- Global Macro Investor’s founder Raoul Pal tweeted about the slow wages in the US not compensating for the rising costs.

- Pal said that US citizens are unable to save money, leading to increasing death rates.

- According to Pal, crypto can form a solution, allowing users to have control over their finances

On September 4, founder of Global Macro Investor Raoul Pal tweeted a thread discussing the “death of the American dream,” and the future of US citizens amid rising costs and stalled wages. He revealed that US wages have not increased in real-time, according to data from the London Stock Exchange Group.

Meanwhile, rising costs have driven the equities up by 2.5% in real time, per year. Simultaneously, this resulted in a loss of 85% in regard to workers’ purchasing power. Financial services firm Charles Schwab also reported that the projected average annual GDP growth rate has decreased from 2.3% to 1.8%.

Pal noted that the gap in wage versus expenses disabled citizens from saving money, pushing older generations of Americans to work alongside their offspring generations, causing the wages to stay down due to steep competition. Truflation recently shared a survey that highlighted “one in five US citizens believe they will never retire.”

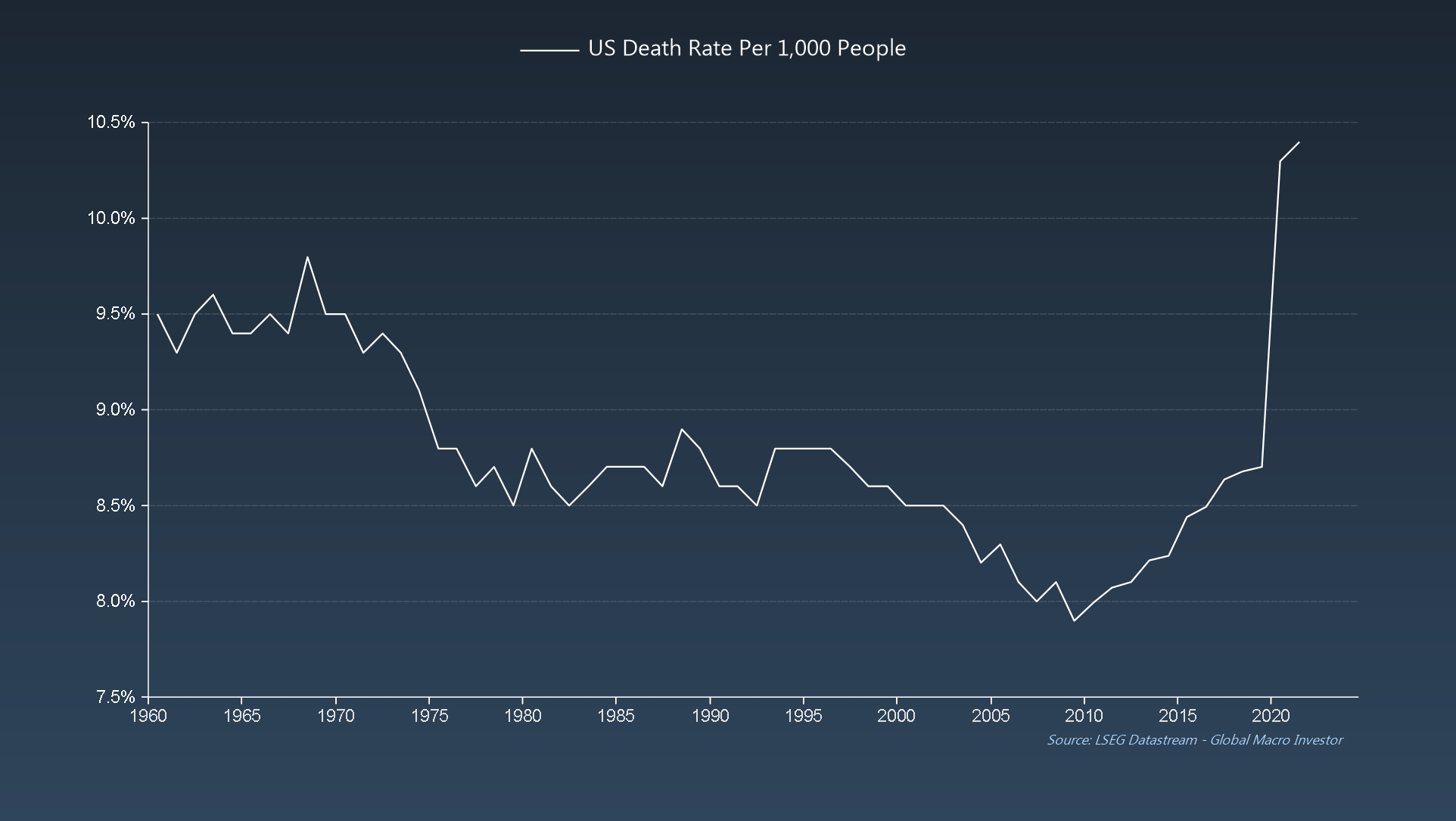

Inflation and debts have led to an “unprecedented opioid crisis,” a dramatic death rate, and falling birth-to-death ratios in the country. Pal predicts that the 2024 elections in the US will feature “show deep fakes and AI misinformation into the mix at scale,” triggering chaos and poverty.

Pal offers a solution to this hysteria:

I know I go on and on (and on) about this but the only way out is to own the assets that rise in exactly this situation – crypto and technology.

According to Pal, crypto will allow users to experience a heightened sense of control and adaptability when facing current circumstances. Even a small investment in these assets will yield a noticeable impact. While there seems to be no alternative course of action, Pal stresses that crypto is a wise choice that needs to be made.

In a previous podcast episode, Flip’s founder Brian Krogsgard explored the correlation between Feds and Bitcoin. The podcast established that the Federal Reserve reacts with a degree of sluggishness and lags behind economic developments.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.