the prices could drastically drop or increase. When the bands squeeze, there could be less volatility. This is because the range of fluctuation would be restricted and the prices will be constrained to move sideways.

Additionally, when the price of a cryptocurrency continuously touches the upper or lower band and thereafter touches the opposite band, (which is, if a cryptocurrency continuously touches the upper band and finally touches the lower band, then we could determine that the bullish trend has faded.) This applies vice-versa as well. This behavior could be seen inside the green rectangle.

Currently, CSPR is on an exponential rise. It is tested the upper band and has broken above it,

hence, there could be a trend reversal awaiting CSPR, as such traders should be vigilant. Moreover, the Keltner channels are also tilted upwards, as such, Casper bulls may have some momentum left in them. If the preceding statement is the case for CSPR, then it would maintain its exponential trajectory.

Casper (CSPR) Price Analysis – Bollinger Bands

The Bollinger bands are a type of price envelope developed by John Bollinger. It gives a range with an upper and lower limit for the price to fluctuate. The Bollinger bands work on the principle of standard deviation and period (time). The upper band as shown in the chart is calculated by adding two times the standard deviation to the Simple Moving Average while the lower band is calculated by subtracting two times the standard deviation from the Simple Moving Average.

When this setup is used in a cryptocurrency chart, we could expect the price of the cryptocurrency to abide within the upper and lower bounds of the Bollinger bands 95% of the time.

The above thesis is derived from an Empirical law also known as the three-sigma rule or the 68-95-99.7 which states that almost all observed data for a normal distribution (normal scattering of data) will fall within three standard deviations.

As such for a data set that follows a normal distribution, 68% of data will fall within 1 standard deviation of the mean, while 95% of data for the normal distribution will fall within 2 standard deviations of the mean and 99.7% of data will fall within 3 standard deviations of the mean.

Hence, as the Bollinger bands are calculated using two standard deviations, we could expect CSPR to abide within the Bollinger bands 95% of the time. (i.e whenever the cryptocurrency touched the upper band, the chances of it coming down are 95%.). This concept applies vice-versa as well.

Moreover, the sections highlighted by red rectangles show how the bands expand and contract. When the bands widen, we could expect more volatility, and when the bands contract, it denotes less volatility. Currently, the bands are expanding, hence, CSPR could go up and crash drastically.

Furthermore, the CSPR has overlapped the upper Bollinger band and has been in the overbought region. As such there could be a price correction and the price of CSPR may fall in the future.

Notably, the Bollinger Band behaves very closely with the Keltner channel. For instance, if you were to use both the Bollinger bands and Keltner channel indicators for a cryptocurrency, you would see that almost most of the time both indicators overlap. However, the only difference between with Bollinger band and the Keltner channel is that the Bollinger bands use Standard Deviation while the Keltner channel uses Average True Range for calculating its bands which are the top and bottom limits.

Casper (CSPR) Price Analysis – Relative Strength Index

The Relative Strength Index is an indicator that is used to find out whether the price of a security is overvalued or undervalued. As per its name, RSI indicators help determine how the security is doing at present, relative to its previous price.

Moreover, it has a signal line which is a Simple Moving Average (SMA) that acts as a yardstick or reference to the RSI line. Hence, whenever the RSI line is above the SMA it is considered bullish and if it’s below the SMA then it is bearish.

When considering the first green rectangle from the left of the chart below we can see that the RSI line (purple) is above the Signal line (yellow). As such, RUNE is bullish or gaining value as its making higher highs. The second green rectangle shows that the RSI is below the signal. Hence, it is bearish as it is making lower lows.

Currently, the RSI is rebounding on the Signal. Since both the RSI and SMA are tilted upwards we could expect the RUNE price to increase.

Moreover, the RSI compares the gains of the securities against the losses it made in the past. This ratio of gains against the losses is then deducted from the 100.

If the answer is less than 30, then we call that the price of the security is in the oversold region. This means that many are selling the security in the market, and as such the security is undervalued. Moreover, as per the Supply-demand curve theory, the price is supposed to drop when there is an increase in supply.

If the answer is more than 70 then the security is overbought as many are buying. Since many want to buy the security the demand increases which intuitively increases the prices.

Additionally, the RSI could be used to determine how strong a trend is. For instance, when a cryptocurrency is bullish or reaching higher highs, then the RSI line also should be making higher highs in unison. Contrastingly, the chart shows how CSPR was making higher highs when the RSI was making lower highs.

The above sentiment shows that although the cryptocurrency is on a bullish trend it is losing value and hence a trend reversal could be lurking around the corner.

Currently, CSPR is in the overbought region and it is tiling downwards towards the Signal line. If the RSI is supposed to decrease, it may seek the assistance of the Signal to rebound on it, as at other times.

However, the RSI could also give false alarms for breakouts. Although we may expect, the prices to retrace if it goes to the oversold or overbought region, the prices also can stay in the oversold or overbought region for an extended period. As such, traders should be wary of it and let the market saturate before making vital decisions.

Casper (CSPR) Price Analysis – Moving Average

The Exponential Moving averages are quite similar to the simple moving averages (SMA). However, the SMA equally distributes down all values whereas the Exponential Moving Average gives more weightage to the current prices. Since SMA undermines the weightage of the present price, the EMA is used.

Whenever the price of cryptocurrency is above the 50-day or 200-day MA, or above both we may say that the coin is bullish (Green triangle section). Contrastingly, if the token is below the 50-day or 200-day, or below both, then we could call it bearish (grey highlighted section).

When considering the red highlighted elliptical in the above chart, we can see that CSPR was rebounding on the 200-day MA. Currently, CSPR is on an exponential rise. In the event that CSPR is to fall down, it may look to rebound on the 50-day MA. However, if the 50-day is not able to hold the CSPR prices, then it may seek the help of the 200-day MA.

Casper (CSPR) Price Prediction 2023 – 20230 Overview

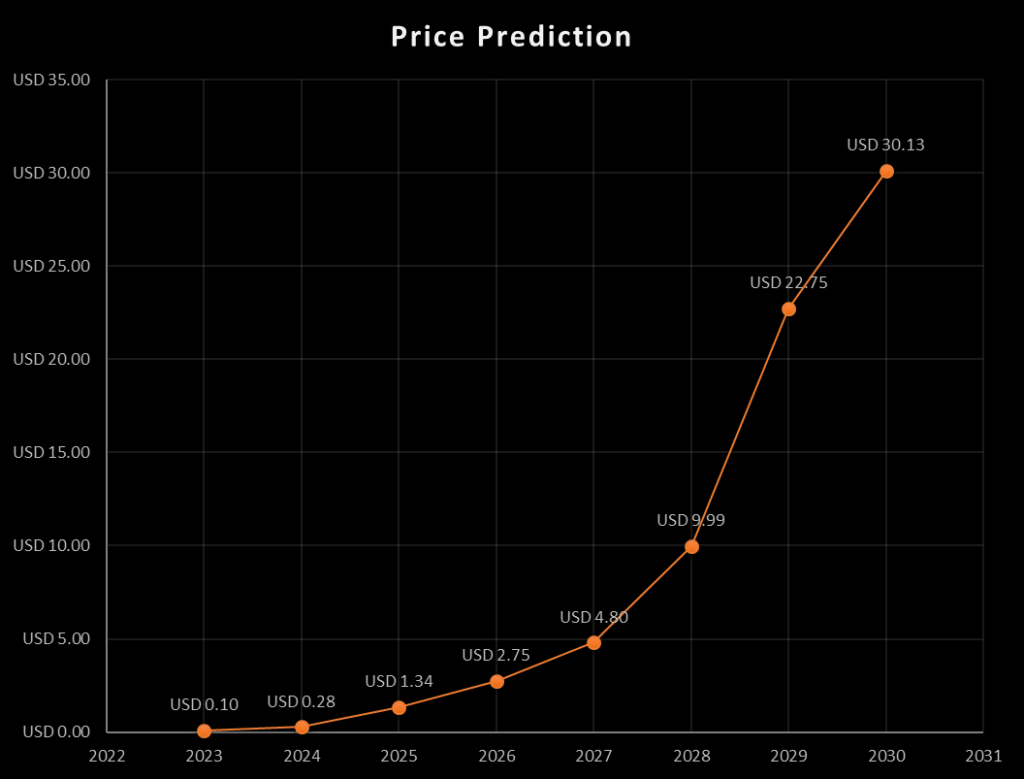

| Year | Minimum Price | Average Price | Maximum Price |

| 2023 | $0.09964 | $0.1010 | $0.1259 |

| 2024 | $0.2662 | $0.2817 | $0.6857 |

| 2025 | $0.8561 | $1.339 | $1.8751 |

| 2026 | $2.2517 | $2.751 | $3.2590 |

| 2027 | $3.9952 | $4.795 | $8.2891 |

| 2028 | $8.8915 | $9.994 | $18.257 |

| 2029 | $20.962 | $22.749 | $26.698 |

| 2030 | $28.2001 | $30.125 | $69.185 |

| 2040 | $72.1351 | $75.10 | $98.7841 |

| 2050 | $100.2578 | $127.83 | $140.5015 |

Casper (CSPR) Price Prediction 2023

When looking at the chart above, we can see that Casper (CSPR) is currently on an exponential rise. However, Casper was consolidating between Support 1 and Support 2 since May 2022. At times it broke above Support 1 but was under $0.055. Nonetheless, this time Casper has broken this barrier and is heading toward Resistance 1 at ≈ $0.095.

But, before CSPR reached reaches Resistance 1 there is yet another obstacle that it has to break through. There lies a weak Resistance of $0.079 which may hinder Casper’s path toward Resistance 1. As it’s weak we may consider that Casper will break it.

However in the event that CSPR is weaker than the weak resistance then it might test and fall on Support 1 at ≈$0.033 (yellow trajectory).

If the bulls are persistent and make Casper traverse the exponential path, then, neither can Resistance 1 nor the weak Resistance hinder its path to Resistance 2 at ≈$0.109 (green trajectory).

There also lies another possibility where CSPR could be rejected at Resistance 2, if this is to happen then Casper will fall straight to the weak resistance and look to rebound. After a session of rebounding it will fall on Support 1. If Support 1 fails to hold, then CSPR will fall to Support 2 at ≈$0.025 (red trajectory).

Casper (CSPR) Price Prediction – Resistance and Support Levels

The chart above shows how Casper started descending since May 2021. It crashed from Resistance 5 at ≈$0.527 to Support 1 at ≈$0.027. When looking at the pattern that it fell we could see that Casper’s fall was followed by a brief period of consolidation, which then was followed by another fall. The chart above shows the reciprocation of this pattern on different Resistance and Support levels.

Currently, Casper has increased exponentially, hence, given that it is reciprocating the same pattern, we may see Casper test Resistance 1 at ≈$0.10 briefly and then follow the pattern, as shown by the white forecasted bar pattern on the chart. If this is what Casper is gearing up for, then traders must be vigilant to sell CSPR when it reaches Resistance 1.

However, some whales might try to make use of this opportunity to enter the market for a sell-off. This could alter the direction of Casper’s movement and thereby make it difficult for perpetual traders.

Casper (CSPR) Price Prediction 2024

There will be Bitcoin halving in 2024, and hence we should expect a positive trend in the market due to user sentiments and the quest by investors to accumulate more of the coin. Since the Bitcoin trend affects the direction of trade of other cryptocurrencies, we could expect CSPR to trade at a price not below $0.2817 by the end of 2024.

Casper (CSPR) Price Prediction 2025

We should expect the price of CSPR to trade above its 2024 price due to the possibility of most cryptocurrencies breaking more psychological resistance levels due to the Bitcoin halving over the previous year. Hence, CSPR could end 2025 by trading at around $1.339.

Casper (CSPR) Price Prediction 2026

Since the maximum supply of CSPR is approached by 2026, the bearish market that follows a solid bullish run impacts its previous price due to the entrance of more institutional investors to its platform. With this, the cost of CSPR could break the usual trend and trade at $2.751 by the end of 2026.

Casper (CSPR) Price Prediction 2027

Investors expect a bullish run next year, 2028, due to Bitcoin halving. Hence, the price of CSPR could consolidate on the previous gains and even break more psychological resistance levels due to investors’ positive sentiment. Therefore, CSPR could trade at $4.795 by the end of 2027.

Casper (CSPR) Price Prediction 2028

In 2028, there will be Bitcoin halving. Hence, the consolidating market in 2027 could be followed by a bullish run. This is due to the impact of news surrounding any year of Bitcoin halving. It is, therefore, possible that the market could attain higher high values. Casper (CSPR) could hit $9.994 by the end of 2028.

Casper (CSPR) Price Prediction 2029

By 2029, there could be much stability in the price of most cryptocurrencies that had stayed for over a decade. This is due to implementing lessons learned to ensure their investors retain the project’s confidence. This impact, coupled with the price surge that follows a year after Bitcoin halving, could surge the price of CSPR to $22.749 by the end of 2029.

Casper (CSPR) Price Prediction 2030

The cryptocurrency market experienced high stability due to the holding activities of early investors so as not to lose future gains in the price of their assets. We could expect the price of Casper (CSPR) to trade at around $30.125 by the end of 2030, irrespective of the previously bearish market that followed a market surge in the earlier years.

Casper (CSPR) Price Prediction 2040

According to our long-term CSPR price estimate, CSPR prices could reach a new all-time high this year. If the current growth rate continues, we could anticipate an average price of $75 by 2040. If the market turns bullish, the price of CSPR could go up beyond what we predicted for 2040.

Casper (CSPR) Price Prediction 2050

According to our CSPR forecast, the average price of CSPR in 2050 might be above $125. If more investors are drawn to CSPR between these years, the price of CSPR in 2050 could be far higher than our projection.

Conclusion

CSPR might reach $0.1 in 2023 and $30 by 2030 if investors decide that CSPR is a good investment along with mainstream cryptocurrencies like Bitcoin and Ethereum.

FAQ

Casper is the first live proof-of-stake (PoS) blockchain, launched on mainnet on 30 March 2021 and based on the Casper CBC protocol. The Casper platform is intended to accelerate the worldwide adoption of blockchain technology, smart contracts, and decentralized applications (DApps).

The future-proof architecture of Casper is meant to ensure the platform is constantly changing to meet the needs of its users. According to the official whitepaper, Casper is geared for corporate and developer requirements. Casper’s goal is to start a new era for Web3 as the demand for simple, integrated services grows. Casper solves the adoption trilemma by putting enterprise-grade security, scalability, and decentralization into a single blockchain protocol.

CSPR can be traded on many exchanges like other digital assets in the crypto world. Bitrue, XT.COM, OKX, MEXC, and Bitget are currently the most popular cryptocurrency exchanges for trading CSPR.

Since CSPR provides investors with several opportunities to profit from their crypto holdings, it seems to be a good investment in 2022. Notably, CSPR has a high possibility of surpassing its current ATH in 2030.

CSPR is among the few active crypto assets that continue to rise in value. As long as this bullish trend continues, CSPR might break through $0.5589 and reach as high as $40 provided that the current market favoring crypto continues. It is quite likely to happen.

CSPR is expected to continue its upward trend as CSPR of the fastest-rising cryptocurrencies. We may also conclude that CSPR is an excellent cryptocurrency to invest in this year, given its recent partnerships and collaborations that have improved its adoption.

The lowest CSPR price is $0.02235, attained on June 18, 2022, according to CoinMarketCap.

CSPR was launched on March 30, 2021.

Medha Parlikar co-founded CSPR.

There is no data.

CSPR can be stored in a cold wallet, a hot wallet, or an exchange wallet.

CSPR price is expected to reach $0.2290 by 2023.

CSPR price is expected to reach $0.2817 by 2024.

CSPR price is expected to reach $1.339 by 2025.

CSPR price is expected to reach $2.751 by 2026.

CSPR price is expected to reach $4.795 by 2027.

CSPR price is expected to reach $9.994 by 2028.

CSPR price is expected to reach $22.749 by 2024.

CSPR price is expected to reach $30.125 by 2030.

CSPR price is expected to reach $75 by 2040.

CSPR price is expected to reach $127 by 2050.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

More Crypto Price Predictions:

- 0x (ZRX) Price Prediction: Will ZRX Price Hit $2 Soon?

- OKB (OKB) Price Prediction: Will OKB Price Hit $30 Soon?

- Harmony (ONE) Price Prediction: Will ONE Price Hit $0.1 Soon?

- Injective Token (INJ) Price Prediction: Will INJ Price Hit $10 Soon?

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.