- Bitcoin miner CleanSpark recently posted its earnings call for Q1 FY2023.

- The firm plans to continue buying up mining company assets to accelerate its growth.

- CleanSpark made a series of acquisitions throughout 2022 to boost its mining capabilities.

US-based CleanSpark recently released its financial report for the first quarter of 2023. During the earnings call, the Bitcoin miner’s executives revealed that the company was optimistic about the year ahead and was confident about the continued growth of operations.

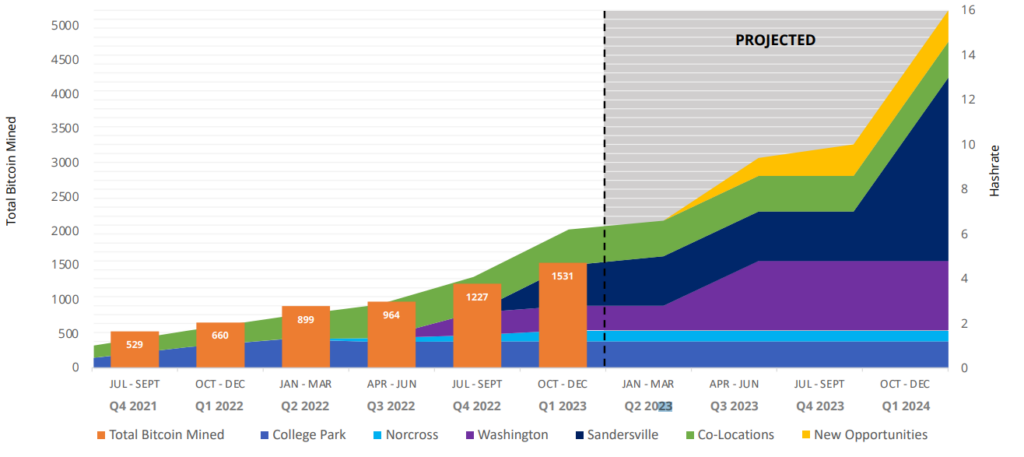

According to the Q1 FY2023 earnings report, CleanSpark saw the highest growth of any crypto miners in Year-over-Year realized hashrate growth. The company beat popular mining firms like Riot Blockchain and Marathon Digital and grew its realized hashrate by a whopping 228%.

CleanSpark’s “explosive growth” can be attributed to its operational strategy, which saw a series of mergers and acquisitions last year. The bitcoin miner was one of the most active buyers, scooping up several distressed bitcoin mining assets throughout 2022.

The bitcoin miner reportedly spent over $50 million last year, buying up multiple mining facilities and thousands of Antminers. The company’s senior management believes that if Bitcoin’s price fails to get near the $40,000 mark, several small-scale mining operations will be in trouble, opening up new opportunities for acquisitions, despite the bear market.

“We have reliably grown, quarter over quarter, as we execute an operational strategy that we believe makes us one of the fastest growing, most reliable, and most efficient publicly traded bitcoin miners in North America,” CleanSpark CEO Zach Bradford said in a press release.

The company has a rather optimistic outlook for the year ahead. They are projecting a 248% increase in their operational miners to reach a total of 150,000. As for megawatts operational, the firm expects 450 MW by the end of this year, as compared to 140 MW operational as of October 1, 2022.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.