- The previous day’s price of Cosmos (ATOM) dropped by 2.75% to $13.57.

- Bulls must fight to overturn the current bearish trend in the ATOM market.

- At $13.59, ATOM faces substantial opposition.

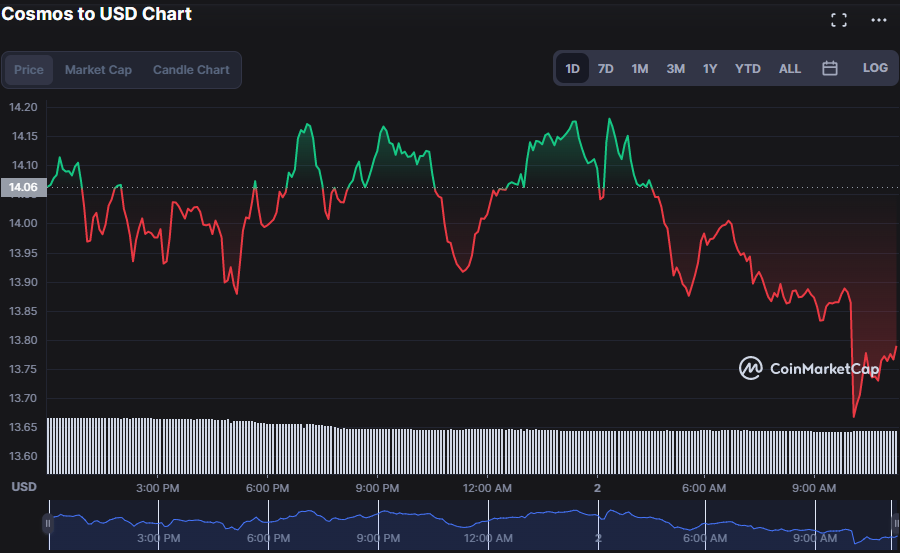

Cosmos (ATOM) has plummeted substantially in the last 24 hours, shedding more than 1.72% of its recovered value. As of press time, the digital currency was trading at $13.84, having faced resistance at the ATOM intra-day high of $14.19.

During the downturn, the market capitalization has decreased by 2.09% to $3,969,938,200, while the trading volume has decreased by more than 24.55% to $253,928,787.

Although the market is bearish, the Bollinger Bands are bulging, indicating that a breakout is possible in the near term. The market’s movement towards the bottom band, on the other hand, denotes this expectation of a bullish run. The upper band reaches 14.25, while the lower band reaches 13.715.

The Relative Strength Index (RSI) is falling, with a score of 36.67 approaching the oversold level. This move shows that the current market trend may persist if bulls do not fight to keep prices stable.

The Elder Force Index (EFI) is below zero “0” with a reading of -2.881k heading south, indicating that the bearish trend will continue.

With a reading of -0.083, the MACD blue line is reading below the signal line. The histogram, with a reading of -0.028, is also in the negative region, confirming the negative momentum. This points to the bearish trend continuing.

With a value of 14.02, the Stoch RSI is in the oversold zone. This price action warns traders that prices may rise since the present market trend is coming to an end.

Bulls are overwhelmed by the ATOM bears as the prices have shot down in the last 24 hours.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or “loss.”

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.