- Coinbase has officially reopened customer registration in India, executing a “clean slate” strategy backed by Financial Intelligence Unit (FIU) registration.

- While crypto-to-crypto trading is live now, the exchange confirmed that full fiat on-ramp services (INR deposits) will launch in 2026.

- The move follows a strategic investment in CoinDCX and a partnership with the Karnataka government, signaling deep institutional commitment.

Coinbase Global Inc. (NASDAQ: COIN) has reopened its app for registrations in India after a pause of more than two years. The U.S. exchange now lets local users trade crypto to crypto while it prepares a regulated fiat on-ramp for 2026, signaling a fresh push into one of the world’s most active digital asset markets.

This staggered return gives Coinbase room to align with India’s rules while re-engaging a large base of retail traders and builders.

Related: Indian State Karnataka Partners With Coinbase To Back ‘Base’ Startups

Coinbase Re-enters India Market After 2 Years

According to John O’Loghlen, Coinbase’s APAC director – while speaking at India Blockchain Week (IBW) – retail investors in India are now able to make crypto-to-crypto trades. O’Loghlen stated that the crypto exchange plans to reopen its fiat on-ramp services in India in 2026.

O’Loghlen noted that the exchange has been engaging with the country’s Financial Intelligence Unit (FIU). As such, Coinbase began to onboard retail crypto traders in India through early access, in October 2025. However, O’Loghlen announced that the services are now available to all crypto investors in India.

Notably, the crypto exchange stopped operating in India in 2023 but its web3 wallet Coinbase Wallet has maintained a robust presence in India over the years.

“We had millions of customers in India, historically, and we took a very clear stance to off-board those customers entirely from overseas entities, where they were domiciled and regulated. Because we wanted to kind of burn the boats, have a clean slate here. As a commercial business person wanting to make money and active users, that’s like the worst thing you can do, and so you know it wasn’t without some hesitation,” O’Loghlen noted.

Increased Footprint in India

On December 3, the Karnataka government, at the 8th ASSOCHAM Smart Datacenters and Cloud Infrastructure Conclave, signed an MoU with Coinbase to accelerate web3 knowledge and investment in the state. The crypto exchange announced that its local arm dubbed Coinbase India will educate the people of Karnataka on web3 skills, including privacy and security.

In October, 2025, Coinbase participated in a funding round for CoinDCX exchange in India. According to Shan Aggarwal, Coinbase’s Chief Business Officer, India and its neighboring states will help shape the future of the global onchain economy.

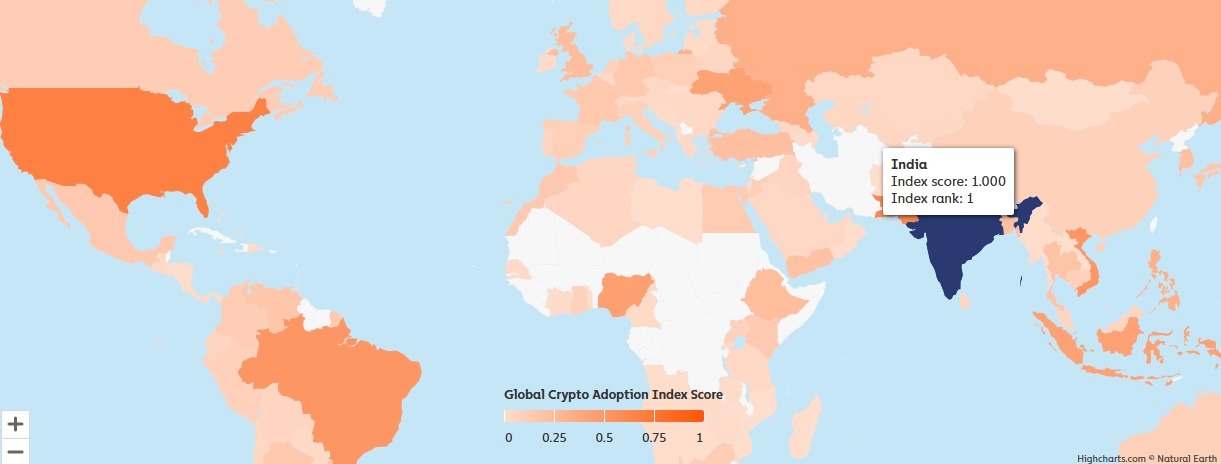

Moreover, the 2025 global crypto adoption index by Chainalysis revealed that India was the top, followed by the United States, and Pakistan.

Market Impact

Coinbase reported during its Q3 2025 report that its transaction revenue grew to $1 billion, largely fueled by increased consumer and institutional activity. However, the crypto exchange has faced fierce competition from Binance, which reported 300 million registered users over the weekend.

As such, the reopening of the Coinbase services in India will play a crucial role in increasing its global outreach. Furthermore, the $72 billion valued company has strong institutional support through acquisitions and collaborations.

Related: India’s Crypto Shift: ‘Bharat’ and Women Drive Shift to Long-Term Wealth Creation

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.