As an active crypto trader on exchange platforms, you have an excellent opportunity to earn profits regularly. This goes without saying that there’s a considerable loss risk involved, too.

A crypto profit tracker is an essential tool in learning how to track crypto profits. As a result, many experienced traders and investors use these tools to calculate profitability and concoct trading strategies.

PnL is regarded as the most crucial trading indicator because it allows you to weigh up your losses against earnings and arrive at accurate estimates of trading results.

What is PnL?

PnL simply means profit and loss.

As it is in simple arithmetic, you earn a profit when your selling price is more than the initial outlay. If the reverse is the case, you’ve made a loss.

PnL can be classified into two distinct categories — unrealized and realized, and it’s a way to explain value changes to trading positions.

For instance, if your trading position is closed, unrealized PnL switches to realized PnL, and vice versa. The latter is so because of an open trading position’s ongoing market changes.

In an open position, the variables include all transactions carried out over a fixed period, such as a year, month, or week, and deals opened based on a single strategy.

Suppose you want to create a special PnL report. In that case, these are the calculations required, as they help a trader determine just how effective his trading strategies are and their long-term investment profitability.

Unrealized PnL

Unrealized profit and loss are the main catalysts for liquidity. As it’s constantly changing, price marks are employed to ensure that calculations for unrealized PnL stay accurate.

Realized PnL

To calculate realized PnL, the main variables are your entry and closing price. Realized PnL is not directly proportional to the marked price because it relates to losses or profits from closed trading positions. As such, it only has links to order prices that have already been executed.

To calculate your realized and unrealized profit, you have to consider your contract type. Here are some equations relevant to various trading contracts.

PnL Trading Calculators.

To calculate your crypto trading earnings, you can go the easy way by doing some simple arithmetic.

For instance, Bitcoin bought at $50,000 and sold for $70,000 has seen a trading profit of $20,000.

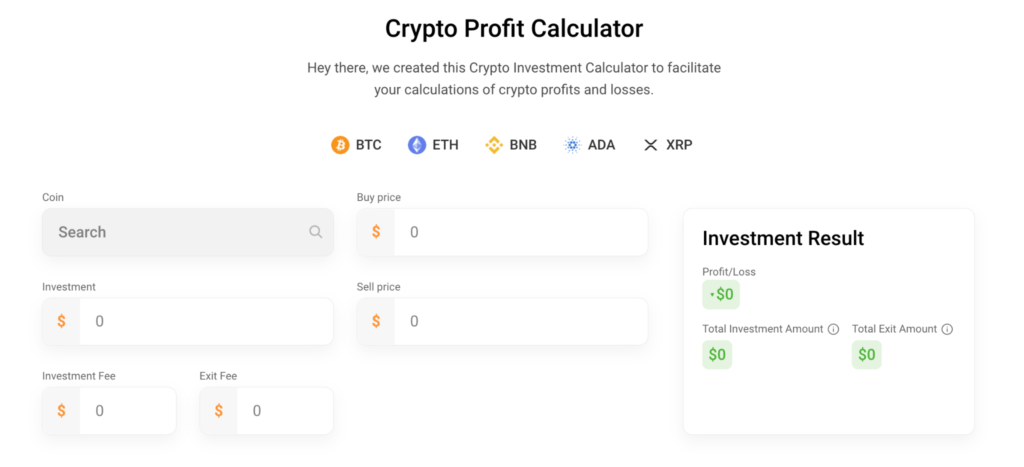

However, it’s ideal to use a crypto calculator tool to save you time for more complicated calculations, especially when there are several variables involved.

Formulas for Calculating PnL

Here are two formulas you can use:

- Marking price minus initial purchase rate

- Initial sell rate minus marking price.

When the trade closes, the asset’s value is referred to as the “tagging price.”

For unrealized PnL, your calculations depend on the asset’s present market rate rather than its closing rate.

This floating indicator shows potential losses or profits for open positions if you decide to close the trading position right away. This means that the value is based on real-time prices rather than incurred, inclusive exchange fees.

Thus, till you close a trading position, your PnL will be unrealized. After it’s closed, your PnL becomes realized.

For long positions, your selling price is your market price. On the other hand, a short position is your purchase price to close said position. In addition, you have to consider the exchange spread to guarantee more precise calculations.

Finally, PnL also includes fees like exchange commissions.

Spot Trading

First, you need to understand how spot trading works for these kinds of calculations.

Spot trading is the act of selling and purchasing tokens at concurrent prices to earn a profit.

Most crypto trading strategies involve HOLDing, which is the hoarding of select tokens for as long as it takes for their values to soar. Spot traders don’t use this strategy. Rather, they engage in short-term trades to earn quick and steady profits.

The investor owns the tokens bought in spot trading and signs off on tokens sold. This is different from buying and selling cryptocurrency CFDs. An example is buying or selling a financial asset that monitors crypto prices rather than trading in actual tokens.

PnL for Spot-Trading

For example, an investor purchases 10 bitcoins and sells them for $40,000, all at a rate of $30,000.

Here, the unrealized PnL is as follows:

- 40,000 minus 30,000, multiplied by 10.

The profit is $100,000 after the position has been closed.

For calculating realized PnL in this trade, you’ll have to exclude depreciation like exchange commissions from the transaction value.

Thus, the realized PnL in this trade is a net calculation less commission. This is also referred to as the trading position’s closing price.

In the same manner, trade losses can also be calculated. For instance, if you purchase 10 Bitcoins and sell everything for $20,000 at a rate of $30,000, the calculations for unrealized PnL go thus:

- 20,000 minus 30,000, multiplied by 10.

The result is a $100,000 loss. You can also calculate the realized PnL by deducting commissions from the overall transaction value.

Margin Trading

This involves doing dealings with more tokens than you currently have in your holdings.

It goes one further by amplifying PnL with borrowed money for additional fees and interest.

Marginal trading is a high-risk, high-reward trading strategy that some investors favor.

Depending on the exchange platform, users can borrow additional funds to top up trades. It is also referred to as leverage trading.

To calculate unrealized and realized PnL, you’ll have to include the leverage variable.

For example, if you hold $1000 and trade one-tenth of it marginally with ten times leverage, you’ll be able to purchase crypto worth $1000.

As such, long position calculations are as follows:

- Leverage (10) multiplied by unrealized PnL.

- Marking price minus initial purchase rate multiplied by position size.

Futures Trading

Futures are derived trading products that include highly specific smart contract agreements. For instance, it can be programmed such that two parties can agree on exchanging a specific digital asset at a particular time.

As a trading strategy, it serves as a hedge to protect from the adverse effects of market volatility, ensuring the profitable sellability of assets in the future, whatever the market value.

However, a disadvantage of this strategy is that prices moving in an unfavorable trajectory can spell a loss as quickly as a contrary price action will yield an investment profit. Here, you may be forced to sell your crypto at a loss or overpay for it.

To calculate PnL for futures contracts, note that a more accurate version of your contract’s value is the label price rather than the projected futures price.

You have to have specific labeling to prevent market manipulation and inadvertent liquidations.

To calculate the unrealized PnL for long positions, the formula is as follows:

- Futures marking price minus initial figure purchase rate, multiplied by position size.

Alternatively, you can calculate for short positions:

- Future initial selling rate minus futures marking price, multiplied by position size

Conclusion

Profit and loss calculators are genuinely essential, as they aid in compiling vital data for your next step in investing. In addition to other tools like charts and price lists, they form the ultimate investor arsenal — a means to navigate the otherwise treacherous waters of crypto investing.

And, platforms like CoinStats have the best array!

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.