- CEO of Xorstrategy tweets that the bear market is over and a bull market was on the horizon.

- Since BTC has lost 80% of its value, a bull market could be awaiting it in 2023.

- BTC’s triangle-forming trend is over, now it’s fluctuating in flags.

Aurelien Ohayon, the Chief Executive Officer of investment strategy firm, XOR Strategy tweeted that the bear market for Bitcoin was over and the bull run was on the horizon. In his tweet, Ohayon makes an analysis of how Bitcoin has been behaving since 2011.

As per his technical analysis, there has been a bull run every single time that Bitcoin’s price tanked by approximately 80%. Now that Bitcoin has lost approximately 80% of its value, Ohayon predicts that there could be a bull market waiting for Bitcoin in 2023.

Interestingly, in a follow-up tweet that gives more insight into the number of days against the percentage of the price gain, the CEO tweeted that BTC has been following a cycle where bulls took over the market after every 1350 days.

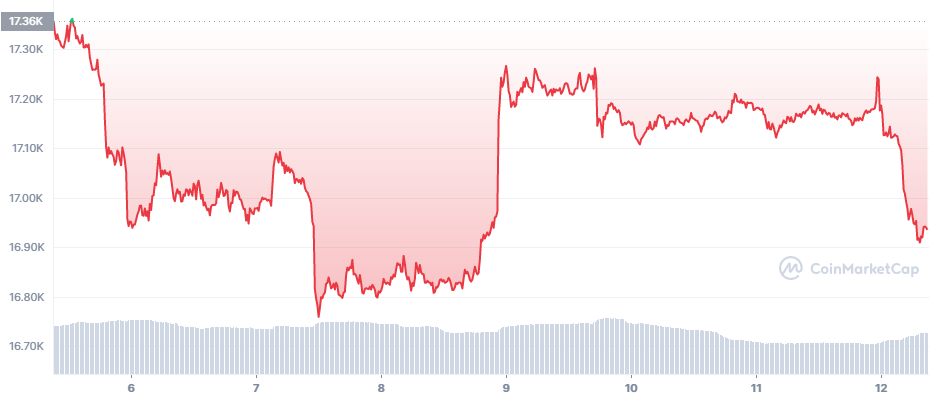

Meanwhile, BTC has been trading in the red zone as shown below in the 7-day trading chart. BTC reached its lowest of $16,759 on December 7 from its highest of $17,362. At press time BTC is down 1.36% within the last 24 hours and is trading at $16,936.16, according to CoinMarketCap.

Notably, as depicted in the chart below, BTC formed its first triangle during mid-November, and once BTC broke through the triangle its price tanked. Similar behavior was also noticed during the aftermath of forming a second triangle.

Notably, as depicted in the chart below, BTC formed its first triangle during mid-November, and once BTC broke through the triangle its price tanked. Similar behavior was also noticed during the aftermath of forming a second triangle.

But with the end of the triangle-forming trend, BTC has been fluctuating in bearish flags during the beginning of December. Significantly, the angle of the flag (red parallel lines) with the horizontal line has been fading away, it could be that the bulls are slowly taking over.

Currently, BTC is moving sideways with minimal vertical movement (blue parallel lines).

If the bulls dominate, BTC will look to break its immediate resistance, the 200-day MA line (yellow line). With more momentum from the bulls, BTC will target Resistance 1 ($18,200).

Contrastingly, if the bears take over, BTC may land on Support 1 ($16,778). It is also likely that BTC could rebound on Support 1 if the bulls manage to minimize the effects brought by the bears.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk, Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.