- SOL is currently trading hands at $22.29 after a 11.04% price increase.

- Crypto fans believe that the price of SOL will stand at about $21.8 by 31 March 2023.

- Helium’s migration to Solana could increase the excitement around the crypto even more.

The crypto market seems to be continuing its recovery despite the tension and uncertainty in the banking sector at the moment. Solana (SOL) is one of the cryptocurrencies showing signs of improvement today.

Solana (SOL) is currently trading hands at $22.29 after a 11.04% price increase over the past 24 hours. SOL also reached a high of $22.86 and a low of $19.94 over the same time period. In addition to this, the altcoin is in the green by more than 28% over the last week.

Then it comes to SOL’s 24 hour trading volume, it is currently in the green zone and now stands at $817,680,669 after a more than 79% increase since yesterday. With its market cap of $8,523,523,956, SOL now officially occupies the 10th position on the list of the biggest cryptos in terms of market capitalization.

Recently, about 1,062 people from the crypto community took a vote on the crypto market tracking website CoinMarketCap to decide what the price of SOL could be at the end of March. According to the results of this poll, crypto fans believe that the price of the Ethereum-killer will stand at about $21.8 by 31 March 2023. This is a more than 7% increase from ts current price.

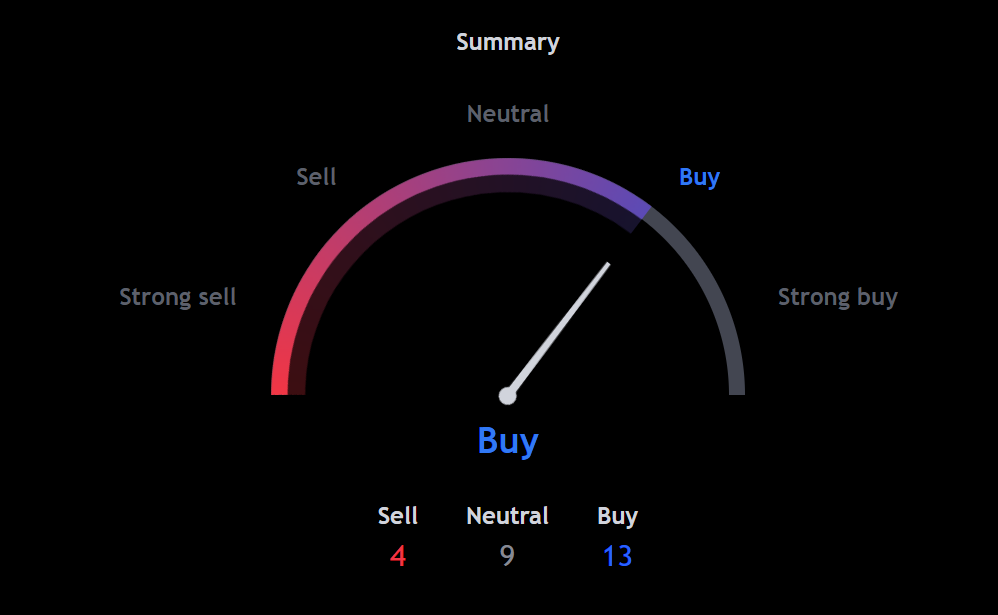

This optimism among SOL fans still, however, needs to reflect on the one-day sentiment gauges on TradingView. At the moment, this metric is still in neutral territory at 9. Helium’s migration to Solana could just be the thing to push up the excitement around SOL even more in the coming weeks.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.