- Chainlink trades near $17.23 after defending $16.70, rebounding on Ondo Finance partnership news.

- Integration with Ondo’s $1.8B tokenized assets enhances Chainlink’s institutional market footprint.

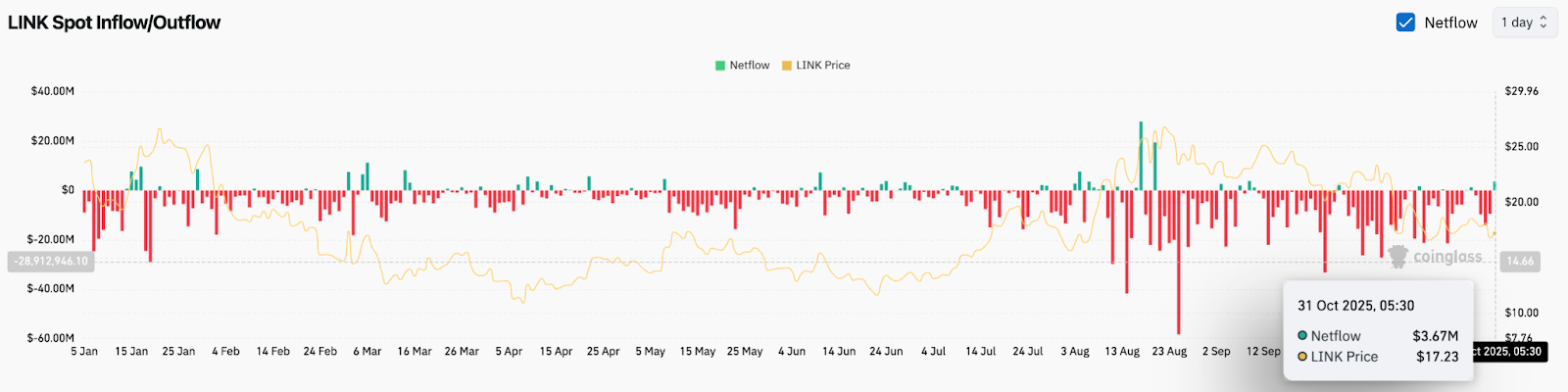

- Positive $3.67M net inflows signal renewed accumulation as LINK eyes breakout above $18.80.

Chainlink price today trades at $17.23, recovering after defending the $16.70 support zone. The rebound comes as the market digests Chainlink’s new partnership with Ondo Finance — a move that strengthens its role in institutional-grade tokenization and could mark the next catalyst for volatility expansion.

Partnership Strengthens Chainlink’s Institutional Reach

The alliance with Ondo Finance positions Chainlink as the primary oracle and interoperability provider for tokenized stocks and ETFs. Using Chainlink’s Cross-Chain Interoperability Protocol (CCIP), Ondo aims to offer secure cross-chain transfers for institutional clients.

Ondo already manages over $1.8 billion in tokenized assets across multiple blockchains. The integration of Chainlink’s oracle system gives traditional institutions a pathway to on-chain markets with transparent and auditable data — a use case that directly supports Chainlink’s core value proposition.

This partnership reinforces the perception that Chainlink’s price performance is tied not to speculative hype, but to real infrastructure demand within the emerging tokenized asset market.

LINK Price Action Tests Key Compression Zone

Technically, Chainlink price continues to trade within a large symmetrical triangle, suggesting an extended consolidation before a breakout. The price currently oscillates near $17.20, bounded by resistance around $18.25–$18.80 and ascending support near $16.00.

Related: Shiba Inu Price Prediction: Fed Cut And Trade Truce Set Stage For Rebound

The 20-day EMA at $18.24 and 50-day EMA near $19.62 are converging, indicating reduced volatility and potential for a volatility expansion move in early November. A successful breakout above the 0.382 Fibonacci level at $18.67 could pave the way toward $20.54 (Fib 0.5) and $23.00 (Fib 0.618), both major resistance points visible on the daily chart.

On the downside, failure to hold the $16.00 trendline could trigger a retest of the $15.04 zone, a level where buyers have previously stepped in aggressively.

Flows Show Renewed Accumulation Interest

Data from Coinglass shows positive net inflows of $3.67 million on October 31, breaking a prolonged streak of red outflows that dominated most of October. The uptick marks one of the largest single-day inflows this month, suggesting that accumulation may be returning among whales and institutional players.

Historically, LINK price has often reversed course following such inflow spikes, signaling renewed confidence at local support levels. The consistent negative netflow throughout Q3 had reflected long-term holders rotating to stablecoins, but this week’s inflow hints at renewed positioning ahead of the tokenization rollout.

Outlook: Will Chainlink Go Up?

For now, the Chainlink price prediction remains constructive. As long as the token maintains support above $16.00, technical and fundamental momentum favors an upside breakout toward $20–$21 in the near term. A daily close above the $18.80 resistance would confirm a bullish continuation pattern, potentially extending to $23.00 if inflows sustain.

If macro headwinds intensify and Bitcoin fails to hold its recent gains, LINK could revisit the $15.00 zone before stabilizing again. Still, institutional catalysts like the Ondo partnership and Chainlink’s expanding oracle dominance provide a solid foundation for long-term recovery.

Related: Dogecoin Price Prediction: DOGE Consolidates as Open Interest Climbs

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.