- According to recent statistics, the Cronos market has been rising over the past few hours.

- CRO market encounters resistance during the upswing at $0.07397 and finds support at $0.0637.

- To keep this trend going, bulls need to hold onto the resistance level.

Bulls in Cronos (CRO) were able to seize market dominance after establishing support at $0.0637, driving the stock’s value up by a staggering 14.88% to a value of $0.07348 as of press time.

The market capitalization and 24-hour trading volume soared by 13.14% to $1,860,638,056 and 584.89% to $86,984,633, respectively, supporting this upturn and providing investors more optimism in a prolonged bullish run.

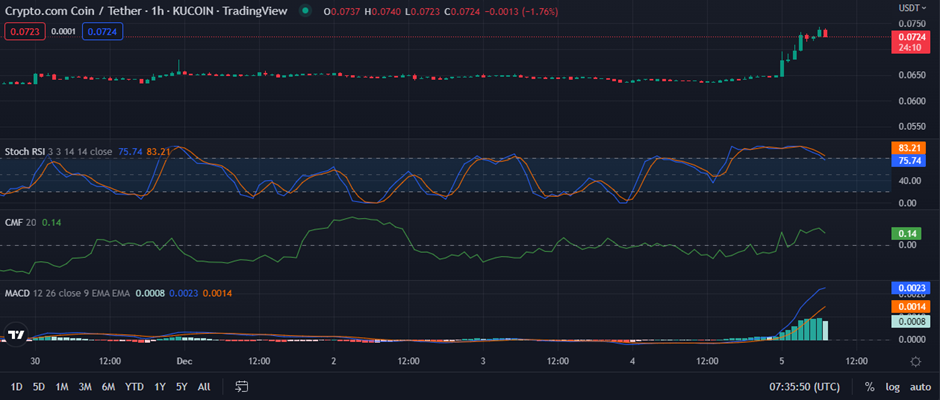

Because the blue MACD line is above the signal line and is currently trending positively, the upbeat attitude in the CRO market will be maintained. With a value of 0.0024, the MACD crosses over the signal line, which is marked at 0.0015. The histogram’s positive motion, which is part of this bullish trend in the CRO market, is another factor backing it.

The Chaikin Money Flow (CMF) is reading 0.16, indicating a further bullish trend, but its current pointing south warns traders to be cautious.

Stochastic RSI readings in the overbought range indicate a potential reversal of the current market trend. This is clear from the CRO price chart, which shows a reading of 77.86. However, the advance southward and away from the overbought area dims the possibility of a reversal.

The True Strength Indicator signals that the bulls are in charge of the market as it crosses over its SMA line at a reading of 65.5529, but its southward pointing cautions traders. The upward trend of the Bull Bear Power, which has a rating of 0.0064, lends support to the CRO market’s trajectory.

Overall, the bears are exhausted because the technical indicators are moving north, which means that the bullish trend may persist.

Disclaimer: The views and opinions, as well as all the information shared in this price prediction, are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.