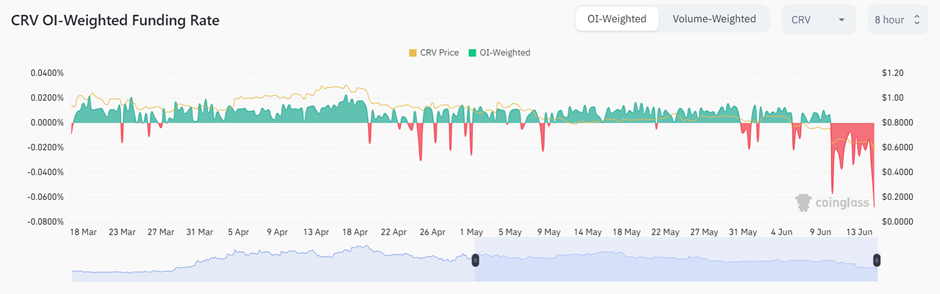

- Curve DAO’s CRV token’s funding rate has fallen to a new yearly low.

- Over the past 24 hours, the CRV token has fallen by 10%.

- The imbalance in the Curve ecosystem resulted in the 0.25% fall in the price of USDT.

According to a recent analysis, the Curve DAO token CRV’s funding rate has fallen to a new yearly low, with a rate of -0.0733% over the past 8 hours. Over the past 24 hours, the token has fallen by more than 10%.

Following the imbalance in the Curve ecosystem, there has been a large exchange of USDT for DAI and USDC, resulting in the 0.25% discount in USDT’s price. At press time, USDT is trading at a price of $0.998, down 0.26%, while CRV is at $0.5683, down 12.17%.

A prominent Chinese reporter Collin Wu, shared a series of threads on Twitter via his official page Wu Blockchain, throwing insights into the possible reasons for CRV’s yearly low.

Reportedly, a few days before, the Curve Finance founder Michael Egorov deposited $24 million worth of CRV tokens, accounting for 34% of the total supply. The massive deposit to the decentralized protocol Aave was an attempt to mitigate a liquidation risk of a $65 million stablecoin loan. According to the crypto sleuth, Lookonchain, Egorov deposited 291 million CRV and borrowed $65 million USDT and USDC.

Today, Wu asserted that CRV’s decline in the funding rate could be attributed to the Curve founder michwill’s bet:

The main reason for this may be due to a bet on the liquidation of the position held by Curve founder michwill (0x7a…5428) by short sellers. This address holds 430 million CRV tokens (about 50% of the circulating supply) as collateral for lending protocols.

The reporter has incorporated the michwill’s wallet address, highlighting that the address holds more than 400 million CRV tokens, equivalent to a total amount of $2,342,134.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.