- The crypto market now sees a 25 bps Fed rate cut in September as the baseline expectation

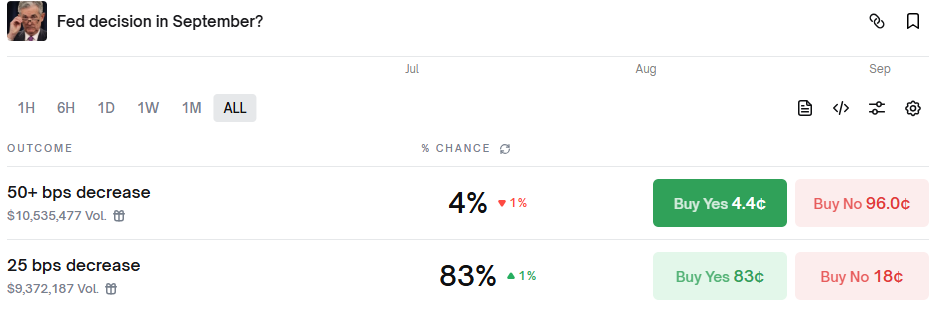

- Polymarket data shows an 83% probability for a 25 bps cut, with only 13% betting on a hold

- A rate cut is a major bullish catalyst for crypto, as the ECB has already begun its easing cycle

The prediction market Polymarket is showing an overwhelming consensus for a Federal Reserve rate cut at the September 17 FOMC meeting.

Data from the crypto-based platform shows that bettors are assigning a combined 87% probability to the Fed cutting rates by at least 25 basis points, a move that would be a major tailwind for the crypto market.

Breakdown of the Bets on Polymarket

The vast majority of users are betting on a cut, with very few expecting the Fed to hold rates steady or raise them.

What is the most likely outcome?

According to the data, 83% of users on the platform are betting on a standard 25 bps rate cut. This is the clear base-case scenario that the market is pricing in.

What are the outlier bets?

A smaller, more aggressive cohort of 4% is betting on a larger 50 bps cut. Only 13% of users believe the Fed will hold rates steady, while less than 1% are betting on a surprise rate hike.

Why a Rate Cut Matters for the Crypto Market

Typically, reducing the interest rate boosts the demand for risk assets, including cryptocurrencies. That is why many analysts consider such a decision crucial for the future of the crypto market. In the meantime, other major economies, including Europe and parts of Asia, are reducing interest rates after raising them earlier to combat inflation.

Are other central banks already cutting rates?

Yes. The European Central Bank (ECB) cut its key rates in June 2025 to stimulate a sluggish economy, setting a precedent for other Western nations.

Meanwhile, US President Donald Trump has been pressuring the Fed to tow the same path, amid America’s dwindling economic conditions.

Related: ECB Cuts Key Interest Rates by 25 Basis Points for Sixth Consecutive Time

Is there political pressure on the Fed?

It is worth noting that the cryptocurrency market took a hit after the Fed’s last time out, when the policymaker ignored the pressure and maintained a steady interest rate.

However, many analysts expect a different outcome in September, considering their belief that the Fed may have stretched to a limit and could bow to socio-economic and political pressure and give way to a lower interest rate.

Related: Trump Pressures Fed Chair Powell Over Costly Renovation and Interest Rates

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.