- Chainlink’s September surge sets the stage for October’s bullish momentum.

- Low LINK exchange deposits signal optimism for a potential price rally.

- LINK’s journey to $10 hinges on breaking through the $9 resistance.

Chainlink (LINK) has captured headlines recently, after soaring 38% in value in September. 2023. Significantly, this rise positioned it among the top-performing assets in the top 20 crypto rankings. Besides this impressive feat, there’s a prevailing sentiment. The momentum suggests that October could witness Chainlink bulls pushing even harder.

However, it was more than just a strong performance that garnered attention. Notably, Chainlink’s ability to integrate off-chain price feeds through blockchain infrastructure played a role. Consequently, the cryptocurrency benefited massively from the asset tokenization and Real World Asset (RWA) trend.

Low Exchange Deposits Signal Optimism

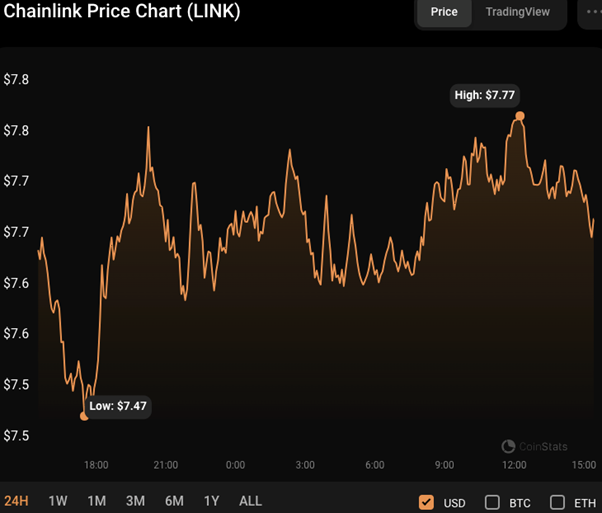

Last month, media circles buzzed about Chainlink’s top performance. And now, LINK’s price has retraced a bit below $8. Yet, on-chain metrics hint at the bulls rallying again. The data from CryptoQuant reveals that LINK’s exchange supply dipped to 152 million tokens recently.

Remarkably, these are the lowest exchange reserve levels since Chainlink launched its staking program in June 2022. When exchange supply diminishes in a bull market, it usually implies a shift. Consequently, optimistic holders are transferring tokens to long-term storage. Hence, with supply at historic lows, a surge in market demand could spark a Chainlink price rally.

Towards the $10 Mark?

Chainlink’s journey to the $10 mark seems quite possible when considering Global In/Out of Money Around Price data. The data showcase the entry price distribution of LINK’s current holders. Moreover, these data suggest that if Chainlink bulls surpass the initial resistance near $9, the rally could quickly escalate to $10.

The data show that 43,500 addresses acquired 46.45 million LINK tokens at approximately $9 each. If these investors decide to take early profits, it might induce a bearish trend. However, if the predicted supply squeeze occurs due to the drop in exchange reserves, the LINK price could comfortably touch $10.

Additionally, Chainlink’s stability is anchored by a significant number of holders. Specifically, 68,300 addresses hold 535.8 million LINK, all purchased at an average of $7. This group will undoubtedly provide considerable support. But, if LINK fails to maintain the crucial $7 support level, bears might drive the price toward $5.

LINK/USD Technical Analysis

On the LINK/USD price chart, the Chaikin Money Flow (CMF) is in the negative sector with a value of -0.06 and trending higher, indicating that the positive momentum is growing. If the CMF goes into the positive zone and continues to climb, it may imply more purchasing pressure and a possible advance in the LINK/USD price. As a result, traders may read this as an indication to consider establishing long stakes or maintaining current bullish holdings.

On the other hand, the stochastic RSI trend rating of 84.32 implies that the LINKUSD price may be overbought in the near term. This level might result in a period of consolidation or a price correction. Traders may consider taking gains on long accounts or starting short positions during this consolidation or correction to capitalize on a possible negative drop in the LINK/USD price.

In conclusion, the road ahead for Chainlink is lined with opportunities and challenges. The key indicators hint at a potential rise, but there’s an inherent risk since indicators point to a consolidation period.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.